The 28th edition of Milano Unica enjoyed a great success

Feb 14, 2019 | by

“The satisfying participation of exhibitors and buyers at the 28th edition of the High End Textiles and Accessories Trade Show encourages us and drives us to continue innovating our offer despite the uncertainties of the general economic situation.”

- Ercole Botto Poala, President of Milano Unica

At the 28th edition of Milano Unica, The Italian Textile and Accessories Trade Show, held at Fiera Milano Rho on February 5th - 7th, the essentially steady number of exhibitors (421) compared to the February 2018 edition was matched by a corresponding presence of visitors from sector companies, both Italian and foreign, numbering about 6,000. There were fewer Chinese companies, as the dates coincided with their New Year celebrations, but that was mostly made up by the Korean and Japanese companies in attendance and a good showing on the part of European operators. A result, keeping in mind the general trend in textile-apparel trade shows, that confirms the wisdom of anticipating the fall edition to July, also to serve as a driver for the winter show.

The 28th edition of Milano Unica was officially opened at the Opening Ceremony, with talks by Ercole Botto Poala, President of Milano Unica, Mauro Scalia, Director Sustainable Businesses Euratex, Raffaello Napoleone, Managing Director of Pitti Immagine, Masahiko Miyake, Presidente Jfw - Japan Fashion Week, and Roberto Luongo, General Director, ICE.

Although the overall number of companies was essentially equal to that of February 2018, there was a significant increase in participation by companies from: Japan (+15%), Korea (+5%), Great Britain (+5%), Poland (+16%), Rumania (+11%) and Spain (+5%), with the USA and Germany holding steady.

Two topics were particularly emphasized by the national and international media: sustainability and the digital initiative launched by Milano Unica with the e-milanounica platform.

“Sustainability is key to the survival of the sector. I am totally convinced that if our companies have overcome difficult times, it is because in addition to service and innovation, they had respect for the product and the environment, they worked to limit the impact of the textile-apparel industry on the planet. Now we must act in concert, because this is a global challenge, with the well-being of future generations at stake,” explained Ercole Botto Poala, President of Milano Unica, during the Opening Ceremony.

During the ceremony, time was also dedicated to presenting the new ‘e-milanounica’ project, the online marketplace launched in a pilot version, which will be fully operative for the July 2019 edition. The initiative is intended to promote the textile-apparel-fashion sector by extending the traditional trade show activities to the digital world, including marketing, contents and promotions, making it possible for companies and their clients to stay up to date year round.

“The richness of the textile and accessories collections presented in this 28th edition of Milano Unica was matched by the encouraging presence of Italian and foreign buyers, reversing the recent trend recorded in other sector trade shows. Many exhibitors were also satisfied with the number and quality of the contacts established. Buyers and exhibitors both appreciated the enhancement of the contents, not only in the now established Area Tendenze, but on strategic topics, such as the Sustainability Project, covering both product and process, and the digital challenge Milano Unica has decided to tackle, as a united industry, in collaboration with Pitti Immagine,” added Ercole Botto Poala.

“The organizational efforts, increasingly aimed at making Milano Unica a can’t miss appointment in the international spectrum of textile fairs, were rated positively by buyers and exhibitors,” said Massimo Mosiello, General Director of Milano Unica, who has overseen the textile-accessories trade show organization since its inception. “Upstream of this result there was not only an important process of selection, intended to ensure a high level of quality of the collections displayed, but also the precise modalities with which we presented the various theme-based areas and the content projects. It involved much teamwork on the part of the entire system, made possible by the essential support provided by the Ministry of Economic Development and the extraordinary collaboration of ICE. Part of the merit for the result is also due to the dedication of our Milano Unica staff and collaborators. Last but not least, we thank Japan Fashion Week for the special evening event celebrating the tenth presence of the Japan Observatory at Milano Unica”.

“The central topics of the 28th edition of Milano Unica, including sustainability and digital innovation, are an integral part of the fundamental contents of ICE initiatives in support of the internationalization of the Italian manufacturing sector. Facing these challenges is essential in order to continue to be competitive in continually changing markets. In Milano Unica and in the time-tested collaboration with Pitti, we have an example of a promotional platform which, flanked by ICE initiatives for the sector, represents an important channel for valorizing Made in Italy production on the international market,” noted Roberto Luongo, General Director of ICE.

“Sustainable Innovation” is the leitmotif that links all the initiatives revolving around the Project, which saw the participation of approximately 120 businesses presenting a total of nearly 700 samples of textiles and accessories. In this edition, the Project goes over the simple registration of the state of the art of product sustainability, inviting all businesses and stakeholders to challenge themselves with the new ambitious goal of integrating sustainability in all corporate management processes.

In its steady commitment to increasing the visibility of sustainability-oriented businesses, Milano Unica has continuously invested in the Sustainability Project by developing initiatives and projects offered throughout the year, which will be disseminated and promoted through all of its different communication channels.

The Area dedicated to the Sustainability Project offers special visibility to those exhibitors that evolved from product sustainability to the more advanced process sustainability across corporate functions. These businesses distinguish themselves because they have defined long-term improvement targets and commitments, monitoring and reporting plans for the adoption of integrated sustainability management systems.

Proposals are not only linked to sustainability. As usual, the trade show presents the Synthesis Areas, with the representative samples of the participating organizations, the Filo Trend Area, dedicated to trends upstream textile production, and the Vintage Area, along with the areas dedicated to Fashion Job, Woolmark, SMI – Sistema Moda Italia, Linen Dream Lab/Celc and the sponsors Banca Sella, Caffè Toraldo and Lauretana. Among the most significant initiatives dedicated to young talents Milano Unica presents Eyes on Me, a showcase for young graduates of fashion schools, while the Special Areas, in addition to the Japan and Korea Observatories, host Origin Passion and Beliefs with a preview of the July Exhibition, featuring a storytelling on Made-in-Italy production of textiles and accessories for the apparel industry.

The Area Tendenze instead presents textiles and accessories manufactured by the participating businesses based on the inspirations, storytelling and suggestions proposed by Stefano Fadda, Artistic Director of Milano Unica, on the occasion of the November presentation. A fascinating journey through different historical periods and music genres in line with the Music Menu theme.

Italian textiles: Sales hold steady in 2018 and trade balance is positive

The preliminary balance for 2018

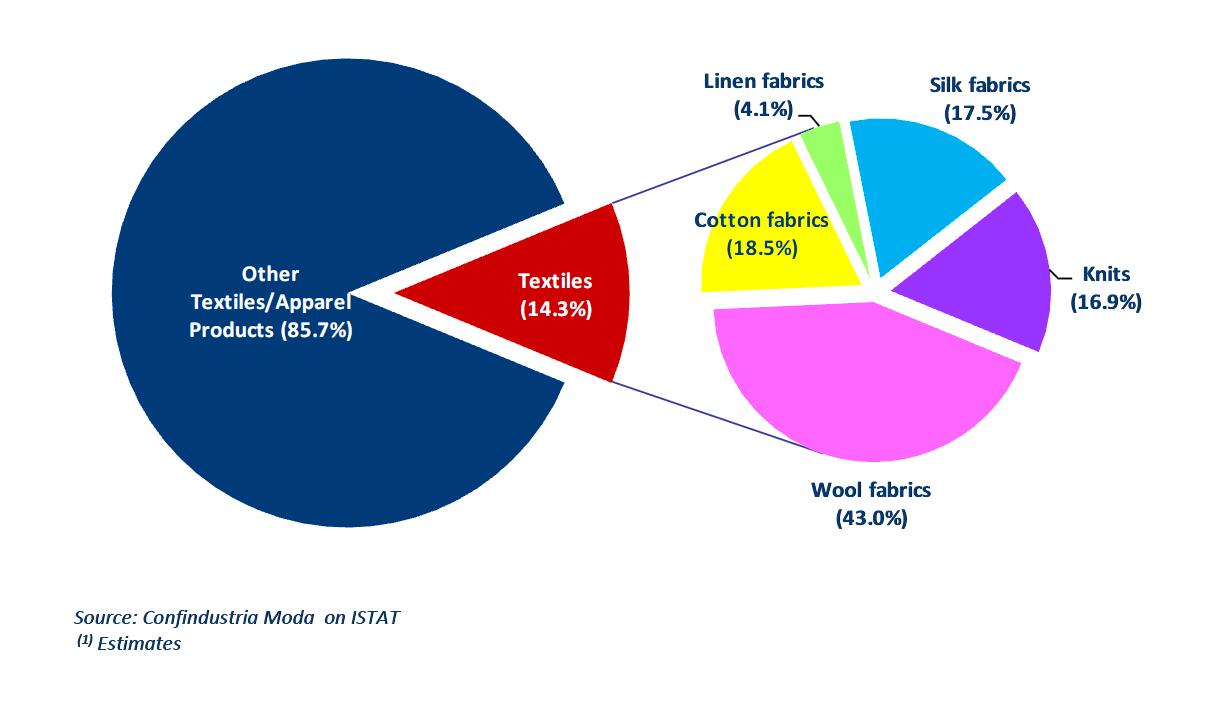

According to Confindustria Moda’s Research Center estimates for SMI - based on the economic context of reference and on internal Sampling Surveys - Made-in-Italy textiles (including wool, cotton and silk fabrics and knits) are expected to close 2018 with a slight decrease versus 2017. Overall sales would therefore amount to slightly more than euro 7.8 billion, making for 14.3% of total sales generated by the Textiles/Apparel industry as a whole (see Fig. 1).

Fig. 1 – The role of textiles in the Italian Textiles-Fashion supply chain (2018)

(% on sales)

More than in the past, the result reflects the slowdown in imports, while sales on the international markets are not yet ready to take off. The domestic market, mainly focused on the manufacturing of high-end items often destined for export, is currently experiencing further reductions, although some types of Made-in-Italy textiles are doing well, but not enough to compensate the downturn in cotton fabrics and knits.

With reference to the different segments considered, wool, linen and silk fabrics are expected to close 2018 with a positive performance. Conversely, cotton fabrics are expected to continue on a downtrend. Lastly, after the positive parenthesis in 2017, knits are expected to perform negatively again.

Production value (which projections by Confindustria Moda’s Research Center calculate separately, considering the value of total sales net of the contribution deriving from the sale of imported products) is characterized by an all-in-all favorable evolution, with a projected timid +0.4% increase.

As for employment, there was some friction during the year. However, the survey carried out by Confindustria Moda on a panel of businesses members of SMI, showed an average moderate increase in the headcount in the wool fabrics segment in 2018.

In 2017, the performance of trade “from” and “to” Italy seemed to show signs of consolidating exports, while imports of semi-finished textiles are on a clear downtrend. In the year, exports increased slightly, by +0.3%, confirming the total of international sales above euro 4.3 billion. Concurrently, imports are expected to drop -5.9%, below euro 1.9 billion.

Given the aforementioned trade performance, the trade balance for the industry is expected to show a moderate increase (euro 128.3 million in twelve months), totaling nearly euro 2,440 million. The surplus in textiles makes for 24.6% of the total sales generated by the Textiles/Apparel segment.

The domestic market (estimated by the ‘apparent consumption’ projections), often represented by luxury brands, posted a reduction of -2.1%; the better performance compared to imports would suggest a preference for Made-in-Italy products.

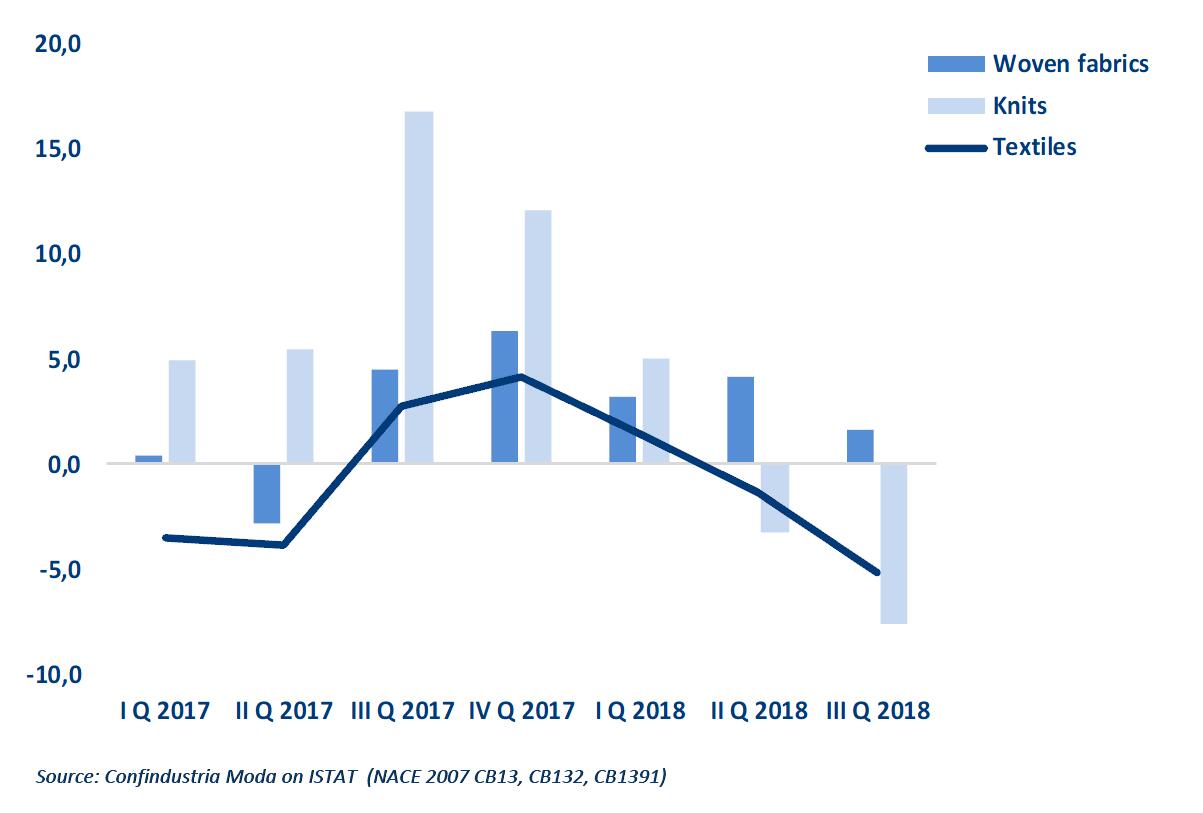

According to ISTAT data on industrial manufacturing (see Figure 2), in 2018 woven fabrics performed positively; the first quarter registered an increase equal to +3.2%, followed by an additional increase of +4.1% in the April-June time span. In the third quarter, the bearish performance halved the growth rate down to +1.6%. Conversely, unlike woven fabrics, knits posted an uptrend in the first quarter (up +5.0%), but a downtrend in the second quarter and in the third quarter (down -3.2% and -7.6%, respectively). The overall performance of the Textiles segment mirrors that of knits, up by +1.4% from January to March, and then down by -1.3% from April to June and by -5.1% from July to September.

Fig. 2 – Textiles: ISTAT index of industrial production (adjusted for calendar effects, base year 2010=100), 1 Q 2017 – 3Q 2018

(% trend variation)

As a result, during the nine-month span textile manufacturing decreased comprehensively by -1.5%, with knits down -1.6% and woven fabrics up +3.1%.

For the sake of completion, the most recent data available, relative to the October- November period, show an additional reduction in the segments considered. In the two-month period indicated above, Textiles dropped -6.3%, with woven fabrics changing sign and negative for -4.5% and knits down -3.5%.

International trade in the first ten months of 2018

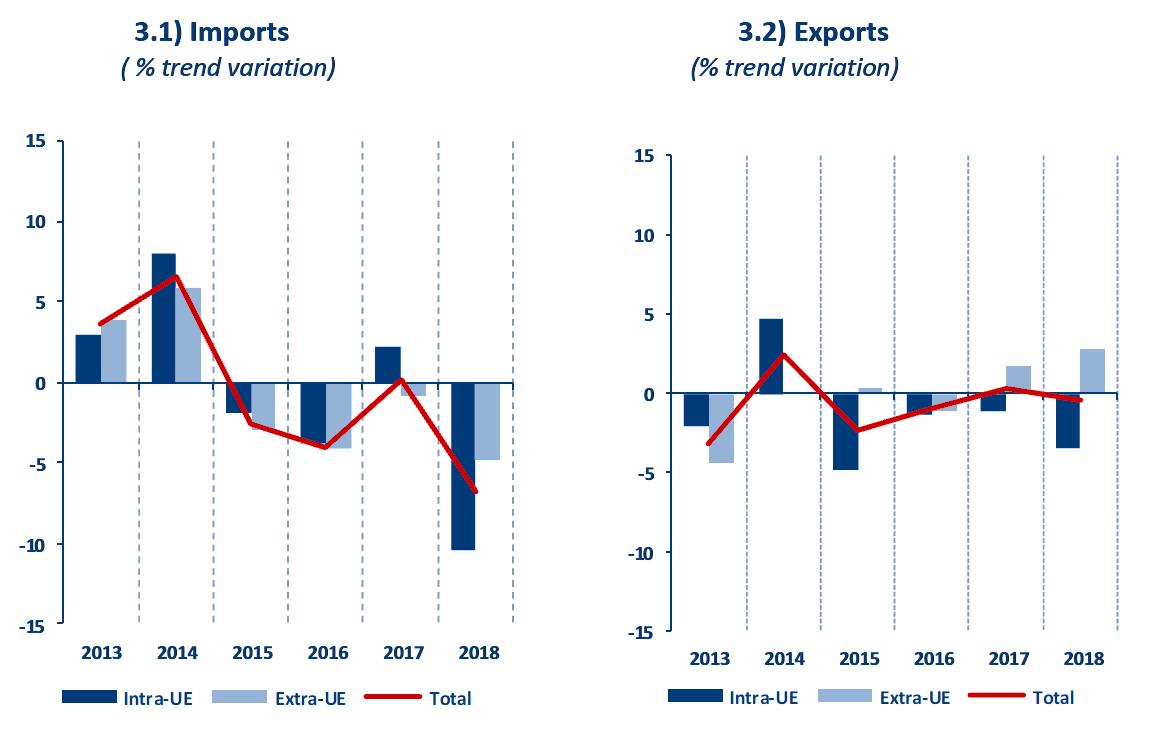

The analysis of international trade of knits and woven fabrics composed of mainly natural fibers (see Fig. 3 Note 1) reveals that exports in the January-October 2018 span reversed the trend, showing an equally small variation of -0.4%, opposite to the very timid +0.3% recorded in the first ten months of 2017. Exports in this period totaled euro 3,028 million, down slightly more than euro 11 million compared to the January-October 2017 period. In terms of volume, this translates into a -3.9% reduction.

Fig. 3 – Imports and exports of textiles: analysis by geographic macro area (1)

(January-October 2013-2018)

(1) The products analyzed here represent a sub-group (including only woven fabrics with at least 50% of natural fiber) of those used for the definition of the industry’s total results reported in Table 1. Conversely, Table 1 also considers woven fabrics with a percentage of natural fiber below 50% and the rest composed of man-made fibers. Knits are instead considered as a whole in both aggregates.

Source: Confindustria Moda on ISTAT

Similarly, imports also reversed their positive trend, falling -6.7% for a total value of euro 1,301 million; in terms of volumes, the reduction amounts to -9.7%.

The geographic breakdown shows that export results differed depending on whether they were destined to EU or extra-EU markets, as indicated in Figure 3: the first, with a 49.5% incidence, dropped -3.4%, while the second grew by +2.9%. Concurrently, imports were down in both segments; the extra-EU markets, making for 67.6% of total imports of fabrics to Italy, dropped by -4.8%, while EU-markets (with a 32.4% incidence) posted a -10.4% decrease.

In addition to the analysis of the average data by macro-area, it is extremely interesting to also examine the market performance of the main commercial partners of Italian textile producers (see Table 2) that are currently recording unusual and often diverging trends.

In the first ten months of 2018 Germany and Rumania, first and second export market for Italy, recorded a decrease by -2.1% and -5.3%, respectively. France, instead, remained essentially stable (+0.2%).

Only China grew by +3.0%, slowing down its 2017 double-digit growth rate, while Hong Kong was up by +6.1%. Exports to China totaled euro 191 million, which, summed up to the euro 133 million of Hong Kong make the China-Hong Kong region the top market for Made-in-Italy fabrics, topping Germany (euro 324 million vs euro 285 million) by far.

If we scroll the list of the other top markets for Made-in-Italy textiles, there are also other short-haul countries posting positive performances for exports; in particular, Tunisia, up +2.2%, and Turkey, up +3.1%.

The United States showed a sharp decrease, down -12.6%, along with Spain, down by -9.8% and Portugal -3.0%.

Continuing the analysis of the top markets, though with lower absolute values, the following countries showed an uptrend: Japan (+8.6%), Bulgaria (+7.2%), Poland (+4.9%) and South Korea (+0.9%). Conversely, the UK was down -7.5%.

Considering the analysis of the markets of origin of textiles imported to Italy, characterized by a high concentration - from a geographic perspective - in the extra-EU regions (67.6%), China and Turkey confirmed - once again - their leading position, as had already been observed in the economic notes of recent years, with a share of 25.7% and 19.9%, respectively, of total imports. In the period of reference, both countries recorded a downtrend: China by -2.9% and Turkey by -9.4%.

Other suppliers with an incidence below 10% included Pakistan, with a -3.0% decrease, while double-digit reductions in imports were recorded in Germany (-12.5%) and Spain (- 15.1%). The Czech Republic and Hungary showed an opposite trend, both up +2.5%, even if on rather different absolute values, and Rumania was up +36.8%.

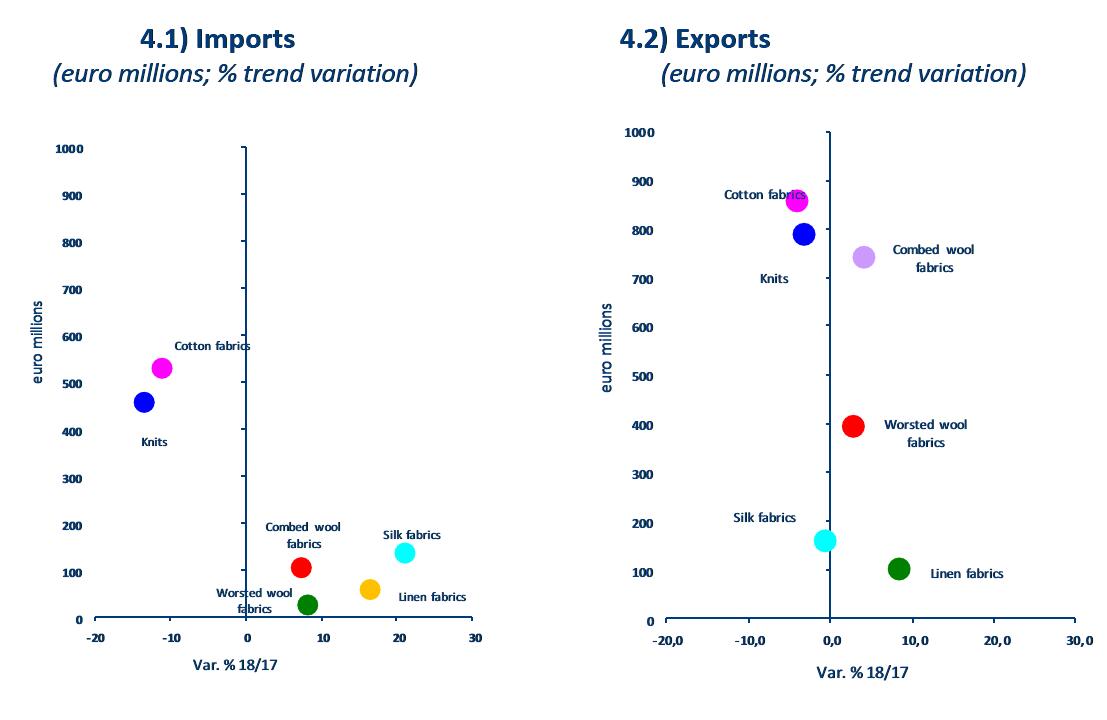

As detailed further below, the results on the international markets for textiles do not show the rather divergent performances of the individual categories of fabrics considered (Fig.4). In the January-October 2018 period exports of some fabrics were up (combed fabrics +4.4%, totaling euro 738.4 million; worsted fabrics +2.9% for a total value of euro 392.5 million) along with linen fabrics (+8.6%). Conversely, all other types of fabrics posted a fall in exports. Knits, reversing the positive performance recorded in 2017, dropped by -3.2%. Exports of cotton fabrics were down -3.8%, while pure silk fabrics limited their fall to -0.6% (although exports of silk fabrics, even if excluded from the sales calculation illustrated above but only included in the data presented in Table, grew by +2.3%).

Fig. 4 – Imports and exports of Italian textiles: analysis by segment

(January-October 2018)

In the January-October 2018 period, imports recorded particularly significant increases especially for linen fabrics (+16.6%) and pure silk (+21.3%). Imports of wool fabrics were also up, with combed wool up +7.5% and worsted wool up by +8.5%. Conversely, double-digit reductions were recorded for imports of knits, down -13.3%, and cotton fabrics, down -10.9%.

For 2019 economic analysts project another slowdown, which will also impact the Textiles/Apparel industry. As for the short-term prospects analyzed in the survey carried out by Confindustria Moda - SMI last November, 57% of wool fabric producers selected in the sample expect that the business conditions experienced in 2018 will continue, while 30% of them fear a worsening of the situation (in the 2017 survey, all wool fabric producers agreed on steady business conditions throughout 2018). In fact, orders placed for SS2019, though still provisional and incomplete at the moment of the drafting of this note, show a negative sign. In particular, orders are down -2.8% in the Italian market and -2.1% in foreign markets.

Apart from these still incomplete figures, Milano Unica will serve as a barometer of the market, assessing market conditions and the short-to-medium term outlook for the industry. Thanks to the feedback collected from the main players/buyers in the industry, it will be possible to formulate projections on the evolution of Italian textiles in the upcoming months.