Textile exports rebound strongly in April! Experts tell you how far foreign trade is from bottoming out

May 14, 2020 | by Zhao xh

The General Administration of Customs of China announced the national goods trade data for April 2020 on May 7. In the first four months, the total value of imports and exports of goods trade was 9.07 trillion yuan, a decrease of 4.9% from the same period last year (the same below), and the decrease was 1.5 percentage points lower than that of the first quarter. Among them, exports were 4.74 trillion yuan, a decrease of 6.4%. In April, foreign trade imports and exports were 2.5 trillion yuan, a slight decrease of 0.7%, and exports were 1.41 trillion yuan, an increase of 8.2%.

Among them, textile exports rebounded sharply in April, driving the overall export growth of textile and apparel. So, does this mean that the foreign trade situation has “bottomed out”?

Textile exports rebounded sharply in April, clothing exports continued to fall

In April, exports of textiles and apparel were clearly different: textiles rebounded rapidly, driven by anti-pandemic supplies, and drove the overall export growth. Apparel exports continued to decline due to the reduction in external market demand, and the gap between the two was further widened. In April, textile exports reached more than double that of apparel.

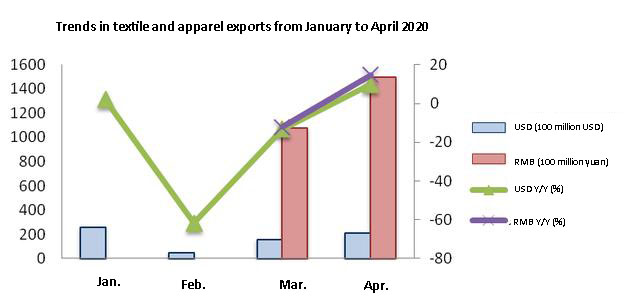

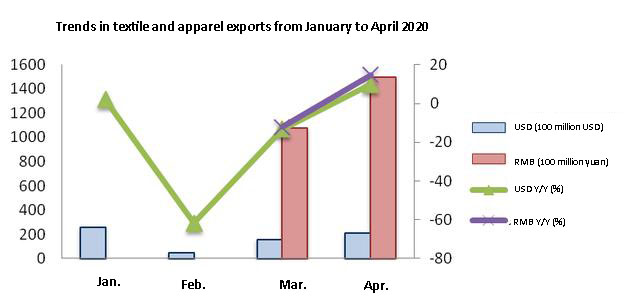

Textile and apparel exports are calculated in RMB: From January to April 2020, textile and apparel exports totaled 466.4 billion yuan, down 7.4%, of which textile exports were 261.3 billion yuan, up 5.9%, and apparel exports were 205.1 billion yuan, down 20.2%.

In April, textile and apparel exports were 150.17 billion yuan, up 14.8%, of which textile exports were 102.79 billion yuan, up 56.2%, and clothing exports were 47.38 billion yuan, down 27.1%.

Textile and apparel exports are in U.S. dollars: from January to April 2020, the cumulative export of textile and apparel was USD 66.62 billion, down 10% (national goods trade export fell by 9%), of which textile exports were USD 37.31 billion, up 2.9%, and apparel exports were USD 29.31 billion, down 22.3%.

In April, textile and apparel exports were USD 21.36 billion, up 9.8% (national goods trade exports increased by 3.5%), of which textile exports were USD 14.62 billion, up 49.3%, and clothing exports were USD 6.74 billion, down 30.3%.

Three major factors drove the rebound, and it will take time for the bottom to recover, and the difficulty has not passed.

Experts analyzed that China’s exports rebounded sharply in April mainly because the pre-hand orders entered the peak of execution.

Secondly, the surge in the export of anti-pandemic materials also boosted exports to a certain extent. According to statistics from the General Administration of Customs, the average daily export volume of China’s national defense pandemic materials has increased from about 1 billion yuan in the early days to more than 3 billion yuan in recent days, and it has continued to grow more than three times within a month.

In addition, the base effect is also one of the reasons why the export growth rate exceeded expectations in April. In April last year, China’s total export value increased by only 3.1%, which was at a low level throughout the year. However, the sharp increase in exports in April does not mean that China’s exports have been “very good.” On the one hand, since mid-March, Europe and the United States cancelled a large number of orders due to the pandemic situation, and its impact will gradually appear in the next few months. On the other hand, although some countries are carefully relaxing the strict restrictions on economic activities, it takes a process for demand to return to the state before the pandemic. Export companies may have to face “order shortage” for a period of time.

Although the decline in foreign trade data narrowed in April, the development of foreign trade still faces greater downward pressure. The overseas pandemic situation continues to grow, with a tremendous impact on the global economy and trade. Uncertainties have increased significantly. The risks and challenges facing foreign trade development are “unprecedented.”