Analysis of 2013 Global Industrial Textile Market Trend

Jul 03, 2013 | by

Global GDP Growth Rate Slows Down

The market sales of global industrial textile increased by about 2.5% in 2012, which is expected to reach the growth of 2.7% ~ 3% in 2013.

The slight growth of the world’s GDP is the main factor that controls the global industrial textile market growth in 2013. In 2012, the world’s GDP increased by 3.3%, which is expected to reach 3.6% in 2013. In addition, the European debt crisis is still the min risk faced by the global economic recovery.

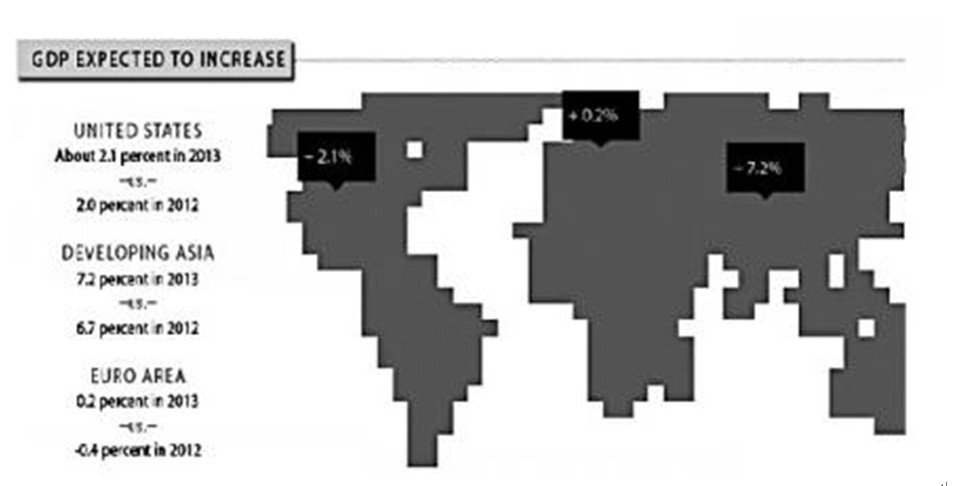

Picture 1 shows that American GDP is expected to grow about 2.1% in 2013 since its growth rate reached 2% in 2012. GDP of the developing country—Asia increased by 6.7% last year, and is expected to reach 7.2% this year. Comparing with the drop of 0.4% last year, the GDP of Euro area is expected to grow by 0.2% in 2013.

Picture 1 shows that American GDP is expected to grow about 2.1% in 2013 since its growth rate reached 2% in 2012. GDP of the developing country—Asia increased by 6.7% last year, and is expected to reach 7.2% this year. Comparing with the drop of 0.4% last year, the GDP of Euro area is expected to grow by 0.2% in 2013. It is expected that the growth of world’s GDP will drive up the GDP growth of many economies around the world. In 2012, the GDP of America and Asia (China, India and Southeast Asia countries) increased by 2% and 6.7% respectively, while the GDP of euro area dropped 0.4% last year. In 2013, the GDP of America, Asia and euro area is expected to grow by 2.1%, 7.2% and 0.2% respectively.

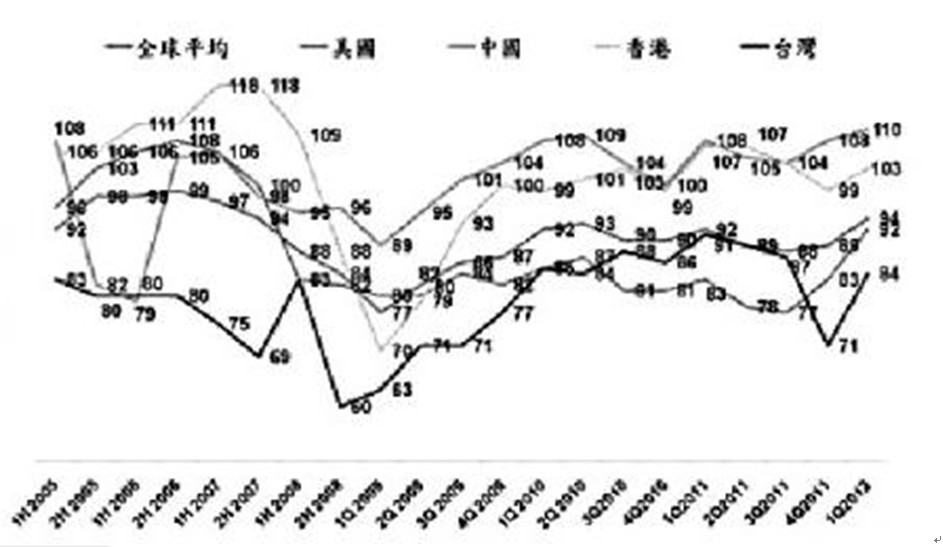

Picture 2 shows that in the first quarter of 2012, the global average consumer confidence index was 94. The consumer confidence index of America, China and Hong Kong was 92, 110 and 103, respectively. Taiwan consumer confidence index was 84, up 13 points, returning to the normal state.

Picture 2 shows that in the first quarter of 2012, the global average consumer confidence index was 94. The consumer confidence index of America, China and Hong Kong was 92, 110 and 103, respectively. Taiwan consumer confidence index was 84, up 13 points, returning to the normal state. According to the Nelson global consumer confidence report, except for the Asia-Pacific region and the Middle East, global consumers still worry about the weak labor market, personal financial situation, the credit crunch and if they can afford the things they want and need. In addition, the weak economic data, slowdown Asia manufacturing, continuing European debt crisis, the political uncertainty in Middle East and the increasing household spending in America have already affected the consumer confidence.

The continuing crises in Euro area scaled back the hope of global economic recovery in the second half of 2012. In later years, the whole European economy is teetering on the brink of recession, which is still the core concern that influences the global economic growth.

From 2002 to 2012, during the 10 years, China had experienced the minimum GDP, and the estimated GDP of China in 2012 reached 7.8%. This conclusion is due to the reason that the real estate caused the personal credit crunch, which has become the biggest risks of China’s residents’ consumption. What’s more, the weakening external demand will affect the export demand. Although facing with the difficulties brought by the slowdown economic, China’s economic activity is expected to speed up by the acceleration of examination and approval for public infrastructure projects starting from the fourth quarter of 2012. It is expected that the economic growth trend will continue in 2013 with the GDP about 8.6%.

Picture 3 shows that in the year of 2012, American housing construction increased by 14% and non-residential construction increased by 7%.

According to the Nelson investigation report in the third quarter of 2012, 62% of the consumers from all over the world think that their located countries’ economy is on the decline, and half of the consumers believe that this recession will last for a year. Compared with the Nelson investigation report in the fourth quarter of 2011, this kind of emotion had decreased by 64%. In many parts of the world, the relevant economic situation is still fragile, which many limit consumer confidence and consumption momentum in the first half of 2013.

The Overall Business and Sales Environment of the United States Have Improved

Many industries’ overall business and sales environment had improved in 2012. Compared with the growth of 4% in 2011, many manufactures of American traditional industrial textile market had a better operation condition with an increase of 7% in 2012, especially in the marine fabric market.

Compared with 2011, American housing construction increased by 14% and non-residential construction increased by 7% in 2012, making larger prospects for the sales growth of awning, compositional fabrics and geosynthetic materials.

In 2012, sales of some American graphic fabric market terminal product manufacturers experienced the single-digit, stable and declined growth. American graphic fabric sales were affected by the flowing two reasons. First, large retailers began to use cheaper materials, which made the terminal products become no more durable. Second, more ink, printer and raw materials suppliers entered the fabric printing market.

According to the American residential builders remodeling market index, consumers have become more cautious about the cost of home renovation projects. In the fourth quarter of 2012, the remodeling market index was 55, which was the highest since the first quarter of 2004. However, the remodeling market recovery, especially for large projects is still limited by the credit crunch and the lower assessment.

The IFAI reported that the industry profit gained a slight increase in the year of 2011 and 2012 with lack of depth development. Before 2009, orders between terminal product manufacturers and suppliers could be in 6 months or more, while in 2011, manufacturers preferred the orders less than 2 months, in order to avoid overstock or out of stock, so as to reduce inventory space and costs.

In 2012, sales of American industrial textile industry increased by about 2.0%, 1.5% higher than 2011. It is expected that in 2013, sales of high temperature processing products (including industrial textiles) will increase by 2%~3% year-on-year.

Reasons for the Increasing American Industrial Market

After recent years of effort, the United States industry participants had made great achievements in sales and profits last year, which due to the fact that they were trying to transform the business in order to meet the challenges. In addition, the American market is in powerful return, the following reasons promoted the sustained growth of American industrial textile market in 2012.

Relax commercial and industrial loan credit standards.

Compared with 2011, the credit market had slight improvement in 2012, but remains tense. In 2012, financial institution relaxed the commercial and industrial loan credit standards, but the speed and loan demand for smaller customers remains slower and weak. A recent survey of small enterprises shows that many small enterprises approved for credit in 2012, but over a quarter of them did not apply for loans because they thought they will be refused.

Declined unemployment rate improved consumer confidence.

The United States average unemployment rate was 8.1% in 2012, had been a marked improvement compared with the 8.9% in 2011. American Federal Reserve Board forecast that the unemployment rate will decline to 7.4% ~7.7% in 2013. But economists said that the United States economic will slow down by the growth of 0.5%, impeling the average unemployment rate to return over 9% from the 8.1% in 2012, which may deepen the US economy recession.

Although the U.S. unemployment rate is still high, compared with 2011, the reduced growth in 2012 helped to improve the consumer confidence index. In 2012, about 67% of consumers regained confidence, while only 58% of consumers regain confidence in 2011. The improvement of consumer confidence in 2012 helped the moderate expansion of the continuing economic activity. Consumers continue to think that the individual economy prosperous will pick up, while many cautious consumers concern about the weak labor market.

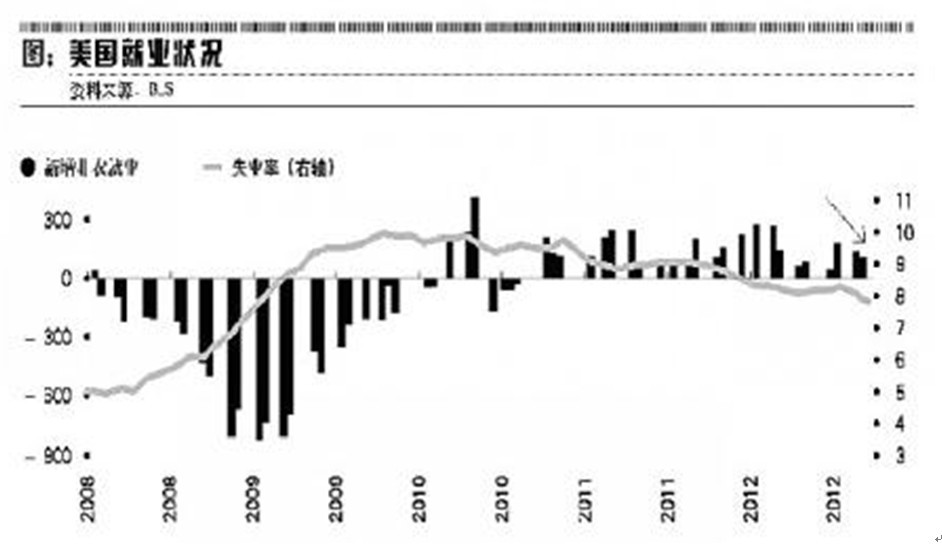

Picture 4 showed that the average unemployment rate of the United States was 8.1% and 8.9% in 2012 and 2011 respectively.

Oil prices control raw material costs.

High oil price drives up the cost of raw material. In 2012, the average cost of a barrel of oil was $94. It is predicted that the price will reduce to $89/ barrel in 2013.

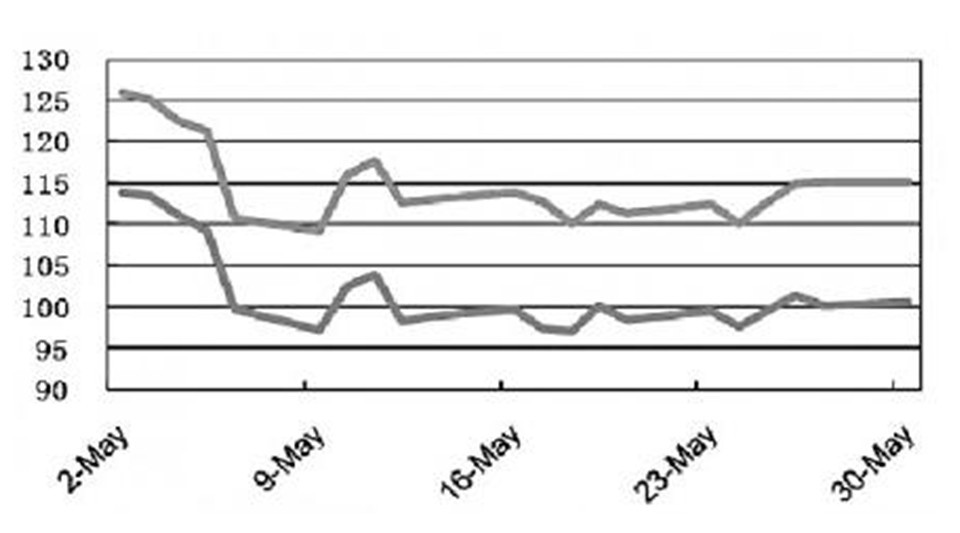

Picture 5 shows that since August 2010, the international crude oil had been rising for 9 month and appeared the first monthly drop in May 2011.

The natural gas has affected some professional textiles market, especially the marine fabric industry. Ship consumers tend to spend much more money to restore their existing ships and buy a new one.

Import from Asia will not drop very quickly.

The United States import industrial textiles share from China and other places will not drop very quickly, which may increase China’s textile industry wages and other costs.

In 2012, China accounted for 52% of the total America industry textile imports. In the past few years, China has raised the main manufacturing minimum wage 14%~21%. It is estimated that the China’s manufacturing industry salary will jump nearly 12% per year on average.

Recently the Boston consulting group found that, China’s pay rate was only 36% of American counterparts in 2000 and increased to 48% in 2010. The pay rate will reach nearly 69% in 2015 with potential. In the future five years, China’s minimum wage standard is expected to grow at an average annual rate of 13%~15%, which means that China’s past cheap products import will be more expensive in the future.

In 2011, the United States global industrial textile imports fell by 3% and the industrial textile products import from China dropped 1% compared with 2010. In November 2012, the United States industrial textiles import from China increased about 2%. The United States imported a lot of Asian industrial textiles would have certain influence in the aspects of both sales and profit of its own industrial textiles manufacturers (especially tents, awning, graphic fabric and waterproof fabric).

The United States industry increased 2% in 2012.The industrial textiles terminal manufacturers pay more attention on high value products and services, such as the intelligent textiles and medical products, expecting to achieve a greater sales growth in 2013. Industry leaders plan to support more funds for capital expenditure in 2013 with positive attitude on sales prospects.