China’s chemical fiber output increased by 17.12 percent Y-o-Y in first six months

Aug 17, 2021 | by Zhao Xinhua

In the first half of 2021, China’s economy continued to recover steadily, the domestic market of textile and apparel improved significantly, the demand in the international market picked up, and the continuous rise of international oil prices provided strong cost support for the chemical fiber industry. The economic operation of chemical fiber industry maintained a good situation, and the main operating indicators showed a rapid recovery. Looking forward to the whole year, the operation of the chemical fiber industry will still face many tests. The industry needs to accelerate the high-quality development to make a good start for the “14th Five-Year plan”.

1. Steady growth of production

In the first half of the year, the operating of chemical fiber industry significantly increased compared with the same period in 2020. Although there are factors of low base in the same period in 2020, it is also at a high level compared with the same period in recent years. According to the National Bureau of Statistics, from January to June, the output of chemical fiber was 33.37 million tons, up 17.12 percent year-on-year. In order to avoid misjudging the operation of the industry due to the high growth due to the low base in 2020, the first half of 2019 is taken as the base period, and the geometric average method is used to calculate (the same below). The average growth rate of chemical fiber output in two years is 9.10 percent.

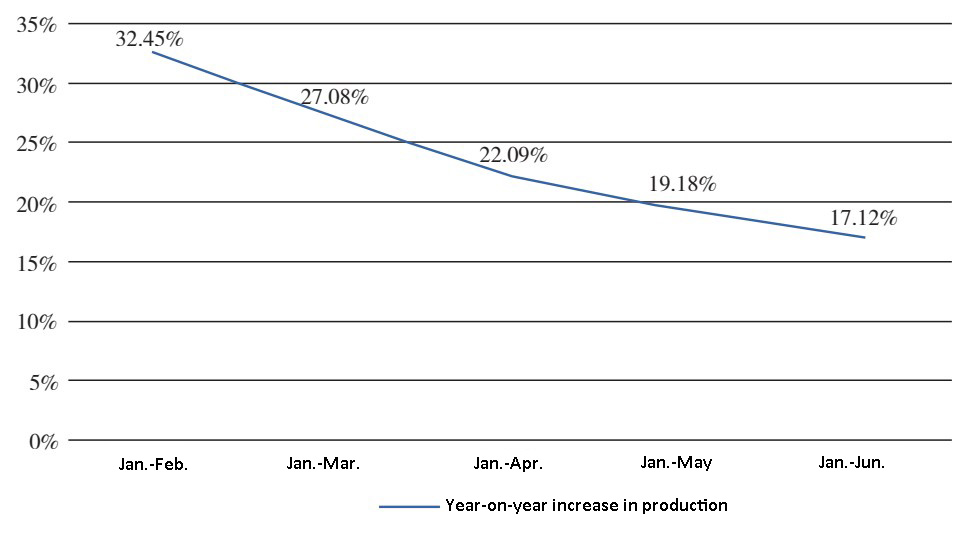

On a monthly basis, with the rapid advancement of the industry’s resumption of work and production after the Spring Festival last year, the base of chemical fiber production increased rapidly, resulting in the year-on-year growth rate of output from January to June this year falling month by month (Figure 1).

Figure 1 Year-on-year growth rate of chemical fiber production in 2021

2. Obvious cost support

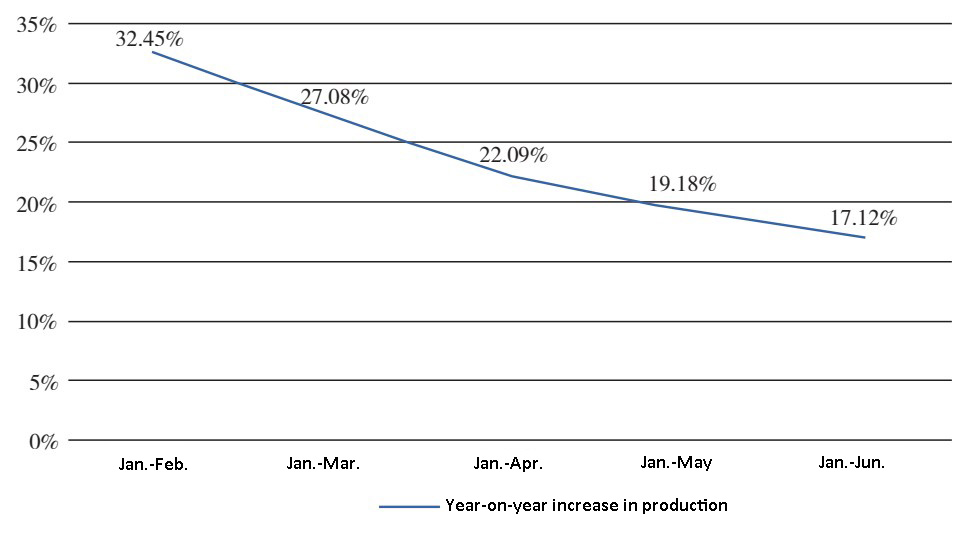

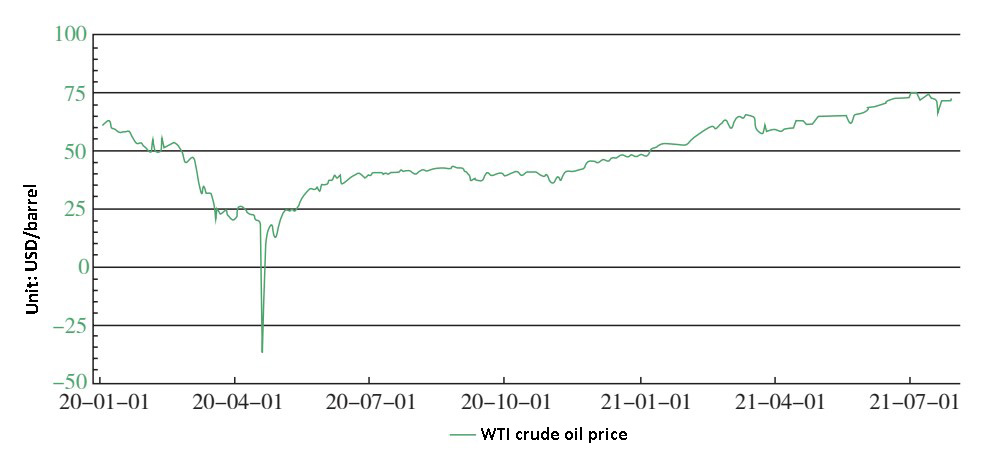

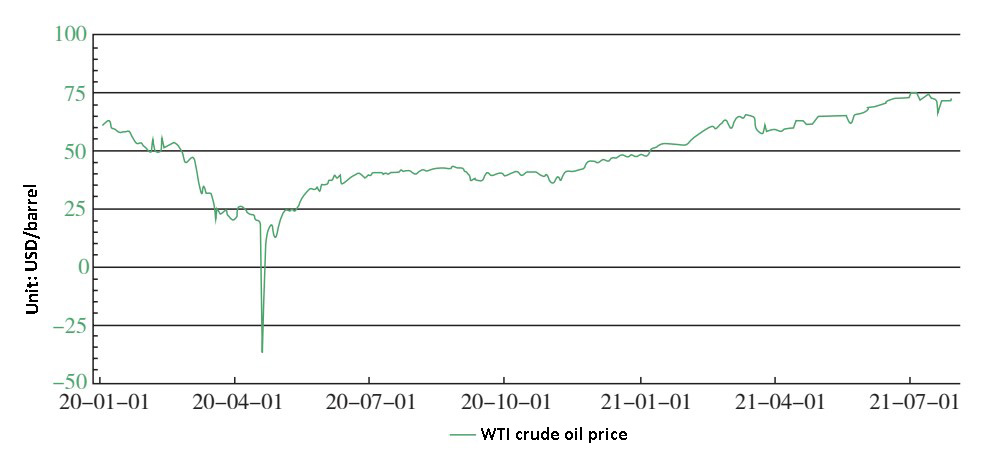

Since 2021, commodity markets have continued to strengthen on the back of recovering demand and inflation expectations. Meanwhile, the OPEC continues to cut production to keep a tight grip on crude supplies. As a result, international oil prices continued to rise from January to June, with WTI crude oil prices rising from around USD 50/barrel at the beginning of the year to over USD 70/barrel in June, surpassing pre-COVID-19 levels (Figure 2).

Figure 2 WTI oil price trend 2020-2021

Affected by the high price of crude oil, the cost of chemical fiber has been increasing, and the price of chemical fiber market increased significantly from January to June. According to CNFC data, at the end of June, the price of main chemical fiber products increased to different degrees compared with the beginning of the year, but compared with the price increase of all links of the industrial chain, it can be seen that the price increase of chemical fiber products is generally less than the increase of the main raw materials and crude oil, so it can be judged that the chemical fiber market in January to June is a cost-driven increase.

Figure 2 WTI oil price trend 2020-2021

Affected by the high price of crude oil, the cost of chemical fiber has been increasing, and the price of chemical fiber market increased significantly from January to June. According to CNFC data, at the end of June, the price of main chemical fiber products increased to different degrees compared with the beginning of the year, but compared with the price increase of all links of the industrial chain, it can be seen that the price increase of chemical fiber products is generally less than the increase of the main raw materials and crude oil, so it can be judged that the chemical fiber market in January to June is a cost-driven increase.

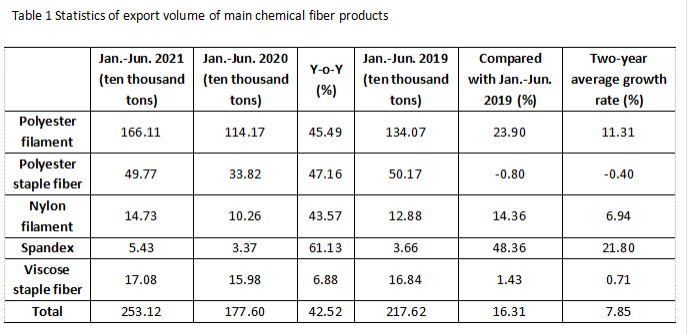

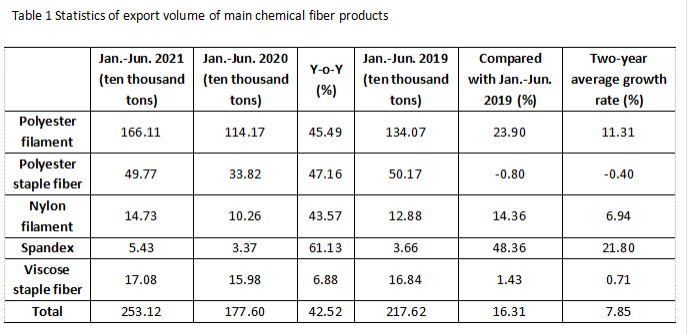

3. Chemical fiber exports increased substantially

With the recovery of global trade demand, the export volume of chemical fiber products increased sharply from January to June. On the one hand, this is due to the low base effect in the same period last year. On the other hand, the demand in the international market has indeed increased. As the pandemic is out of control in Southeast Asian countries such as India, Vietnam and Myanmar, some orders have been returned to China. According to Chinese Customs statistics, from January to June, the export volume of main chemical fiber products such as polyester filament, polyester staple fiber, nylon filament and spandex increased significantly year-on-year, and exceeded the data of the same period in 2019 before the pandemic (Table 1).

4. Steady recovery in end-market

Since 2021, the steady improvement of China’s national economy has driven the steady recovery of the domestic market for textile and apparel. According to the data of the National Bureau of Statistics, from January to June, the sales of garments, shoes, hats, and knitting textiles above designated size increased by 33.7 percent year-on-year, with an average growth of 3.7 percent in two years. China’s online retail sales grew by 24.1 percent year-on-year, 27 percentage points higher than the same period in 2020, with an average growth of 9.8 percent in two years.

In terms of export, the data of China Customs Express show that the total export amount of China’s textiles and apparel from January to June was USD 140.09 billion, with a year-on-year growth of 12.1 percent and an average growth of 6.2 percent in two years. Among them, the apparel export continued to improve, and the cumulative export amount from January to June reached USD 71.53 billion, with a year-on-year growth of 40.3 percent. With an average growth rate of 4.4 percent in two years, the proportion of textile and apparel exports increased from 40.8 percent in the same period in 2020 to 51.1 percent; the amount of textile exports has shrunk as the demand for foreign pandemic prevention materials decreases. From January to June, the cumulative export amount was USD 68.56 billion, down 7.4 percent year-on-year, with an average growth of 8.1 percent in two years.

5. Economic benefits continued to grow

In the first half of the year, the economic benefit of the chemical fiber industry increased significantly compared with the same period in 2020, and decreased in the second quarter compared with the first quarter.

In recent years, the structural reform of the supply side of the chemical fiber industry has achieved remarkable results. Backward production capacity has been phased out, new production capacity has been effectively controlled, the growth rate of production capacity has slowed down significantly, and the supply and demand pattern of the industry has improved. This is also the fundamental reason for the rapid recovery of the chemical fiber industry and the substantial growth of benefits. In addition, raw materials and product prices continue to rise, inventory surplus also contributed to a certain profit for the enterprise.

According to the data of National Bureau of Statistics, from January to June, the operating income of chemical fiber industry reached 476.012 billion yuan, 35.05 percent more than the same period last year, and the two-year average growth rate was 5.37 percent. The total profit was 32.658 billion yuan, an increase of 387.77 percent year-on-year, with an average growth rate of 56.44 percent in two years; the operating profit margin was 6.86 percent, up 4.96 percentage points year-on-year and 3.75 percentage points higher than the same period in 2019; the percentage of loss-making enterprises is 22.00 percent, 20.75 percentage points narrower than the same period in 2019, 4.52 percentage points narrower than the same period in 2019; the loss of loss-making enterprises was 2.711 billion yuan, 60.42 percent less than the previous year and 12.77 percent less than the previous two years.

6. Fixed asset investment resumes growth

According to the National Bureau of Statistics, from January to June, the actual completed fixed asset investment in the chemical fiber industry increased by 16.6 percent year-on-year. New production capacity is still mostly concentrated in leading enterprises, its scale advantage has been further consolidated. With the gradual investment of new production capacity, the contradiction between supply and demand of the industry will appear in stages, but the disorderly competition will be significantly reversed, and the self-discipline of the industry will be greatly improved.

In the second half of the year, the volatility of the chemical fiber market is likely to increase due to the uncertain factors such as the trend of international oil prices, the repeated outbreak, the direction of monetary policy and the sustainability of backflow orders. Due to concerns about the production cuts and downstream demand, oil prices in July have shown significant volatility, and the subsequent upward pressure has increased, but it is expected to still support the cost of chemical fiber. The recurrence of the pandemic at home and abroad will still have a great impact on the terminal consumption and shipping market, but also increase the uncertainty of the recovery of the terminal market. In the second half of the year, as the production of new chemical fiber equipment will continue to increase the pressure on the downstream market, it is expected that in the third quarter, in the traditional peak season, the chemical fiber industry can still maintain a good operation situation, but the fourth quarter of the risk of decline is greater. It is expected that the annual chemical fiber output, exports, economic benefits and other operating indicators will still be significantly better than 2020, however, due to the low base in the first half of 2020 and the continuous recovery in the second half of 2020, so in 2021, the growth of the industry indicators will show a significant trend of high before and low after.