Operation analysis of home textile industry in the first quarter of 2019

Jul 02, 2019 | by CT

In the first quarter of 2019, the overall performance of the home textile industry tended to be stable under the influence of the complex international economic situation and the Spring Festival holidays. The export of the industry has increased steadily, and the benefit of the industry has decreased compared with the previous year, but the efficiency has improved. Enterprises are optimistic about the industry’s second quarter expectations.

1. Overall stable development of the industry

According to statistics from the National Bureau of Statistics, in the first quarter of 2019, 1,791 home textile enterprises nationwide achieved 51.139 billion yuan in their main business income, an increase of 8.73% year-on-year. The 219 key enterprises tracked by the association realized 17.852 billion yuan in the first quarter, down by 1.34% year-on-year. The 16 home textile industry clusters tracked achieved 55.056 billion yuan of main business revenue in the first quarter, an increase of 2.72% year-on-year. The output value of domestic sales shows the same trend. (See Table 1.)

Table 1. Main indicators and year-on-year growth rate of home textile industry in the first quarter of 2019 (unit: 100 million yuan, %)

|

Item |

Main Business Income |

Domestic sales value | ||

|

Value |

Y/Y |

Value |

Y/Y | |

|

Enterprises above designated size (1,791) |

511.39 |

8.73 |

370.12 |

9.59 |

|

Tracked Enterprises (219) |

178.52 |

-1.34 |

114.65 |

-9.36 |

|

Clusters (16) |

550.56 |

2.72 |

420.92 |

5.06 |

Data sources: National Bureau of Statistics, China Home Textile Association

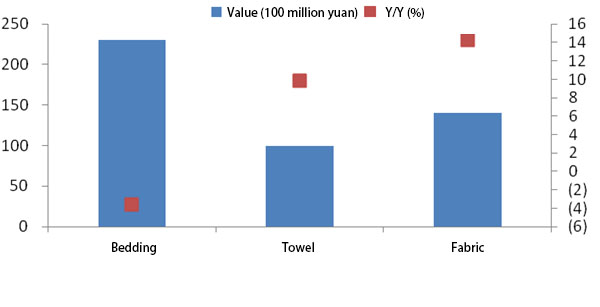

From the perspective of various sub-industries of home textiles, the main business income of bedding industry declined relatively in the first quarter. Four bedding industry clusters tracked by the association realized income of 23.069 billion yuan in the first quarter, down by 3.56% year-on-year. The main business income of 107 bedding enterprises tracked declined by 1.80% year-on-year. Towel and fabric industry as a whole maintained stable and good growth. The home textile industry income under each statistical caliber is shown in Fig. 1-3.

Fig. 1. Main business income of home textile subindustries in the first quarter (enterprises above designated size).

Fig. 2. Main business income of home textile subindustries in the first quarter (enterprises tracked by the association).

Fig. 3. Main business income of home textile subindustries in the first quarter (clusters tracked by the association).

2. Exports of industries have increased steadily

According to customs data, in the first quarter of 2019, the total import and export volume of domestic textile industry reached USD 9.299 billion, of which USD 8.961 billion were exported, an increase of 0.55% year-on-year, the import volume reached USD 339 million, a decrease of 1.42% year-on-year, and the trade surplus reached USD 8.622 billion. Exports of the industry remained stable on the whole.

From the category of export products, the export of bedding has achieved steady growth. In the first quarter of 2019, the export of bedding totaled USD 2.785 billion, accounting for 31.08% of the total export of home textiles. The export of bedding increased by 2.69% year- on- year. The growth rate of kitchen textiles is relatively large. In the first quarter, the export of kitchen textiles amounted to USD 547 million, an increase of 6.12% year-on-year, accounting for 6.10% of the total export of home textiles. Exports of fabrics, towels and blankets declined from the previous year. The export situation of all kinds of home textile products is shown in Table 2.

Table 2. Exports of main home textile products in the first quarter of 2019

(unit: USD 100 million, %)

|

No. |

Product category |

Value |

Y/Y |

|

|

Home textiles |

89.61 |

0.55 |

|

1 |

Bedding |

27.85 |

2.69 |

|

2 |

Fabrics |

17.52 |

-0.12 |

|

3 |

Towel |

6.20 |

-11.21 |

|

4 |

Carpet |

6.13 |

-4.37 |

|

5 |

Blanket |

5.62 |

-7.03 |

|

6 |

Kitchen textiles |

5.47 |

6.12 |

|

7 |

Accessories |

7.84 |

3.80 |

|

8 |

Other products |

12.98 |

5.42 |

Data source: China Customs

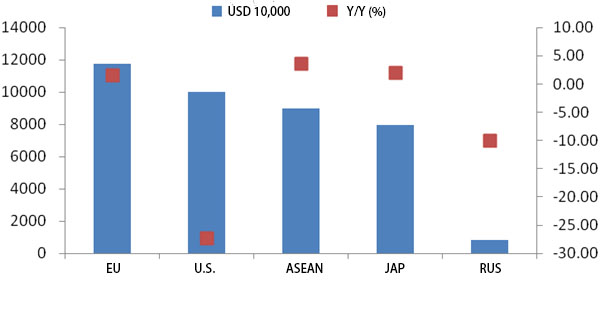

From the main market situation of export products, in the first quarter of 2019, China’s export volume to several important markets achieved good growth. The three traditional markets of the United States, Europe and Japan are still dominant, and their share is further expanded. In the first quarter, China’s exports of home textiles to the U.S., Europe and Japan totaled USD 4.669 billion, accounting for 52.13% of the total industry exports, and the share continued to expand by 0.76 percentage points year-on-year. ASEAN exports grew well in the first quarter, with an increase of 7.48%. Exports amounted to USD 999 million, accounting for 11.15% of total industry exports, an increase of 0.72 percentage points year-on-year. Vietnam is the main country exporting home textile products from our country to ASEAN. In the first quarter, it exported home textile products to Vietnam totaling USD 290 million, of which USD 139 million were exported in March.

Table 3. Volume of business in the main export markets of home textiles in the first quarter of 2019 and Y/Y.(unit: USD 100 million, %)

|

Countries |

Value |

Y/Y |

|

U.S. |

23.26 |

0.98 |

|

EU |

15.16 |

2.95 |

|

Japan |

8.27 |

3.35 |

|

ASEAN |

9.99 |

7.48 |

|

Russia |

1.44 |

1.67 |

Data source: China Customs

Affected by Sino-U.S. trade frictions, the export of tax-related carpet products to the United States market fell 27.32% in the first quarter year-on-year, with an export value of USD 100 billion, the largest decline in similar exports. At the same time, carpet exports to the EU, Japan and ASEAN markets have achieved good growth. (See Figure 4.)

Fig. 4. Main carpet export market in the first quarter of 2019

3. Decrease of industry benefits and increase of efficiency

Under the influence of Global trade downturn, complex macro-situation at home and abroad and the factors of Spring Festival, the growth rate of home textile production slowed down in the first quarter, and the profit declined year-on-year. The early closure or delayed opening of the market will affect the normal business of enterprises. Reducing profit promotion, enterprises are more active in de-stocking, and the turnover rate of finished products has increased over the past year.

According to the data of the National Bureau of Statistics, in the first quarter, the total profits of 1,791 home textile enterprises above designated size reached 2.030 billion yuan, down by 7.41% year-on-year, a narrower decline than the previous two months. The profit margin was 3.97%, down 0.69 percentage points from the same period last year. The 219 key enterprises and 16 industrial clusters tracked by the association also show this feature. (See Table 4.)

|

Item |

Total profit |

Profit margin | |

|

Value |

Y/Y |

(%) | |

|

Enterprises above designated size (1,791) |

20.30 |

-7.41 |

3.97 |

|

Tracked Enterprises (219) |

13.25 |

-15.41 |

7.42 |

|

Clusters (16) |

28.56 |

-2.56 |

5.19 |

Data sources: National Bureau of Statistics, China Home Textile Association

Home textile production and sales index declined. In the first quarter of 2019, the production arrangement of home textile enterprises was affected by factors such as the Spring Festival holidays and weak market demand at home and abroad. The growth rate of production in the industry slowed down. According to the results of the questionnaire on the management of textile and apparel enterprises, the index of new orders for home textiles in the first quarter was 47.75, which was lower than the index of each period in 2018. Among them, the foreign order index was 53.6, up 1.95 points from the fourth quarter of 2018. The production index was 51.1, down 8.35 points from the same period last year, but up 2.5 points from the fourth quarter of 2018.

Inventory of finished products of industrial enterprises declined and industrial efficiency improved. According to the results of the questionnaire on management of textile and apparel enterprises, the inventory index of domestic textile products in the first quarter of 2019 was 38.6, which was 19.95 points lower than that in the fourth quarter of 2018. It can be seen that in the first quarter, home textile production enterprises were more active in de-stocking, the stock of products slowed down, and the product inventory of production enterprises declined faster. According to the data of the National Bureau of Statistics, the turnover rate of finished products in the home textile industry in the first quarter was 16.52, which was 0.28 points higher than the same period last year.

The productivity utilization rate of the industry has increased. According to the results of the Questionnaire on the Management of Textile and Garment Enterprises, 60.5% of the household textile sample enterprises in the first quarter of this year maintained the utilization rate of equipment capacity at more than 80%, which was higher than the previous period and the same period last year. Home textile sample enterprises with equipment capacity utilization rate below 50% have decreased compared with the previous year.

The productivity utilization rate of the industry has increased. According to the results of the questionnaire on the management of textile and apparel enterprises, 60.5% of the home textile sample enterprises in the first quarter of this year maintained the utilization rate of equipment capacity at more than 80%, which was higher than the previous period and the same period last year. Home textile sample enterprises with equipment capacity utilization rate below 50% have decreased compared with the previous year.

4. Enterprises are optimistic about the industry’s second quarter expectations.

According to the results of the questionnaire on management of textile and apparel enterprises, 34.1% of the sample enterprises choose to increase the demand for orders in the second quarter of 2019, 50.0% choose to be “keep the same”, and the prediction of enterprises tends to be cautious.

For the second quarter of the enterprise’s main product production, home textile enterprises are optimistic about the future production judgment. Expected growth of home textile enterprises accounted for 38.6%, higher than the current growth of the main product production of enterprises by 5.3 percentage points.

For the second quarter of 2019, the proportion of home textile enterprises expected to increase profits is 31.1%, which is 6.7 percentage points higher than the actual increase in profits in the current period. It shows that the sample companies are optimistic about the second quarter earnings expectations (See Table 5).

|

|

Increase |

equal |

decrease |

|

Comparing this period with the previous one |

24.4 |

44.4 |

31.1 |

|

Expected comparison between next and this period |

31.1 |

55.6 |

13.3 |

Data source: China Home Textile Association

(Note: This period is in the first quarter of 2019 and the next period is in the second quarter. The same below)

Enterprises have a slightly positive attitude towards the next period of raw materials stockpiling. For the next period of raw material procurement, 25.0% of home textile sample enterprises choose to “increase”, which is higher than the expected increase judgment of the sample enterprises in this period (See Table 6).

|

|

Increase |

equal |

decrease |

|

Comparing this period with the previous one |

9.1 |

77.3 |

13.6 |

|

Expected comparison between next and this period |

25.0 |

63.6 |

11.4 |

Data source: China Home Textile Association

For the expectation of the overall operation of the textile industry in the second quarter, the proportion of home textile enterprises with “optimism” is 37.8%, which is higher than 2.5 percentage points of the relevant options in the textile industry, the proportion of household textile enterprises with “general” is 55.6%, which is higher than 4.4 percentage points of the relevant options in the textile industry, which shows that the household textile enterprises are more optimistic about the overall operation of the next macroeconomic period (See table 7).

|

|

optimistic |

general |

Not optimistic |

|

Views on the overall operation of the textile industry at present |

31.1 |

62.2 |

6.7 |

|

Views on the overall operation of the textile industry in the next period |

37.8 |

55.6 |

6.7 |

Data source: China Home Textile Association

For the judgment of the next period of domestic and foreign markets, the sample enterprises are more optimistic about the expected increase judgment of the two markets. It is expected that the domestic textile and apparel market demand in the next period will “increase” and “keep the same” as that in this period, accounting for 88.6% of the total textile samples, while the foreign textile and apparel market demand in the next period will “increase” and “keep the same” as that in this period, accounting for 88.1% of the total textile samples (See table 8).

(unit: %)

|

|

Increase |

equal |

decrease |

|

Views on the domestic market of the textile industry in the next period |

22.7 |

65.9 |

11.4 |

|

Views on the export market of the textile industry in the next period |

26.2 |

61.9 |

11.9 |

Data source: China Home Textile Association

Overall, the overall market demand in the first quarter of 2019 is not strong, home textile enterprises’ order volume has declined compared with the previous period, and enterprises tend to be cautious in forecasting. With the gradual improvement of the domestic market environment and the effect of relevant policies, there may be room for a rebound in the second quarter. Enterprises’ confidence in the operation of the second quarter has increased.