- What’s the performance of the textile industry in the first three quarters?

- Since 2018, the world economy stays on the road to recovery, the market demand is relatively exuberant, and the international and domestic market of textile and garment achieve rapid growth, ensuring the stable operation of textile industry. With the continuously promoting of supply-side reform

- Dec 06, 2018

- Operation of domestic textile clothing wholesale market in the first half of 2018

- China Commercial Circulation Association of Textile and Apparel (CATA) issued the operation data of China ’ s textile clothing wholesale market in the first half of 2018, and emphatically analyzed the general operation of the specialized market, operational characteristics

- Nov 20, 2018

- Status quo of dyeing and printing industry in H1, 2018

- Operation of dyeing and printing industry in the first year Generally, China ’ s economy has been converted into “high-quality growth model” from “high- speed growth stage”, namely the new stage focusing o

- Nov 20, 2018

- Status quo of China nonwovens and industrial textiles industry in the first half of 2018

- In the first year of 2018, the global economy continues to recover, China actively boosts supply-side structural reform, and the economic development develops steadily. However, due to the emerging of protectionism in global trade and upturn in petroleum prices, China’s industria

- Nov 20, 2018

- Textile industry run stably in the first half of 2018

- The first half of 2018 witnesses sound market demand environment due to accelerated recovery of world economy and steady growth of domestic economy, China’s overall textile garment export and domestic market achieved good growth, to provide fundamental support for steady operation of textile ind

- Nov 15, 2018

- Monthly Cotton Economic Letter (2018.10)

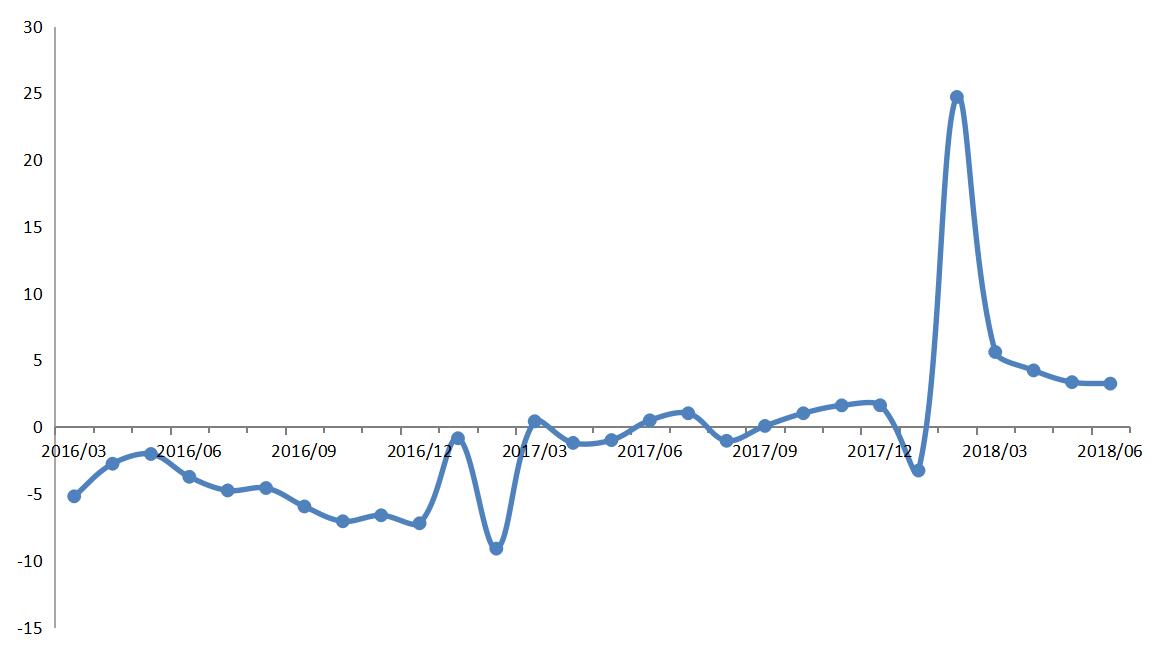

- Recent price movement Most benchmark prices decreased over the past month. Chinese prices were stable. l Values for the December NY futures contract moved lower in the second half of September, dropping from 82 to 76 cents/lb by early O

- Oct 29, 2018

- Monthly Cotton Economic Letter (2018.8)

- Recent price movement In contrast to recent months, when cotton prices have been volatile, several benchmarks were stable over the past month. Indian and Pakistani prices, however, increased. l Prices for the December NY Futures contract we

- Aug 23, 2018

- Monthly Cotton Economic Letter (2018.7)

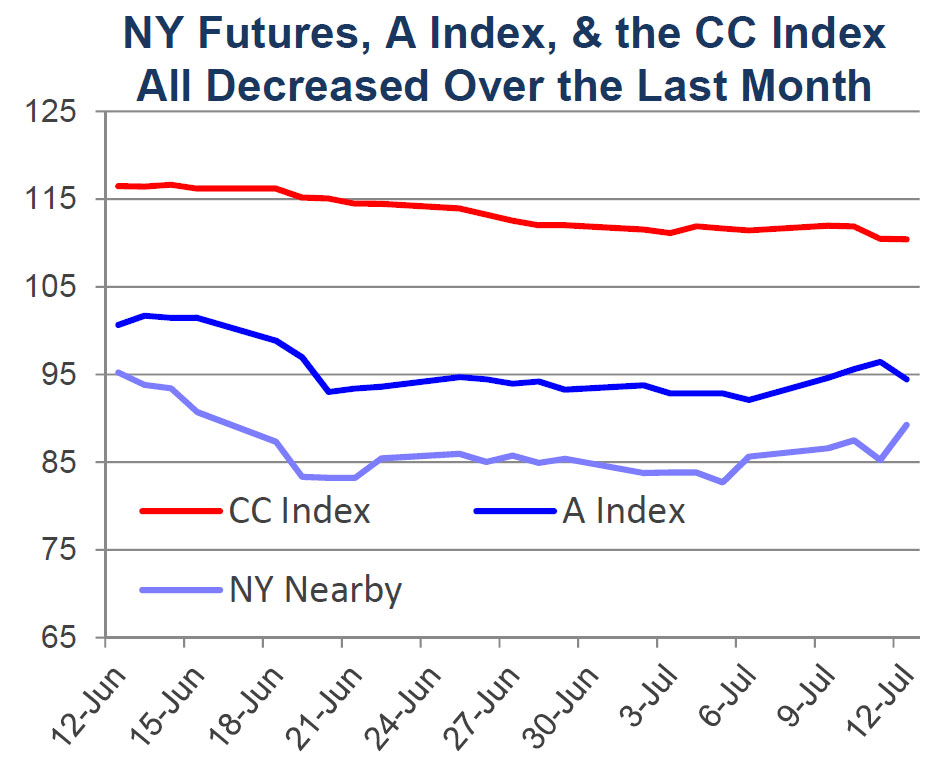

- Recent price movement NY Futures and the A Index moved sharply lower in the middle of June, erasing gains made earlier that month. The CC Index decreased in June and early July. Indian prices were comparatively stable in USD terms. Pakistani price

- Jul 25, 2018

- Monthly Cotton Economic Letter (2018.6)

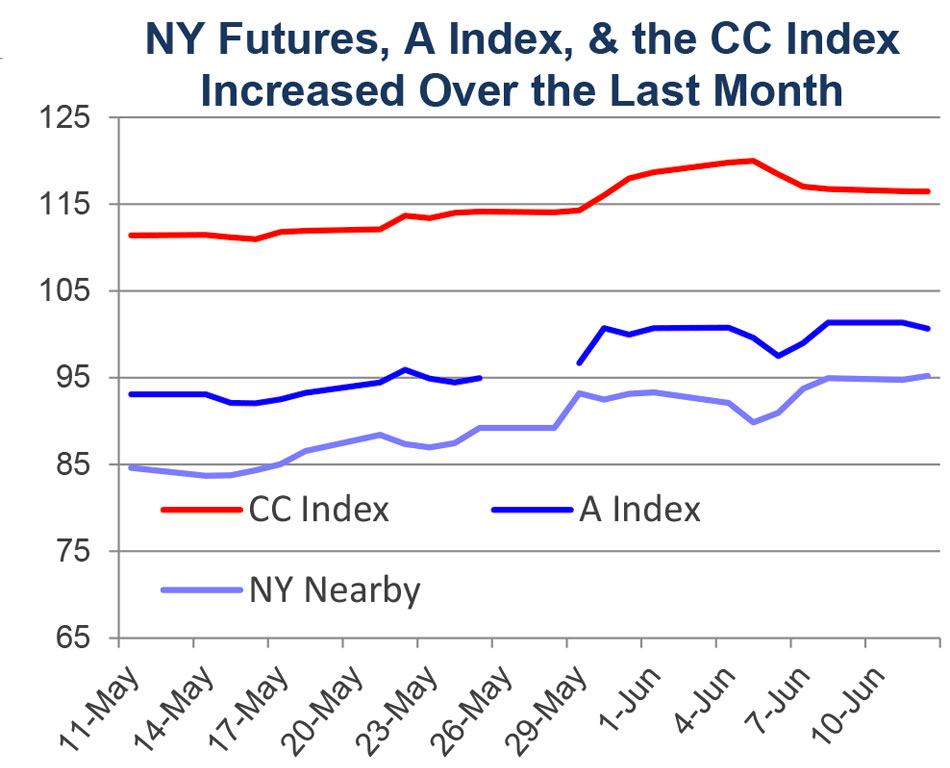

- Recent price movement The global cotton market was volatile over the past month, with values for most benchmark prices moving strongly higher in the second half of May. l Values for the July NY futures contract surged from levels near 84

- Jul 20, 2018

- Monthly Cotton Economic Letter (2018.5)

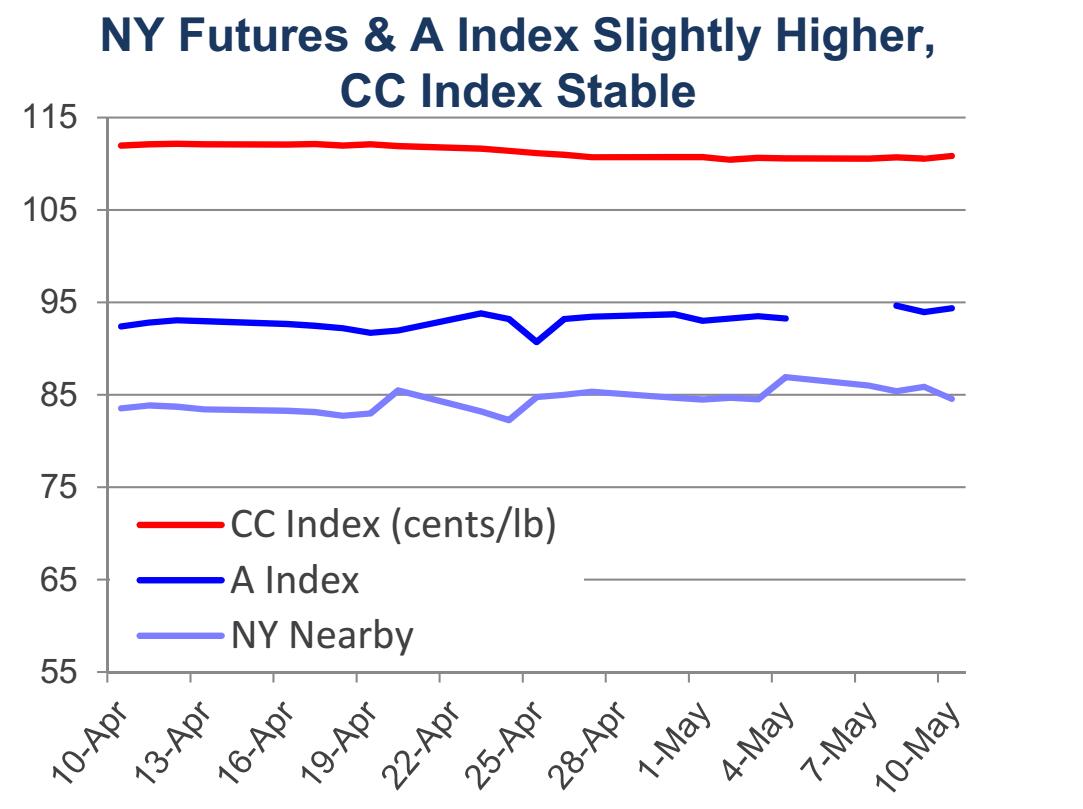

- Recent price movement NY futures experienced volatility recently, with the net effect being a slight increase in prices. The A Index also moved slightly higher, while other benchmark prices were stable. l NY futu

- Jun 20, 2018

|