THE BULLWHIP EFFECT

Jun 05, 2017 | by Mausmi Ambastha

Do you face growing level of inventory, especially when you move upwards in the supply chain?

Is your supply chain characterized by problems like lack of communication, disorganization, delay in order decisions and demand and supply gaps?

You might be facing the dreaded bullwhip effect.

CONCEPT:

(This image is for reference purpose only)

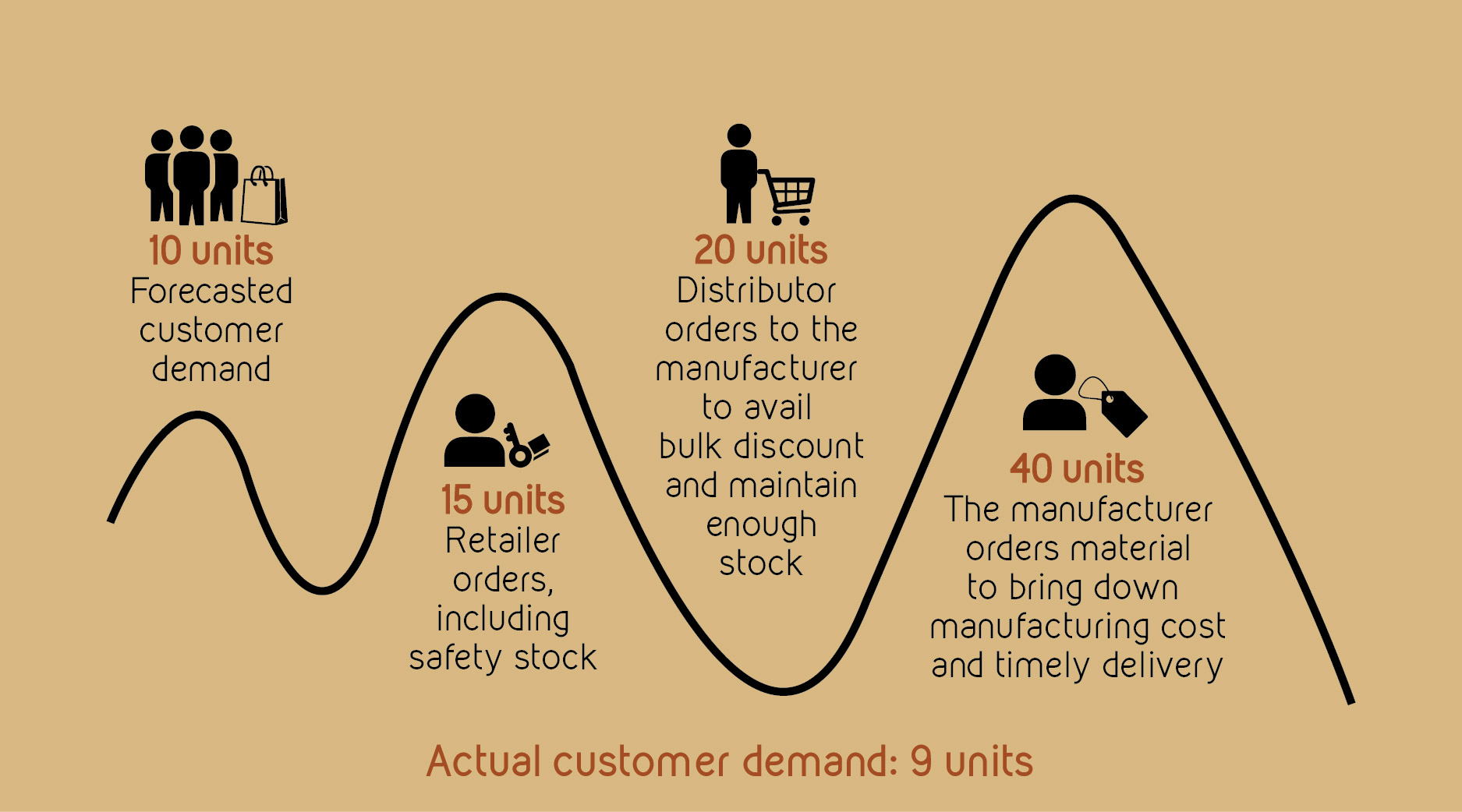

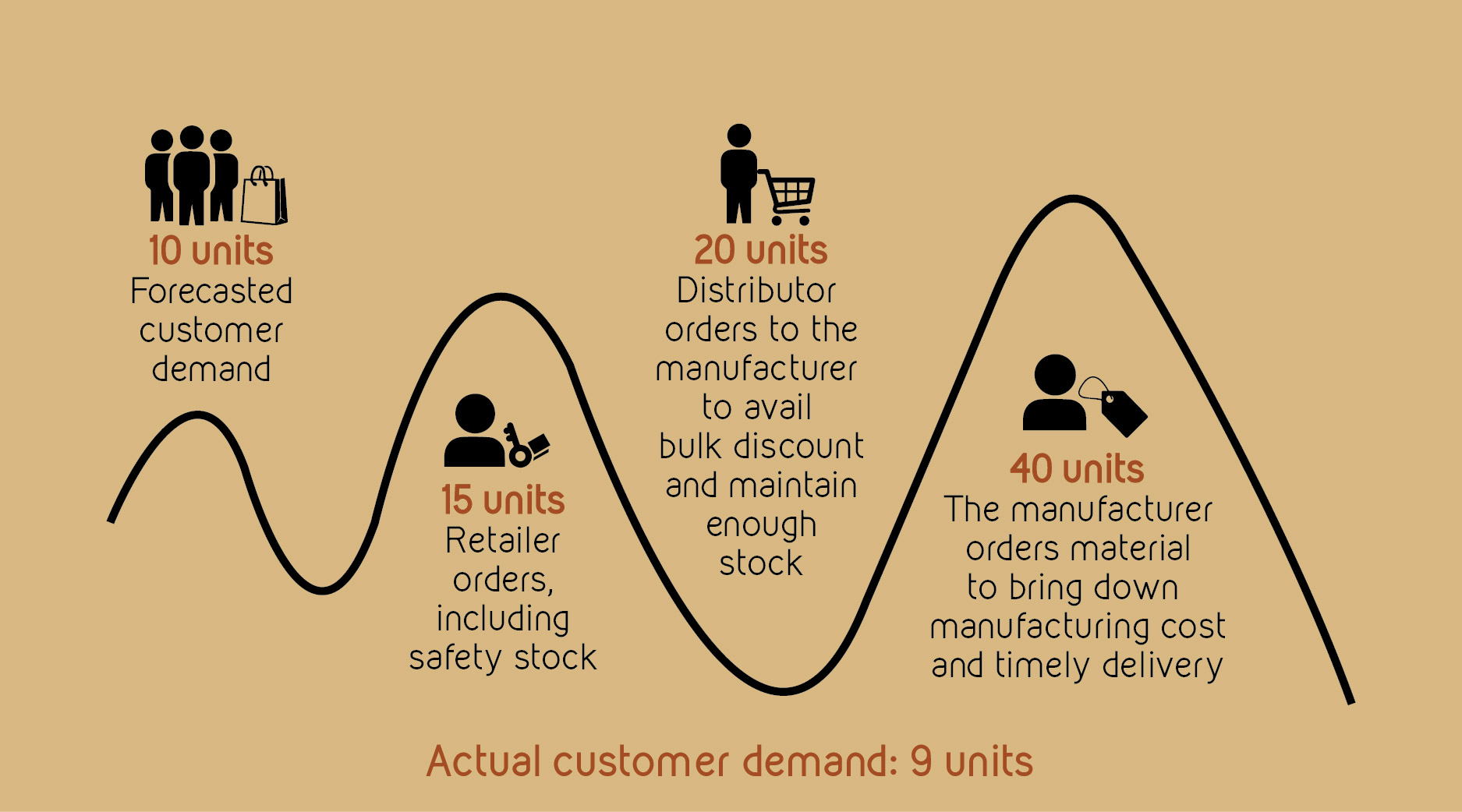

The order that the manufacturer receives is often much larger than what the actual customer’s demand is at the point of sale. This irregularity or variance in the size of the orders placed increases as we move up the supply chain, i.e. from the customer to the retailer to the distributor, and then the manufacturer. So, there is a downstream flow of physical goods and an upstream flow of demand information.

Let’s take an example:

So eventually, 40 units were produced against a demand of 9 units, and now the inventory will be pushed to the customer through offers & discounts and more investment will be made for the product’s marketing and advertising efforts.

This effect was observed by executives of P&G (Procter & Gamble) that the sales patterns for one of their best-selling products, pampers, fluctuates in retail stores, but the variabilities were certainly not excessive. However, as they examined the distributor’s orders, the degree of variability increased. When they further looked at P&G’s orders of materials to their suppliers, they discovered that the swings were even greater. This did not make sense. While the consumers, in this case, the babies, consumed diapers at a steady rate, the demand order variabilities in the supply chain were amplified as they moved up the supply chain. [1]

In a supply chain for a typical consumer product, even when consumer sales do not seem to vary much, there is pronounced variability in the retailers’ orders to the wholesalers [2]. Orders to the manufacturer and to the manufacturers’ supplier spike even more. To solve the problem of distorted information, companies need to first understand what creates the bullwhip effect so they can counteract it.

What causes this bullwhip effect?

While the lack of information sharing is the most obvious reason, there are 4 identified causes of this whiplash effect:

· Demand forecast updating: Every company in a supply chain follows product forecasting which is usually based on the past order history. This helps in production scheduling, material requirement planning, inventory control and capacity planning.

But in this case, the fluctuations are not accounted for. Also, the lead time of the orders varies or fluctuate drastically in some cases, which might force the buyer to place bigger sized orders.

For example, if you are a manager who has to determine how much to order from a supplier, you use a simple method to do demand forecasting, such as exponential smoothing. With exponential smoothing, future demands are continuously updated as the new daily demand data become available. The order you send to the supplier reflects the amount you need to replenish the stocks to meet the requirements of future demands, as well as the necessary safety stocks. The future demands and the associated safety stocks are updated using the smoothing technique. With long lead times, it is not uncommon to have weeks of safety stocks. The result is that the fluctuations in the order quantities over time can be much greater than those in the demand data.

Now, one site up the supply chain, if you are the manager of the supplier, the daily orders from the manager of the previous site constitute your demand. If you are also using exponential smoothing to update your forecasts and safety stocks, the orders that you place with your supplier will have even bigger swings. Because the amount of safety stock contributes to the bullwhip effect, it is intuitive that, when the lead times between the resupply of the items along the supply chain are longer, the fluctuation is even more significant.

· Order Batching Practice: Larger order sizes often offer discounts and lower cost advantages to the buyer, or at times suppliers don’t entertain smaller order sizes. Hence, companies tend to accumulate the demand to reach a respectable order size and develop the practice to order monthly or weekly, which creates demand variability as the average demand is not stable across the time-period.

Consider a company that orders once a month from its supplier. The supplier faces a highly erratic stream of orders. There is a spike in demand at one time during the month, followed by no demands for the rest of the month.

If the majority of companies that do MRP or distribution requirement planning (DRP) to generate purchase orders do so at the beginning of the month (or end of the month), order cycles overlap. Periodic execution of MRPs contributes to the bullwhip effect, or “MRP jitters” or “DRP jitters.”

· Pricing Fluctuations & Trade promotions: Specific period discounts, or cost fluctuations, can lead the buyers to order in bulk to avail the discounts which cause demand variability in the supply chain.

Estimates indicate that 80 percent of the transactions between manufacturers and distributors in the grocery industry were made in a “forward buy” arrangement in which items were bought in advance of requirements, usually because of a manufacturer’s attractive price offer.[3] Forward buying constitutes $75 billion to $100 billion of inventory in the grocery industry.[4]

· Rationing and short gaming: When product demand exceeds supply, a manufacturer often rations its product to customers. For example, the manufacturer then allocates its products in proportion to the amount ordered by the different retailers. Retailers often anticipate on potential shortages by exaggerating their real needs when they order. If demand drops later, this will lead to small orders and cancellations. Lee et al. [2] call this overreaction by customers, rationing, and shortage gaming. This “gaming” results in misleading information on the product’s real demand.

One example is the shortage of DRAM chips in the 1980’s. In the computer industry, orders for these chips grew fast, not because of a growth in customer demand, but because of anticipation. Customers placed duplicate orders with multiple suppliers and bought the first one that could deliver, then canceled all other duplicate orders.

More recently, Hewlett-Packard could not meet the demand for its LaserJet III printer and rationed the product. Orders surged, but HP managers could not find out whether the orders genuinely reflected real market demands or were simply phantom orders from resellers trying to get a better allocation of the product. When HP lifted its constraints on resupply of the LaserJets, many resellers canceled their orders. HP’s costs in excess inventory after the allocation period and in unnecessary capacity increases were in the millions of dollars.

CONTROLLING MEASURES:

The only way to counter bullwhip effect is to have the accurate, real-time demand information. To achieve that, we need to shift from a forecast-driven ordering system to measures that allow information sharing with the supply chain partners and hence complete visibility of the actual customer demand. Some of the common measures that companies are following globally to counter the bullwhip effect and establish a demand-driven supply chain are Kanban System, Vendor managed inventory, Strategic supply chain partnerships, Lean management, Real-time information sharing, and Just in time inventory replenishment system.

Incorporating one or more of the above-mentioned systems and management philosophies, we can not only counter bullwhip effect in our supply chain but also form better long-term strategic partnerships.

My next series of posts will elaborate on the controlling systems of supply chain and inventory management to avoid bullwhip effect. Stay tuned!

References:

1. J. W. Forrester. Industrial dynamics. MIT Press, Cambridge, MA, 1961.

2. H. L. Lee, V. Padmanabhan, and S.

Whang. The bullwhip effect in supply chains. Sloan Management Review, 38(3), 1997

Whang. The bullwhip effect in supply chains. Sloan Management Review, 38(3), 1997

3. Salmon (1993).

4. P. Sellers, “The Dumbest Marketing Ploy,” Fortune, volume 126, 5 October 1992, pp. 88–93.

5. Yossi Sheffi, “China’s slowdown: The first stage of the bullwhip effect”, Harvard Business Review, 9 September, 2015.

For more such articles, log on to www.stitchdiary.com

For more such articles, log on to www.stitchdiary.com