What should the chemical fiber industry focus on in the future?

Dec 05, 2021 | by Zhao Xinhua

The chemical fiber industry has faced complex challenges at home and abroad since the beginning of this year, The recurrence of the pandemic and the continuous “dual control of energy consumption” policy have had a significant impact on the recovery of the main operating indicators of the industry especially in the second half of the year. Stable domestic demand market, increased international demand, etc., are still good for industry economic operation. The continuous rise of international oil prices provides strong support for the chemical fiber market, but also increases the production cost of enterprises. Looking forward to the year, the chemical fiber industry will still face many tests, but the industry has good development resilience and risk resistance ability, and will still achieve stable development.

1. Slowdown in production growth

The overall operating load of the chemical fiber industry remained high in the first three quarters, but the operating load dropped rapidly affected by the “dual control of energy consumption” policy in September. Take direct spinning polyester filament as an example, the operating load at the beginning of September was about 85 percent, and it fell to about 75 percent at the end of September; although there was a slight recovery in October, it was still under low load on the whole, with the average monthly operating load of about 77 percent, a new low in the year (FIG. 1). According to the National Bureau of Statistics, the output of chemical fiber was 50.37 million tons from January to September, up 13.54 percent year-on-year. The average growth rate of chemical fiber output in two years was 6.75 percent based on the January-September 2019 period.

FIG. 1 Load variation of direct spinning polyester filament from 2019 to 2021

(Data source: Huarui Information)

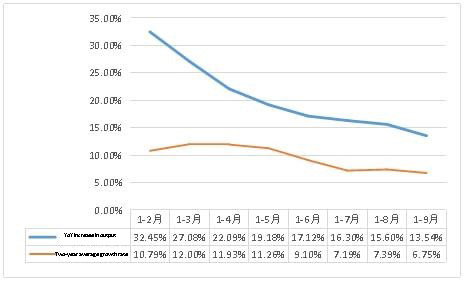

On a monthly basis, affected by the change in the base of chemical fiber production last year, the year-on-year growth rate of this year’s chemical fiber production dropped month by month (Figure 2). Coupled with the influence of “dual control of energy consumption” policy and power cuts, the monthly chemical fiber production decreased by 2.0 percent in September, and the growth rate of chemical fiber production dropped to 13.5 percent from January to September, 3.6 percentage points lower than the growth rate of the first half of the year. In terms of the two-year average growth rate, the average growth rate in the first three quarters of this year remained stable and slowed down.

FIG. 2 Growth rate of chemical fiber production in 2021

(Source: National Bureau of Statistics)

2. Price shifts up

From the cost side, international oil prices continued to rise, WTI and Brent crude oil prices rose from USD 48 and USD 51 per barrel at the beginning of the year to USD 75 and USD 78 per barrel at the end of September respectively, increasing by more than 50 percent. WTI and Brent crude both crossed the USD 80 mark in October (Chart 3), and international oil prices have far exceeded pre-pandemic prices.

FIG. 3 International oil price trend from 2019 to November 2021

(Data source: Huarui Information)

The cost of chemical fiber is rising affected by higher crude oil prices, pushing up the price of chemical fiber market, but not as much as raw materials. Taking polyester as an example, compared with the beginning of the year, the raw material PTA and MEG increased by 36 percent and 43 percent respectively at the end of September (Figure 4), and the polyester filament (POY) and polyester staple fiber increased by 30 percent and 24 percent respectively (Figure 5). It can be seen that fiber product price rises lower than raw material rises.

Figure 4 Price trend of polyester raw materials from 2019 to November 2021

(Data source: Huarui Information)

Figure 5 Price trend of polyester from 2019 to November 2021

(Data source: Huarui Information)

3. Export keeps growing trend

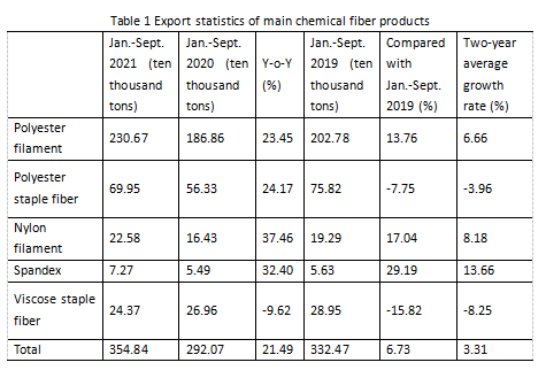

from January to September, the export of main chemical fiber varieties was 3.5484 million tons, up 21.49 percent year-on-year, and the growth rate was 21.03 percentage points lower than that of the first half of the year, according to the statistics of China Customs. On the one hand, it was due to the increase of the base in the same period last year, and on the other hand, due to the decrease of production and supply in the third quarter. On the whole, the export of chemical fiber is still growing. Although the growth rate has dropped from the previous month, the export scale still exceeds the pre-pandemic level, with an average growth rate of 3.31 percent in two years (Table 1).

(Data source: China Customs)

4. Terminal market remains well

Since this year, China’s textile and apparel domestic market has withstood the impact of local pandemic and flood conditions, and the recovery trend has been consolidated. According to the Data of the National Bureau of Statistics, the total retail sales of clothing, shoes, hats, and knitting textiles above designated size increased by 20.6 percent year-on-year from January to September, up 33 percentage points from the same period last year, with an average growth of 2.8 percent in two years. Online consumption continues to play a driving role in the domestic market. the retail sales of online wear goods increased by 15.6 percent year-on-year from January to September, 12.3 percentage points higher than the same period last year, and the average growth in the two years was 9.3 percent.

In terms of export, China’s textile and apparel export maintained good growth due to the recovery of international market demand and the return of some overseas orders. Data from China Customs Express showed that from January to September, China’s total textile and apparel export was USD 227.59 billion, up 5.6 percent year-on-year, 6.5 percentage points slower than that in the first half of the year, with a two-year average growth of 6.2 percent. From January to September, apparel export reached USD 122.41 billion, up 25.3 percent year-on-year, the highest growth level since 2010, and an average growth of 4.2 percent in two years. Due to the slowdown in international demand for pandemic prevention materials, textile exports from January to September were USD 105.18 billion, down 10.7 percent year-on-year, but the average growth rate for the two years was 8.6 percent.

5. Sustained and stable profitability

The overall economic benefits of the chemical fiber industry increased significantly compared with the same period in 2020. From January to September, the business revenue of chemical fiber industry reached 744.183 billion yuan, an increase of 33.28 percent year-on-year, with an average growth rate of 7.85 percent in two years; the total profit was 47.138 billion yuan, an increase of 317.99 percent year-on-year, with an average growth rate of 52.70 percent in two years; operating revenue margin reached 6.33 percent, 4.31 percentage points higher than the same period in 2020 and 3.17 percentage points higher than the same period in 2019; the percentage of loss-making enterprises was 20.56 percent, 18.36 percentage points narrower than that of the same period in 2020, and 3.86 percentage points narrower than that of the same period in 2019; the loss of loss-making enterprises was 3.952 billion yuan, a year-on-year decrease of 54.17 percent and a two-year average decrease of 12.89 percent, according to data from the National Bureau of Statistics.

The profit of chemical fiber industry ranks first in the whole textile industry chain, with polyester and spandex contributing 40 percent and 23 percent of the total profit respectively. The supply-side structural reform is the fundamental reason for the chemical fiber industry to achieve a substantial increase in benefits. The supply and demand pattern of the industry is improved, and the profits of the industrial chain are transferred from raw materials to fibers. In addition, raw materials and products in the rising price channel inventory premium also contributed to the larger profits.

6. Investment in fixed assets increased significantly

According to the National Bureau of Statistics, from January to September, the actual completed fixed asset investment in the chemical fiber industry increased by 29.5 percent year-on-year, with a growth rate of 51.8 percentage points higher than the same period last year. Among them, the average growth rate of the chemical fiber investment in the two years was 0.3 percent, and the investment scale has basically recovered to the pre-pandemic level.

Prospects

Looking forward to the whole year, the chemical fiber industry will still face many tests. In the context of global economic recovery, as the weather gets colder, the demand for crude oil consumption is expected to remain strong, and OPEC remains cautious in increasing production on the supply side. It is expected that oil price will weaken its support for the chemical fiber market in the fourth quarter. In October, local power cuts has been somewhat relaxed, the downstream weaving operation rate has significantly recovered, but the chemical fiber industry load picked up slowly. Recently, Fujian, Zhejiang and other places suspended orderly power cuts measures, which means that the power cuts policy will be further relaxed in the short term, and the year-end festival atmosphere will increase the terminal market demand, but the release of new capacity will offset the positive to a certain extent. In addition, we still need to pay attention to the uncertainty caused by the recurrence of the pandemic in winter.

Overall, it is expected that with the consumption of raw materials and stable demand of downstream enterprises, the operating load of chemical fiber industry will be further improved in the fourth quarter, but it is difficult to recover to the previous high, and the price of chemical fiber market will remain high and shock operation. Chemical fiber production is expected to be affected by the gradual increase of base in the same period last year, and the annual growth rate is further reduced compared with the first three quarters; economic performance indicators will still be significantly better than last year. However, the industry should have a clear understanding and be alert to the great risks brought to China’s chemical fiber textile industry by the drop in international oil prices and the return of overseas orders after the obvious alleviation of the COVID-19 pandemic. The tightening of China’s dual control of energy consumption will also be a long-term problem for the industry.