Monthly Cotton Economic Letter (2018.2)

May 10, 2018 | by

Recent price movement

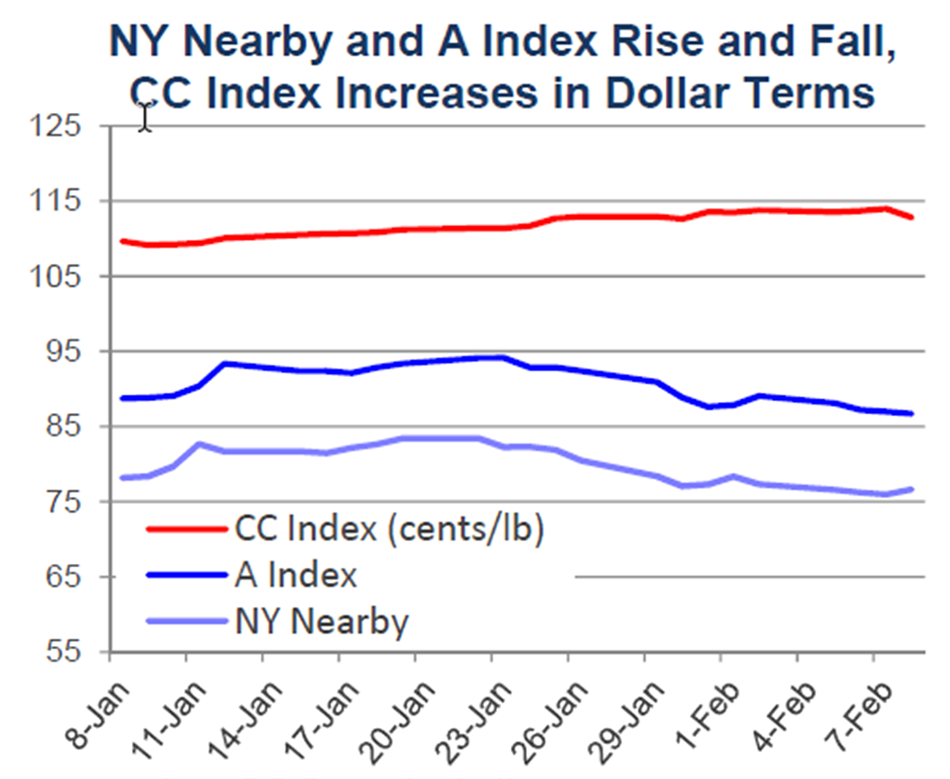

Despite some significant upward movement, most cotton prices are either even or lower than one month ago. An exception is the CC Index, which rose in international terms due to a weaker USD relative to the RMB.

l Prices for the March NY futures contract surged ahead of the release of last month's USDA report (January 12th), rising from levels near 78 cents/lb to those approaching 85 cents/lb. Over the next couple weeks, those gains were generally maintained, with values mostly trading between 81 and 84 cents/lb. In late January, however, prices collapsed. Recent values have been between 77 and 79 cents/lb, which is essentially where they were one month ago.

l The A Index rose and fell alongside NY futures. Despite the movement, the latest prices are even with those from one month ago (88 cents/lb). On the 22nd and 23rd of January, the A Index climbed as high as 94 cents/lb.As is common, movement in the A Index was highly correlated with that for NY futures, with values increasing from levels near 85 cents/lb in late December to those near 90 cents/lb most recently.

l The China Cotton Index (CC Index, base grade 3128B) increased in international terms over the past month, rising from 110 to 113 cents/lb. In domestic terms, the CC Index held to levels near 15,700 RMB/ton. Correspondingly, the increase in terms of USD was driven by weakening of the dollar versus the RMB (USD down 3% over the past month). The China Cotton Index (CC Index, base grade 3128B) was stable over the past month. In international terms, the CC Index held to levels near 109 cents/lb. In domestic terms, the CC Index eased slightly, falling from 15,800 to 15,700 RMB/ton.

l Indian spot prices (Shankar-6 quality) followed NY futures, climbing from the equivalent of 81 to 84 cents/lb before dropping to levels near 80 cents/lb. In domestic terms, prices climbed from 40,500 to 41,900 INR/candy and then fell to 40,000 INR/candy.

l Relative to other benchmarks, the pattern of movement in Pakistani prices was more uniform, with values declining fairly consistently over the month. In international terms, prices decreased from 86 to 80 cents/lb. In domestic terms, prices decreased from 7,700 to 7,300 PKR/maund.

Supply, demand, & trade

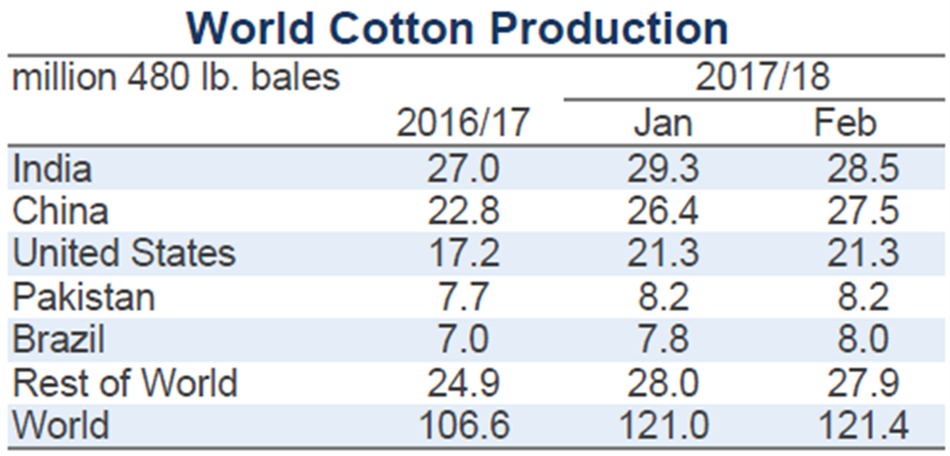

This month’s USDA report featured a slight increase in global production (+0.4 million bales, from 121.0 to 121.4 million) and a slight decrease in global mill-use (-0.3 million bales, from 120.8 to 120.5 million). In combination, these revisions implied a slight increase in global ending stocks (+0.8 million bales, from 87.8 to 88.6 million).

Despite the small change to the world production figure, there were several large country-level revisions. The biggest of these was for China, where the crop forecast was increased 1.1 million bales (from 26.4 to 27.5 million). Smaller additions were made to projections for Brazil (+200,000, from 7.8 to 8.0 million) and South Africa (+105,000, from 70,000 to 175,000). These increases were partially offset by lower crop forecasts for India (-800,000 bales, from 29.3 to 28.5 million) and Australia (-200,000, from 4.6 to 4.4 million). For mill-use, the only notable country-level revisions were for Vietnam (+100,000, from 6.3 to 6.4 million), India (-250,000, from 24.8 to 24.5 million), and Thailand (-150,000, from 1.2 to 1.1 million).

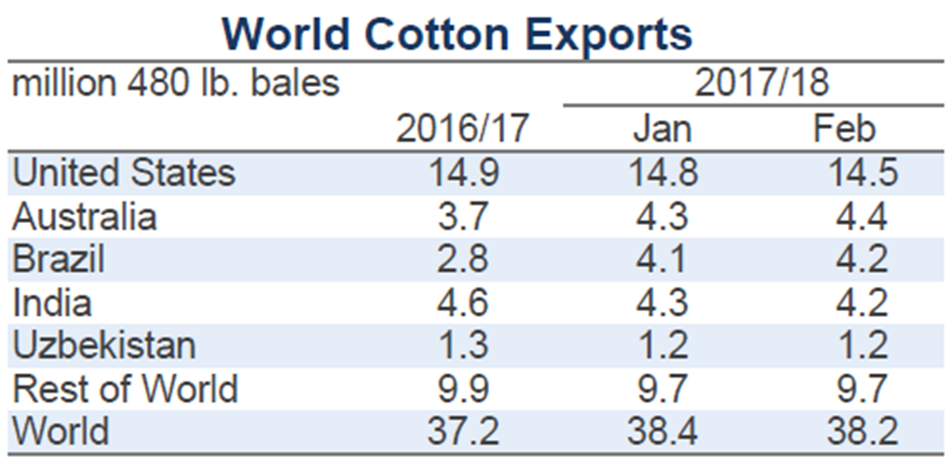

Global trade forecasts changed only marginally, dropping 140,000 bales (from 38.4 to 38.2 million). Relative to imports, the largest updates were for India (+100,000 bales, from 1.6 to 1.7 million) and Thailand (-200,000, from 1.3 to 1.1 million). For exports, the largest changes were for Turkmenistan (+150,000 bales, from 550,000 to 700,000), Australia (+100,000, from 4.3 to 4.4 million), Brazil (+100,000, from 4.1 to 4.2 million), Tajikistan (+100,000, from 400,000 to 500,000), and the U.S. (-300,000 bales, from 14.8 to 14.5 million). Significantly, with no other changes to U.S. supply and demand numbers, the decrease in U.S. exports lifted the forecast for U.S. ending stocks by 300,000 bales to 6.1 million. If realized, this will be the largest volume for U.S. ending stocks since 2008/09 and would represent a year-over-year increase of nearly 120%.

Price outlook

The National Cotton Council will release results from its survey of U.S. cotton producers’ planting intentions February 11th. Given the recent strength of cotton prices, and the persistent weakness in corn and soybean prices, expectations are that the U.S. will increase cotton acreage for a third consecutive year. For production, a factor potentially offsetting the increase in acreage could be higher abandonment and lower yields. Much of the important West Texas region, which is mostly non-irrigated, is currently in a state of drought.

Globally, cotton acreage can also be expected to be supported by attractive price for cotton relative to those for other crops in 2018/19. Most large producers are likely to maintain or increase acres. A possible exception could be India, where planting may decline slightly due to discouragement suffered by farmers in growing regions that experienced pest-related damage this crop year.

The USDA will release a preliminary partial set of supply, demand, and trade forecasts at their annual outlook meeting February 23rd. These forecasts could be anticipated to include a slight increase in global mill-use alongside a slight increase in global production. Such a scenario would result in a situation similar to the one in the current crop year, where the world cotton harvest and world mill-use are nearly equal.

Parity between production and consumption implies little change to global cotton stocks. What will continue to be important for prices is the allocation of stocks. This crop year, stocks outside of China are predicted to increase 8.5 million bales (+22%) while Chinese stocks are predicted to decrease 7.6 million bales (world stocks increasing the 0.9 million bale difference).

Without an increase in Chinese imports, a similar set of changes in the allocation of stocks could be experienced next crop year. Ending stocks outside of China are forecast to set a record this year, and the potential for further accumulation of supply outside of China could be expected to eventually weigh on prices. Nonetheless, price movement in recent months has shown that other data points are also important, with record on-call sales and record open interest in NY futures having been proven capable of supporting prices.Without an increase in Chinese imports, a similar set of changes in the allocation of stocks could be experienced next crop year. Ending stocks outside of China are forecast to set a record this year, and the potential for further accumulation of supply outside of China could be expected to eventually weigh on prices. Nonetheless, price movement in recent months has shown that other data points are also important, with record on-call sales and record open interest in NY futures having been proven capable of supporting prices.