Monthly Cotton Economic Letter (2017.05)

Jun 26, 2017 | by Flora

Recent price movement

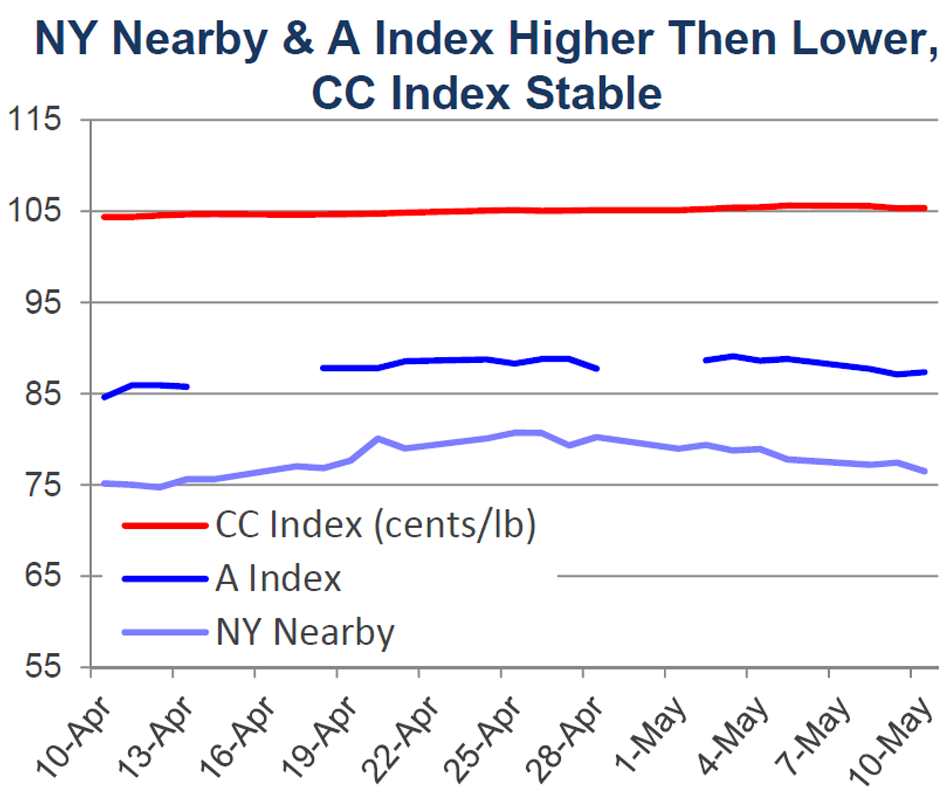

After some upward movement in April, most benchmark prices turned lower in early May.

•After climbing to the upper end of its trading range and testing values near 80 cents/lb in April, prices for the July NY futures contract have decreased in May. Current values near 77 cents/lb are virtually even with those one month ago.

•Prices for the NY December futures contract, which are interpreted as a reflection of price expectations with the 2017/18 harvest, also moved higher and lower over the past month. In early April, prices were near 72 cents/lb. By late April, values were near 75 cents/lb. In early May, prices fell, and current values are near 72 cents/lb.

•The A Index posted its highest value of the crop year (89.1 cents/lb) May 3rd. Since then, the A Index has eased slightly, with current values near 87 cents/lb. In early April, values were near 85 cents/lb.

•The China Cotton (CC) Index edged marginally higher over the past month. In international terms, prices rose from 104 to 105 cents/lb. In domestic terms, the prices rose from 15,800 to 16,000 RMB/ton.

•Chinese futures prices (Zhengzhou Commodity Exchange, ZCE) trended higher throughout most of April, but sharply reversed direction in the second week of May. Values for the most actively traded September futures contract are currently near 15,500 RMB/ton. Prices for the January futures contract, which reflect price expectations after the conclusion of the current auction from reserves and after the 2017/18 harvest, are trading a slight premium to nearby futures prices with current values near 15,700 RMB/ton.

•Cash prices for the Indian Shankar-6 variety decreased in international terms over the past month, falling from 85 cents/lb to 83 cents/lb. In domestic terms, values dropped from 44,000 to 42,000 INR/candy.

•Pakistani prices were stable over the past month (near 78 cents/lb in international terms and near 6,750 PKR/maund in domestic terms).

Supply, demand, & trade

This month’s USDA report is the first to include a complete set of forecasts for the 2017/18 crop year. Estimates indicate that both world production and mill-use will increase in the coming season. The global cotton harvest is projected to increase by 7.3 million bales (+7%, from 105.9 in 2016/17 to 113.2 million in 2017/18). World mill-use is projected to increase by 2.6 million bales (+2%, from 113.2 in 2016/17 to 115.8 million in 2017/18). Consumption is expected to exceed production for the third consecutive crop year. However, the size of the shortfall is estimated to only be 2.5 million bales, which is considerably smaller than the deficits of 14.4 million bales in 2015/16 and 7.3 million bales in 2016/17.

Nonetheless, a production level below mill-use implies a corresponding reduction in ending stocks. The distribution of stocks remains important for the market. China, where government controlled reserves are intermittently available, is expected to reduce supplies by 9.1 million bales in 2017/18 (-19%, from 48.7 million bales to 39.6 million bales. With a slight increase in Chinese mill-use, this drawdown in stocks generates a stocks-to-use ratio of 106%, which remains more than twice the average in the decade preceding the price spike and the massive accumulation of stocks in China.

Outside of China, stocks are forecast to increase 6.7 million bales (+16%, from 40.8 to 47.5 million bales). Since this cotton is generally available for trade, the increase in cotton supply outside of China can be expected to exert downward pressure on prices. The stocks-to-use ratio for the world outside of China is forecast to increase from 50% to 57%, reaching its highest level since China joined the WTO (2001).

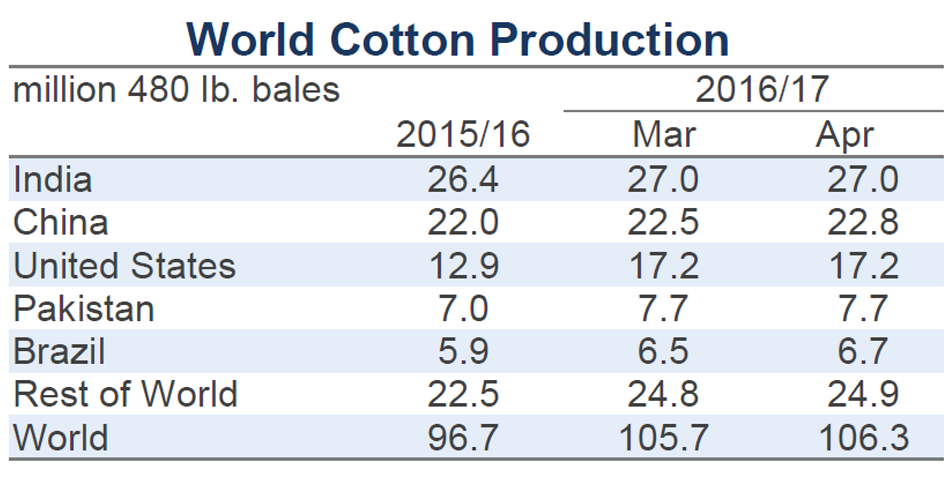

Nearly every cotton producing country is expected to grow more in 2017/18. The largest year-over-increases are expected in the U.S. (+2.0 million bales, from 17.2 to 19.2), India (+1.5 million, from 26.5 to 28.0), China (+0.8 million, from 22.8 to 23.5), Pakistan (+0.8 million, from 7.7 to 8.5), Turkey (+0.5 million, from 3.2 to 3.7), and Australia (+0.4 million, from 4.4 to 4.8). In terms of mill-use, the largest year-over-year changes are for Vietnam (+0.6 million bales, from 5.3 to 5.9), China (+0.5 million, from 37.0 to 37.5), Bangladesh (+0.4 million, from 6.5 to 6.9), Turkey (+0.3 million, from 6.3 to 6.6 million), and India (+0.3 million, from 23.8 to 24.0).

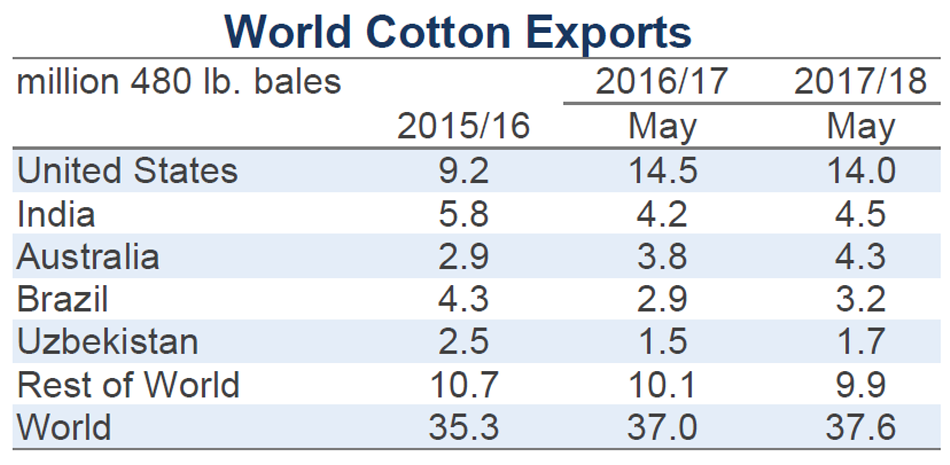

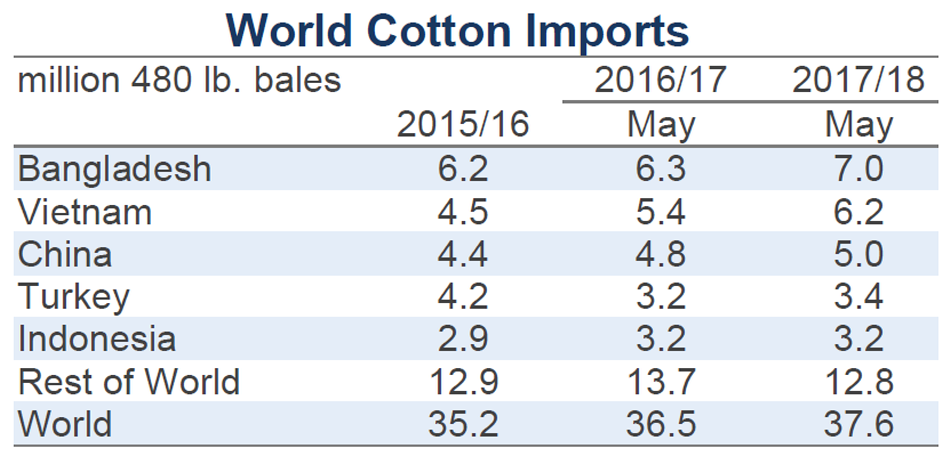

Global trade is expected to grow slightly (+3%, from 36.5 to 37.6 million bales). Countries with the largest expected increases in imports include Vietnam (+0.8 million bales, from 5.4 to 6.2), Bangladesh (+0.8 million, from 6.3 to 7.0), Turkey (+0.3 million, from 3.2 to 3.4), and China (+0.2 million, from 4.8 to 5.0). A notable decrease in imports is forecast for India (-0.8 million bales, from 2.5 to 1.8). Among exporters, the largest year-over-year gains are predicted for Australia (+0.5 million, from 3.8 to 4.3), Brazil (+0.3 million, from 2.9 to 3.2), India (+0.3 million, from 4.2 to 4.5). In 2017/18, the U.S. is forecast to export half a million bales less than in 2016/17 (from 14.5 million bales to 14.0 million).

Price outlook

The market is facing a mix of contradictory forces. Exportable 2016/17 supplies have drawn tight and this has been supportive of nearby prices. Technical factors related to high speculative positions and the large volume of unfixed on-call sales tied to the July NY futures contract may prove to be sources of volatility in the next few months. In 2017/18, the collective market outside of China faces a larger harvest, limited demand growth, and the possibility of a significant buildup in stocks. The potential accumulation of supply outside of China is likely why NY December futures have been trading at a discount relative to nearby prices.

Within China, the ability to coordinate the transition from supply sold at auction to the domestic harvest can be expected to influence Chinese price direction. The potential for disruption in supply, such as those experienced last fall, is a likely reason why Chinese (ZCE) January futures have been trading at a premium to nearby Chinese futures.

Globally, it remains very early relative to 2017/18, and the eventual set of supply and demand statistics can be expected to differ from current forecasts. Variables to watch include the weather, the release of any information related to the timing and magnitude of possible increases in Chinese import quota, as well as any other significant changes to government policies in major countries.