Spatial Pattern of Foreign Direct Investment of China’s Textile Enterprises

Jan 22, 2018 | by FAN Yuting

Abstract: China textile industry has achieved encouraging achievements, becoming the primary industry of the integration of investment, production, consumption, employment increase and foreign exchange earnings. On the basis of reviewing studies on foreign direct investment of domestic textile enterprises, this paper come up with the structure analysis framework of spatial strategies of foreign investment of China’s textile enterprises with the methods of statistical information, field research and interviews of senior managers. Besides, this paper analyze the spatial distribution and industry choices of foreign direct investment of China’s textile enterprises.

Key words: China textile; foreign direct investment; spatial distribution

Overseas investment volume fluctuates and overseas investment accelerates

According to the Ministry of Commerce, from 2003 to 2012, the composite annual growth rate of foreign direct investment (OFDI) in the textile industry was 10.64%, reaching $25, 5.52 million in 2012; China's manufacturing sector grew is at an average annual compound rate of 30.10%, reaching to $866, 7.41 million in 2012, accounting for 9. 9% of China's total foreign direct investment that year. As a result of the great increase in 2011 , the annual growth rate of textile and clothing apparel industry was 36.52 % , which was higher than the growth rate in the same period of manufacturing. As a result of the 2008 financial crisis, China's textile industry has witnessed a massive decline in the growth rate of foreign direct investment, down from -30.9 percent in 2009 and -21.2 percent in 2010. In 2011, under the influence of the national favorable policies, the foreign investment of the textile industry increased by 56.4% compared to the same period last year. In 2012, the growth rate was 107%, and the total foreign investment amounted to 544 million 590 thousand US dollars (Table 1).

Tab.1 Amount of ODI for Chinese textile industry from 2003 to 2012

|

Year |

Investment in textile industry / millions of dollars |

Textile industry as a percentage of manufacturing industry |

Foreign investment in the textile industry increased by% over the same period last year | |||

|

Textile industry

|

Textile and clothing industry |

Chemical Fiber |

Summation | |||

Source: Ministry of Commerce of China

Since the abolition of the national textile quotas in 2005, in order to break through the barriers to trade in developed areas, many countries began to speed up the process of the construction of foreign investment. Before 2005, domestic textile companies with outbound investment of more than $1 million were rare. In recent years , not only a large number of companies that have invested more than $ 1 million in foreign investment have sprung up , but have also been investing more than $10 million in construction projects. For example, in 2008, Zhejiang Tianlong digital printing and dyeing Co. Ltd. invested 80 million yuan in Vietnam, and established Tianlong (Vietnam) Limited by Share Ltd; In 2011, Zhejiang Fulita Co. Ltd. invested $253 million in the acquisition of Nada seed Cellulose Co. Ltd.

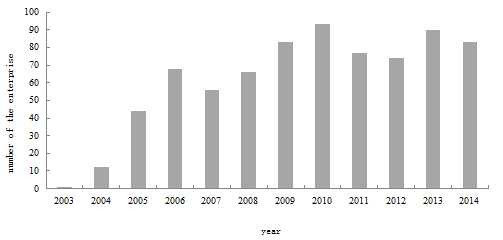

The global layout and the overall pace of industrial transfer have accelerated simultaneously. According to the enterprise data in the Ministry of Commerce's list of overseas Investment Enterprises (institutions), from 2006 to 2014, the number of overseas Chinese textile enterprises has increased overall, from 12 in 2004 to 83 in 2009, and reached a peak of 93 on 2010. But it fell back to 77 in 2011, 74 in 2012, and 90 in 2013. On the whole, overseas Investment in China's Textile Industry is rising steadily (Table 1).The main investment output is concentrated in the eastern coastal provinces of China , and the value chain optimization layout is implemented.

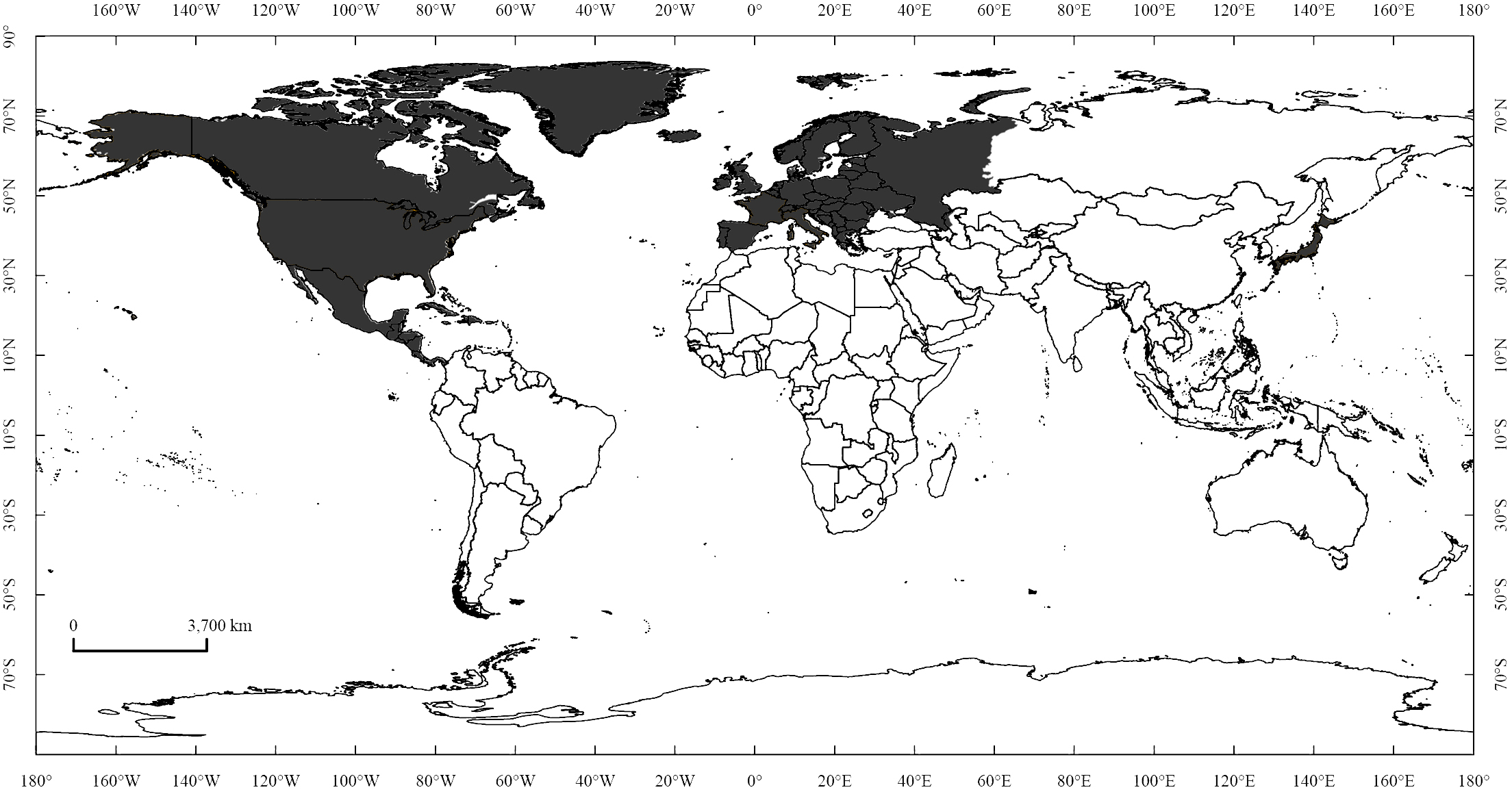

Fig.1 Textile enterprises for Chinese ODI from 1983 to 2014

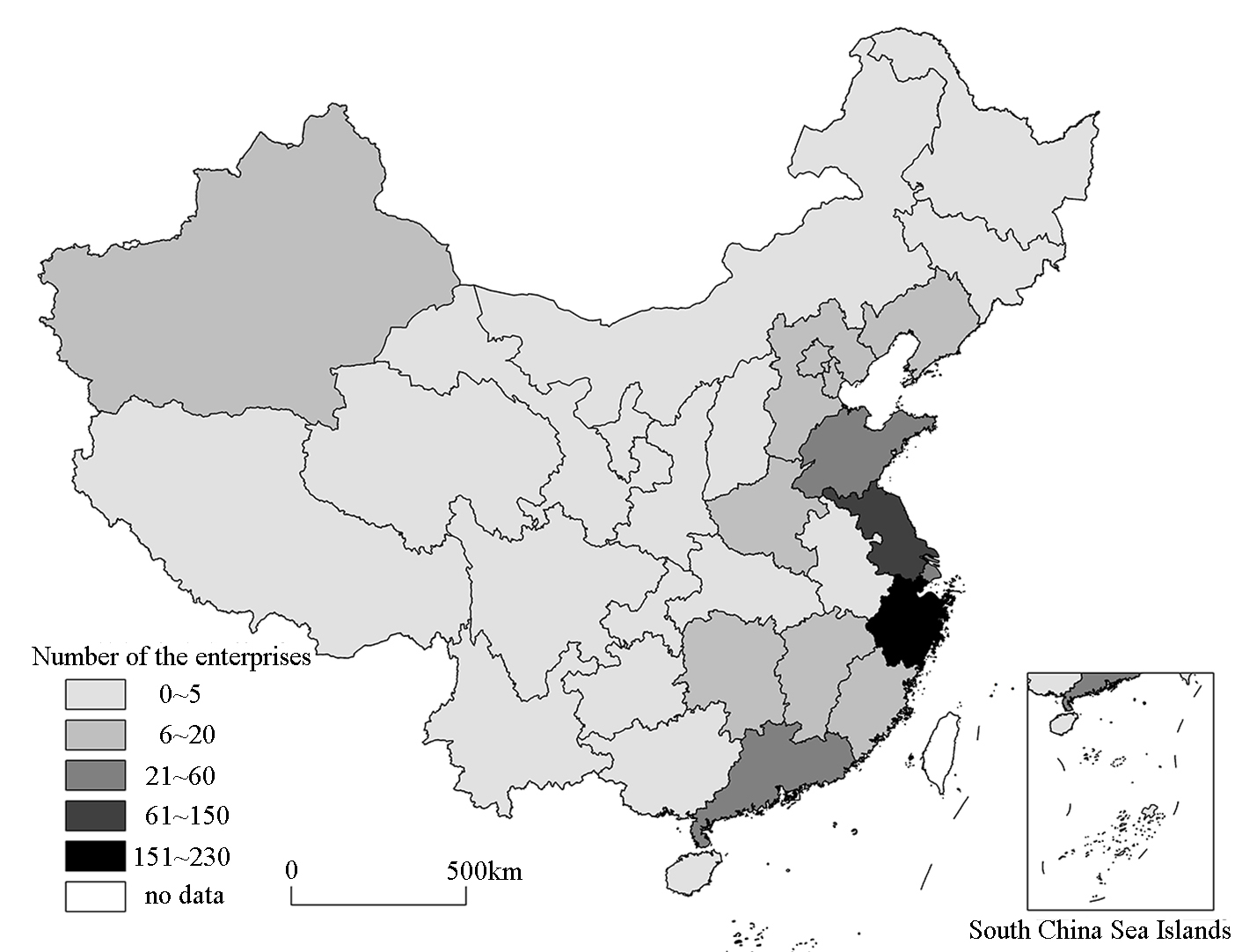

From the point of view of the main export places of foreign investment, it is concentrated in Zhejiang, Jiangsu, Shandong, Guangdong and other eastern coastal provinces. These areas are the most concentrated and developed areas of China's textile industry. Its outward investment also occupies a very high proportion in the whole country (Fig 2). The number of enterprises investing abroad in these four provinces accounts for 78% of the total, while Zhejiang and Jiangsu provinces account for 57.6% of the total. Enterprises are the main carriers of China's textile industry transfer. More than 99% of China's textile enterprises are private enterprises. Currently, limited liability companies and private enterprises invested in foreign investment have become the backbone of the transfer of textile industry, and the proportion of external transfers has increased.

Fig.2 Numbers of ODI enterprises in the provinces and cities nationwide

Through the establishment of the factory in the world, Guangdong Yida Group has formed a perfect shirt production chain, implemented vertical integrated management, and provided services for the global mainstream market. Its first step on the road of internationalization was to cooperate with mainland enterprises in compensation trade, but at that time the management and technical level of mainland enterprises could not meet the requirements of Yida for product quality. At the same time, there are also industrial policies which do not match the actual national conditions. In this case, it turns to the foreign countries such as Singapore, Taiwan, the Philippines and other areas, directly invest in the garment making factory, use the local high quality labor resources, begin to expand the upstream of the industrial chain, start to control from the raw materials, and then develop cotton cultivation, cotton spinning, dyeing and finishing, color-weaving and other industrial chain links ( as shown in Table 2 ) . ( Interview with the head of the Group )

Table 2 Main events of development history of Yida Group

|

Time |

The end of 1970s |

Early 1980s |

1980s to 90s |

Mid and late 1990s |

End of 1990s |

Since 2000 |

|

Area |

Jiangsu, Hubei, Beijing |

Mauritius, Jamaica, Singapore, Taiwan, Philippines. |

Guangdong, Zhejiang, Jiangsu |

Xinjiang |

Inland coastal cities |

Vietnam and Liangshan Industrial Zone |

|

Main events |

compensation trade |

Invest abroad and build a garment factory |

Invest in the Mainland and build a garment factory |

Purchase of cotton fields, cultivation of cotton, construction of cotton mills |

Construction dyeing and finishing factory |

Build a garment factory |

Source: author's summary based on data

Diversity of transfer destinations covering key areas such as Southeast Asia , North America and Europe.

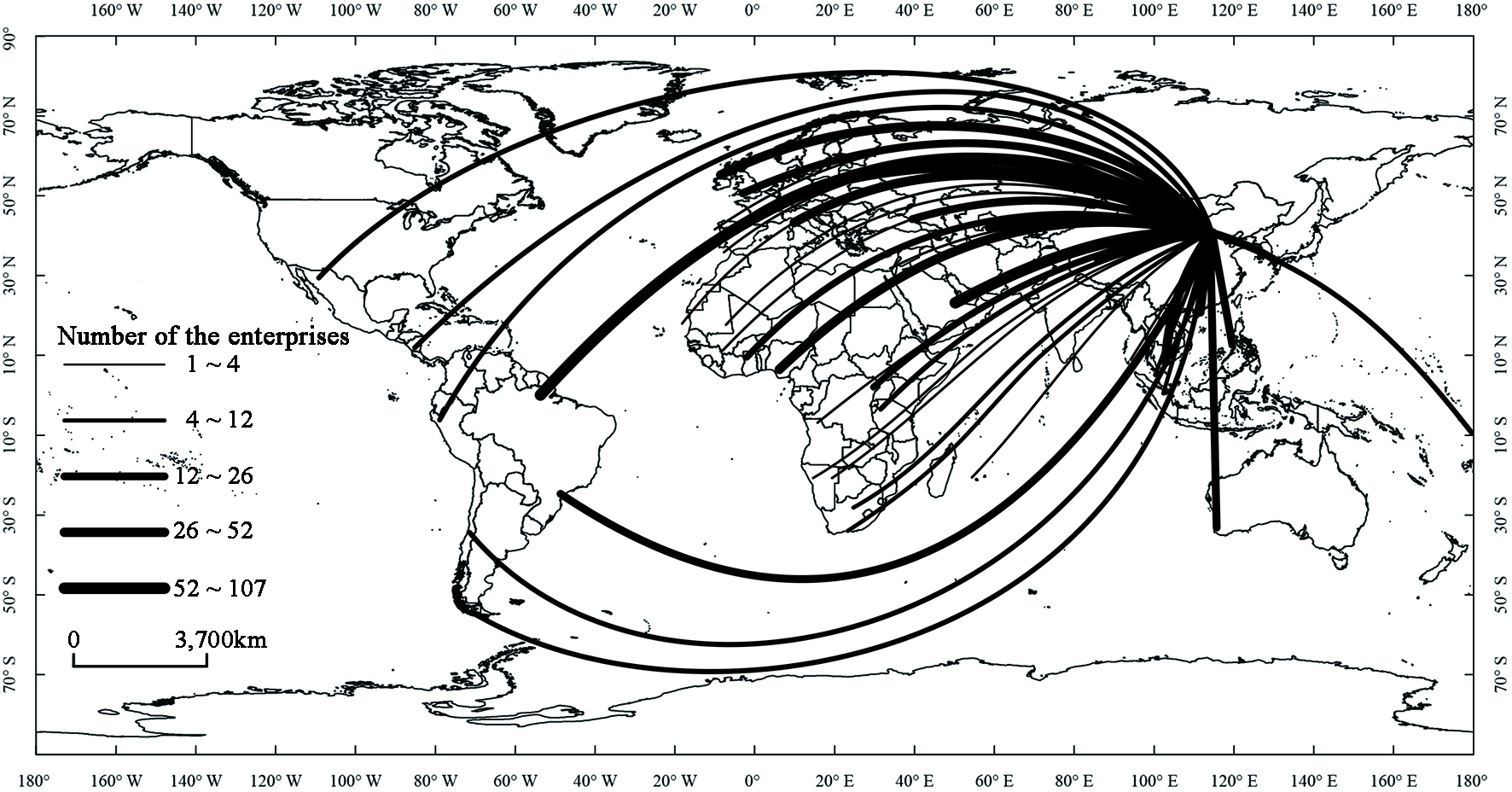

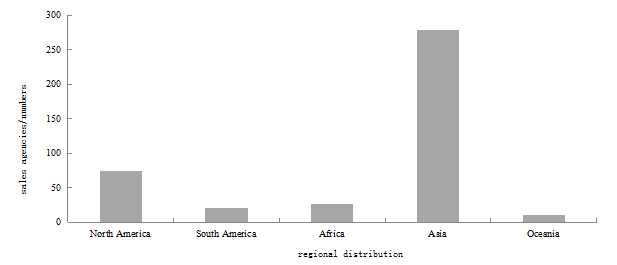

According to the enterprise data in the list of overseas investment enterprises (institutions) of the Ministry of Commerce, there are 689 overseas investment enterprises approved by the Ministry of Commerce at the end of April 2014. The main investment areas are production, R & D design and trade sales . In terms of geographical distribution, the number of overseas investment enterprises established in Asian countries is the largest, which accounts for 55.78% of the total, while other regions include 14.58% in Europe, 13.95% in North America and 9.67% in Africa, 3.80% in South America, 2.22% in Oceania (Fig 3). China's textile industry transfer destinations show a trend of diversification.

Fig.3 The Distribution of China's textile enterprises overseas investment countries and regional from 1983 to 2014

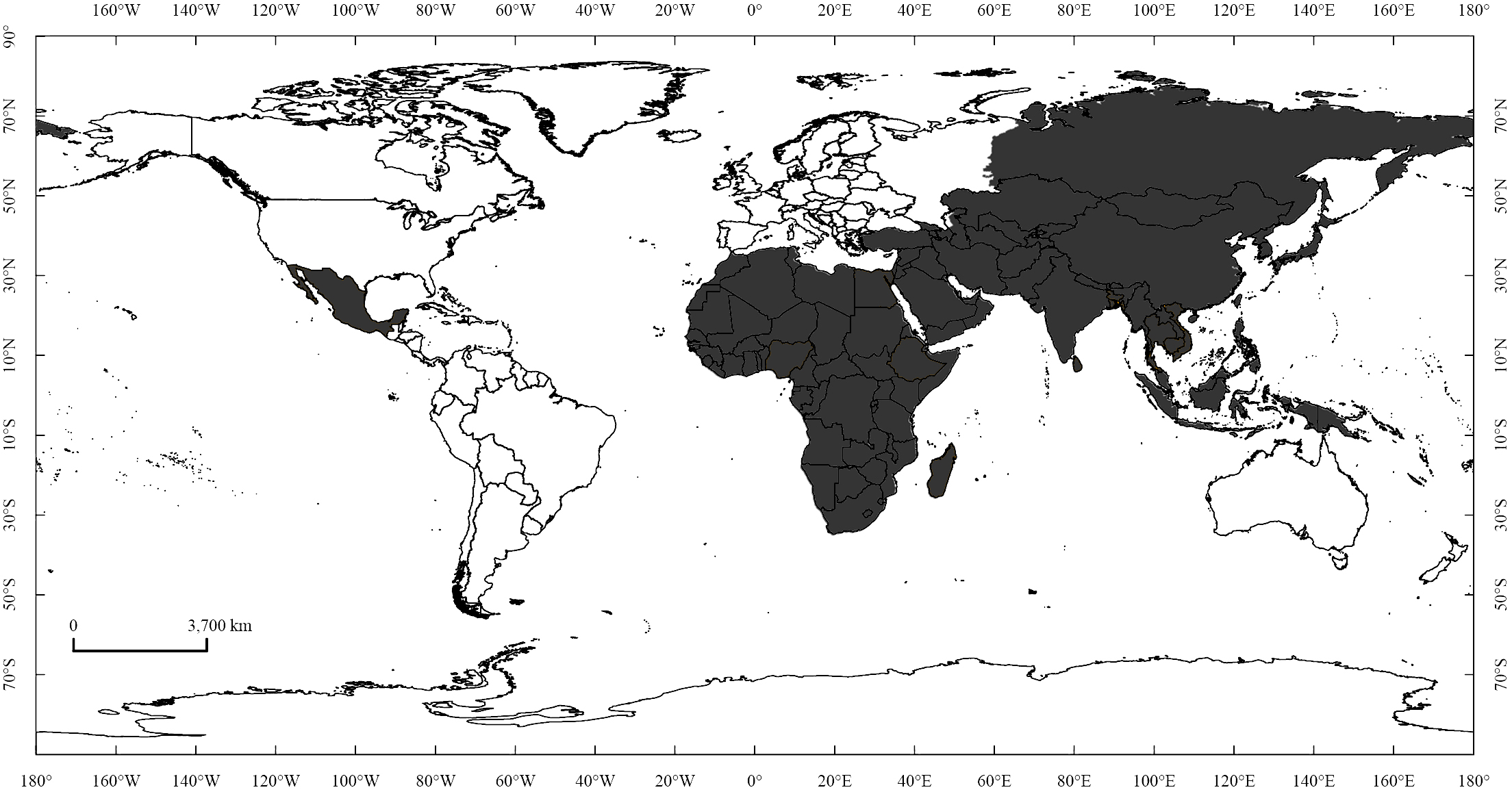

The main production Chinese textile enterprise to destination is the 153 overseas developing countries or developed countries. From1983 to 2014, there are 93 production enterprises transferred to Asia, the production of textile enterprises accounted for 58.23%, the transfer destination is mainly in Kampuchea, Vietnam, Bangladesh and other Southeast Asian countries. African countries have also taken over the transfer of more textile production links, accounting for 26.43% of them, such as Egypt, Nigeria, Ethiopia and so on (Fig 4). The transfer of textile enterprises is onto the developing countries, such as Mexico, Thailand, Kampuchea, Sri Lanka, Madagascar and other regions, it is mainly based on the low labor factor prices of these countries, which can effectively reduce the cost of the company. In recent two years, due to the continuous and rapid rise of the cost of labor and other factors of production and the pressure of garment processing cost in coastal areas is too large, enterprises are increasingly investing in garment processing industry in Southeast Asian countries.

Fig.4 Global distribution of manufactural companies from 1983 to 2014

From 1983 to 2014, there were 43 R & D overseas textile enterprises, 14 in the United States and 11 in Hong Kong. Accounting to 33.33% and 28.21% respectively, as well as Japan, Italy, France and so on (Fig 5). The main aim of the developed countries is to avoid trade barriers imposed by other developed regions through regional free trade zones and to sell products to Europe and the United States. Second, in the developed regions, R & D institutions can be set up and sold to obtain greater economic benefits and promote the further development of the industry in the highly developed areas.

Fig.5 Global distribution of research & development companies from 1983 to 2014

The distribution of trade and sales enterprises is very extensive and the enterprises are distributed all over the world. Among the 493 trade and sales textile enterprises, the largest number of textile enterprises in Asia are in the region, with 279, accounting for 56.64%, of which 124 are located in Hong Kong, which is set up in Hong Kong for entrepot trade. There are 84 in Europe, 74 in North America, 20 in South America, 26 in Africa and 10 in Oceania (Fig.6). Textile enterprises set up their own international marketing network when they just started to "go out", usually based on the establishment of trade selling companies. These foreign trade companies can meet customer needs faster, enhance customer relationship, grasp the pulse of the local market, facilitate the purchase of foreign orders, and improve the total sales and profit margins of enterprises. The Industry and Investment form of overseas Investment of Chinese Textile Enterprises.

Fig.6 Global distribution of trade and sale companies from 1983 to 2014

The current foreign investment mainly relates to China's textile industry are: cotton spinning, knitting, wool spinning, chemical fiber, printing and dyeing, clothing, home textiles, textile machinery, and other fields, the accumulation of foreign investment statistics amount is only billions of dollars. According to the 2012-2015 China textile industry association of special research, investment industry mainly for processing base, raw material base, industrial park, market channels, equity acquisition, high-end brands and technology etc, which is shown in various fields, area and form. There are two main types of overseas investment in China's textile industry: First, greenfield investment. Greenfield investment is not susceptible to the host country law and the protection policy limit, this is because the new enterprise can increase the tax for the host country, promote the growth of the economy, actively attract foreign investment of enterprises in developing countries. Second, mergers and acquisitions. In order to obtain the developed countries' ready-made R & D technology, the marketing network actively cooperates with famous organizations such as the United States, Britain, Italy and so on, so as to increase the added value of the products and increase the market competitiveness of the products.

The transfer of textile industry in China mainly adopts two modes: first, green space enterprise investment. The textile engineering construction is in the underdeveloped area of textile industry, the advantage of relatively low labor cost is utilized, and human resources are fully utilized. In 1999, Huayuan Textile Group changed its development strategy based on the overcapacity of domestic textile industry and turned to Mexico, where the development of the country was stable and the investment atmosphere was good, and the labor price was low. Raw materials from Canada and the United States are shipped to Mexico for production, and the finished products are then shipped to the United States for sale. Because Mexico is a member of the North American Free Trade area (NAFTA), there is no quota limit on obtaining US cotton cost subsidies. Second, related acquisitions. Shanghai Textile Group has taken on with developed countries, such as the UK and Italy brands, they cooperate with each other to use more advanced science and technology in developed countries to develop foreign sales and push goods to the top end of the market. Further improve international competitiveness and enhance the value of domestic textile brands (Interviews with Group leaders).

From the historical experience, after the initial stage of industrialization, the internationalization of textile brands must make full use of foreign capital to ensure the sustainable development of the economy. Nowadays, our country is in the middle stage of industrialization, the promotion of the Chinese surplus production factors and production capacity in the global scope flow and configuration, and the introduction of strategic resources and advanced production technology in the world, they all have an important strategic significance for the development of the textile industry in China. The strategy of "going out", which is put forward by the Central Committee, and it is adapted to the development trend of the internationalization of the world economy. Therefore, the overall industrial upgrading of China's textile industry to foreign industries is an important strategic choice for China's textile industry.

References:

Bai S Q,Guo M Y, Xing J. 2015. TPP's Potential Impact on the Export Competitiveness of China's Textile and Clothing[J]. Contemporary Economy & Management | Contemp Econ Manag,37(08):35-39.

Chen Y T. 2011. Chinese Enterprises Overseas Investment Situation and Layout Difference Analysis. Technoeconomics & Management Research[J] (06):66-69.

Ding W H, Gao Z G. 2014. Under the Perspective of “Silk-road Economic Belt” strategy research the direction of export-oriented economy development in Xinjiang[J]. Journal of Lanzhou Commercial College, 30(3): 87-90.

Du Q Y,Zheng X B. 2015 Relationship between international entrepreneurial orientation and international performance of the born global enterprises—A view from the dynamic coupling of network relationship and learning orientation.

Fu C,Yang Z, Fu D G. 2015.Does Peer Effect Affect the Good will: Empirical Evidence from High-Premium M&A on the GEM,China Soft Science2015,(11):94-108.

Geng W C. 2015.The viscous analysis on inter-district transfer of textile industry from the perspective of New Economic Geography in China[J]. GEOGRAPHICAL RESEARCH, 2015,34(02):259-269.

Jiang Y S,He S H. 2016. The Added Value Accounting of Chinese Textile Clothing Export Trade and Its Influencing Factors. Journal of International Trade[J], (08):40-51.

Liu S G, Chen Y F. 2008. The inspiration of the development of japan’s textile and garment industry to the innovation of china’s textile and garment industry [J]. Shandong Textile Economy, (5): 24-27.

Liu W D. 2015 Scientific understanding of the Belt and Road Initiative of China and related research themes[J], Progress in Geography,34(05):538-544.