The decline in the export of our textile clothing narrowed from January to April, and masks and protective clothing become an important support

Jun 12, 2020 | by Zhao xh

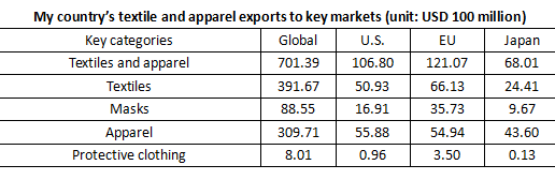

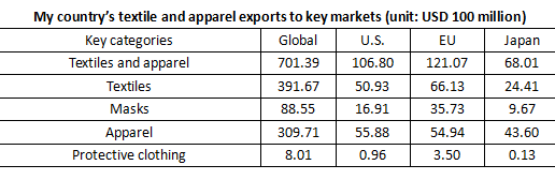

According to China’s customs data, from January to April 2020, China’s total exports of textiles and apparel reached USD 70.139 billion, a year-on-year decrease of 10.49%. Although the decline from January to March was narrowed, it still fell by 7.17 percentage point year-on-year.

Apparel demand in the international market has fallen

Under the impact of the global pandemic, the decline in my country’s textile and apparel exports even exceeded the level of 2009 after the financial crisis. In April, despite the effective control of the domestic pandemic and the continued steady recovery of economic activities, the overseas pandemic is still spreading. Various restrictive measures adopted by countries to combat the pandemic have greatly suppressed people’s demand for clothing.

According to statistics from the U.S. Department of Commerce, U.S. retail sales plummeted 8.7% in March this year, the largest decline since 1992. Sales of apparel stores fell by 50.5%, and department stores fell by 19.7%. According to Japanese customs data, from January to April this year, Japan’s imports of clothing fell by 9.48%, while the imports of clothing from my country fell by as much as 14.49%. The share of my apparel in the Japanese market has dropped to 53%, which is 3 percentage points lower than the same period last year. The German Retail Association (HDE) said that fashion sales fell by 75% to 85% from April to May. Global Data also predicts that sales of apparel and footwear in the UK this year will decrease by 26.1% year-on-year, with a loss of approximately 14 billion pounds.

The weakness in apparel consumer demand in the international market directly affects the product structure of my country’s textile and apparel exports. Since the beginning of this year, my country’s textile and apparel exports have shown an obvious “textile increased apparel decline” export characteristics, and the proportion of apparel exports has fallen below 50% for the first time in many years. According to customs data, from January to April 2020, my country’s textile exports amounted to USD 39.167 billion, an increase of 1.32% year-on-year; clothing exports amounted to USD 30.971 billion, a year-on-year decrease of 21.99%. Although in recent years, the growth rate of my country’s apparel exports has basically been lower than that of textile exports, making the scale of textile and apparel exports continue to be close, but the proportion of apparel exports has basically remained stable at more than 55%. Due to the relevant impact of the pandemic, from January to April, the proportion of my country’s clothing exports has dropped to 44.2%.

Masks and protective clothing become important supports for exports

According to statistics from my country’s customs data, from January to April 2020, my country’s mask exports were USD 8.855 billion, and protective clothing exports were USD 801 million, accounting for 13.8% of the total textile and apparel exports to the world during the same period.

According to Chinese customs data, from January to April 2020, China exported USD 5.093 billion in textiles to the United States, a year-on-year increase of 16.83%, of which export masks accounted for 33% of textiles, reaching USD 1.691 billion; during the same period, China exported USD 2.441 billion in textiles to Japan, an increase of 46.22% year-on-year; of which export masks accounted for 40% of textiles, reaching USD 967 million; China’s exports of textiles to the EU were USD 6.613 billion, an increase of 62.32% year-on-year, of which export masks accounted for 54% of textiles, reaching USD 3.573 billion. Even the amount of masks exported to Germany accounts for 64% of the total amount of textiles exported to Germany.