Five characteristics of China textile industry performance in 2017

Former and present driving forces transferred significantly

Jan 26, 2018 | by Zhao Zihan

According to the 2017 Summary Conference of China National Textile and Apparel Council (CNTAC) held on January 22nd to 23rd, in the first 11 months of 2017, the overall operation of China’s textile industry showed a steady growth rate, stable domestic demand growth, recovering overseas market demand, active investment in the east and steady improvement in performance. Specifically speaking, the improved performance, high capacity utilization, rising consumer spending, and the the conversion of former and present driving forces showcased the industry’s high-quality development.

Steady growth rate

According to statistics from Institute of Industrial Economics, CNTAC, in the first 11 months of 2017, China’s industrial added value growth rate was 6.6%, manufacturing growth rate 7.7% and textile industry growth rate 4.9%. The value-added growth of the textile industry slowed gradually from 6.7% in February 2016 to 4.9% in December 2016; since 2017, the growth rate has steadily stabilized and reached 4.8% for the full year of 2017. The development of China’s textile industry has basically shifted from a transition period to a smooth period. In the various sub-branches of textile industry, the growth of home textiles, garments and chemical fiber industries increased sharply, with the growth rates of 9.3%, 6.0% and 5.4% respectively.

Stable domestic demand growth

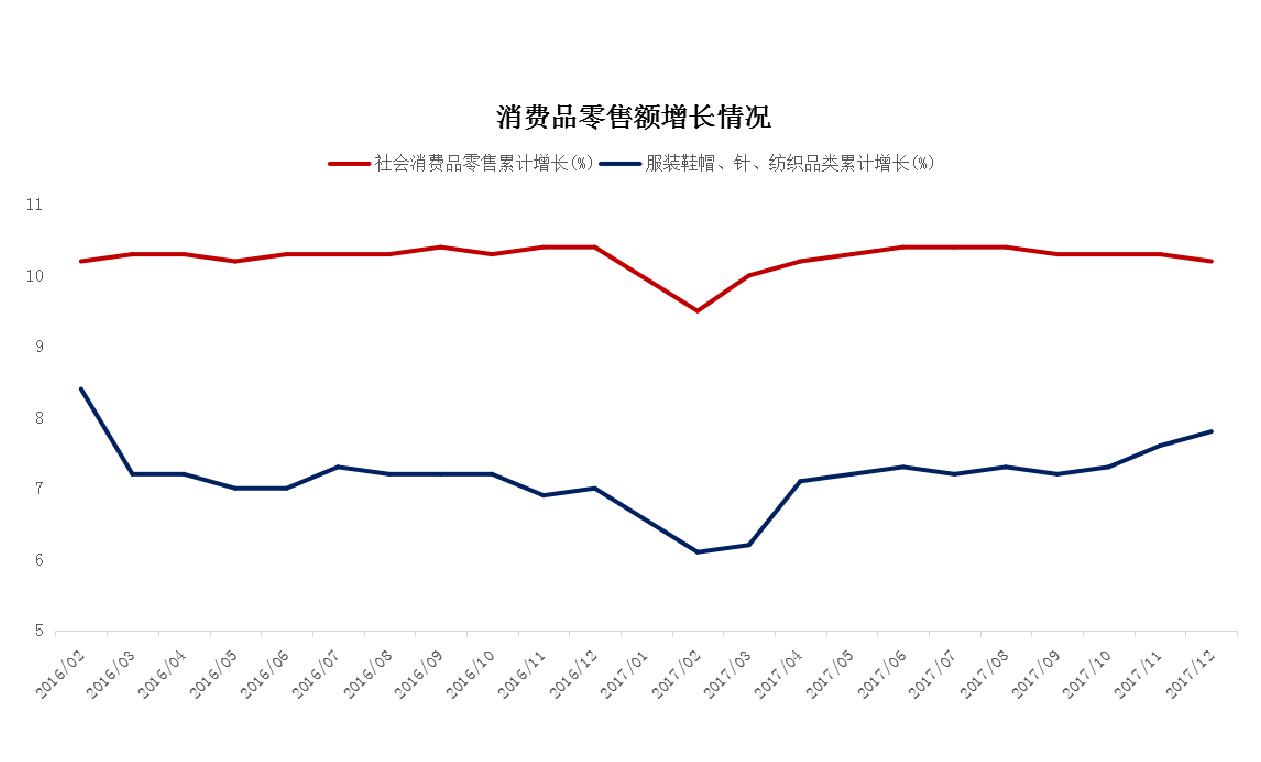

In 2017, the retail sales of garments, hats, shoes, and knitwear amounted to 1,455.7 billion RMB, up 7.8% year on year, an increase of 0.8 percentage point from the previous year, and it is the first increase in seven years. (Fig. 1)

According to a preliminary estimate by CNTAC, in 2017, the trade volume of e-commerce in China’s textile industry is about 5.34 trillion RMB, up 20% over the same period of last year. It can be seen that the scale of e-commerce transactions in the textile industry maintained a steady growth at a relatively high speed. (Fig. 2)

The urbanization rate in China has continued to increase from 45.9% in 2007 to 58.5% in 2017. Since there is a gap between urban and rural areas in the expenditure on clothing, the overall expenditure on clothing will continue to grow as the urbanization rate continues to rise.

Recovering overseas market demand

In 2017, the global economy grew by 3.6%, up 0.4% from the previous year. Three-quarters of the countries in the world achieved positive growth, enjoying recovery. Global trade increased by 4.2%, a growth of 1.8 percentage points over the previous year. Trade growth was better than economic growth, presenting a more clearly trend that recovering market demand has been advancing economic recovery.

In 2017, China’s textile and garment exports reached 266.95 billion USD, an increase of 1.53% year on year, reversing the negative growth for two consecutive years. The external demand market rebounded significantly.

In relation to the volume and value of textile and apparel exports, the overall trend is increase in volume and decrease in value. From January to November 2017, the volume of China’s textile and apparel exports increased by 6.63% year on year, reversing the negative growth in two years; the drop in export prices narrowed to -6.3%.

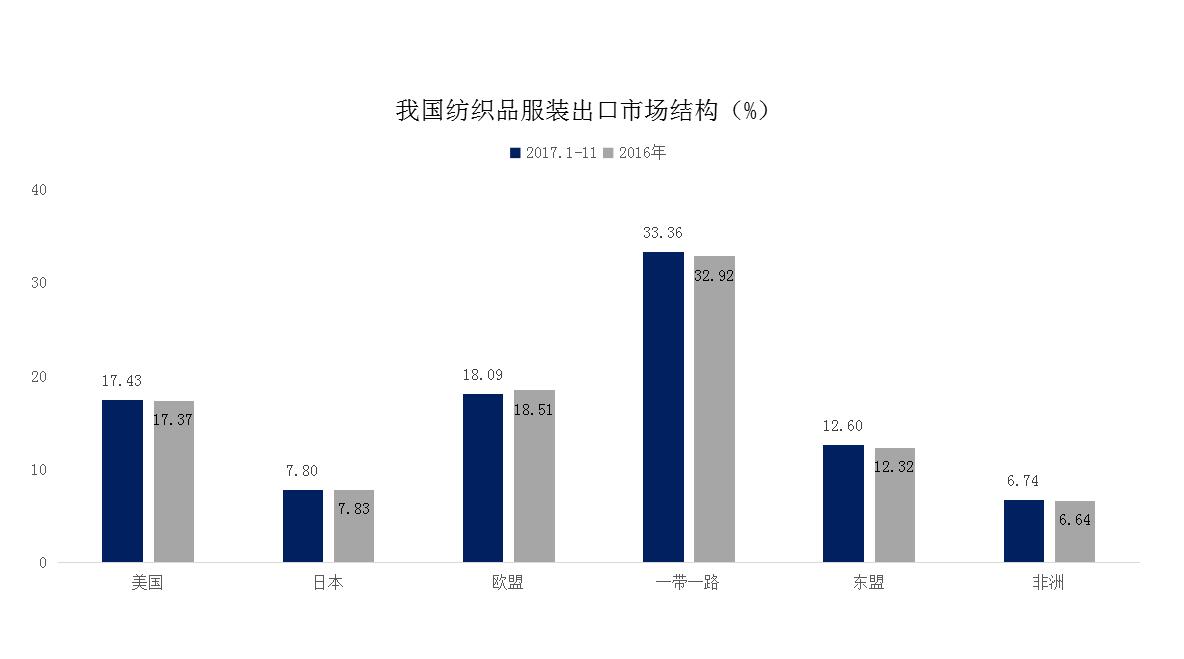

In China’s textile and apparel export market structure, exports textile and apparel products to the countries and regions along the Belt and Road accounted for 33.36% of the total, with 18.09%, 17.43% and 7.8% respectively to Europe, the United States and Japan. (Fig. 3)

● EU market

From January to November 2017, the EU imported 105.26 billion euros of textile and apparel, up 1.78% year on year, reversing the negative growth of the previous year. The EU textile and garment import growth rate presents such a trend as firstly a continuous dropping from February 2016 to March 2017 when the rate dropped to the bottom, and then the decline was gradually narrowed until June 2017 when the negative growth was reversed with a stabilized growth rate at about 2%.

● US market

From January to November 2017, the United States imported 98.38 billion USD of textile and apparel, an increase of 1.24% year on year, reversing the negative growth of the previous year. Judging from the growth rate of the US textile and apparel imports, the decline has continued to deepen from March 2016 to February 2017, after which the decline has been gradually narrowed until negative growth is reversed in October 2017, achieving positive growth.

● Japanese market

From January to November 2017, Japan imported 3.7051 trillion yen of textile and apparel, an increase of 4.04% from a year earlier, reversing the negative growth of the previous year. Judging from the growth rate of Japan’s textile and apparel imports, the decline kept on dropping from March 2016 to October 2016, after which the decline narrowed gradually until July 2017, reversing negative growth and maintaining steady growth.

● Markets along the Belt and Road

From January to November 2017, China’s textile and clothing exports to the countries and regions along the Belt and Road reached 83.435 billion USD, up 3.11% year on year, reversing the negative growth for two years. Among them, the top five markets are Vietnam, Russia, the Philippines, Bangladesh and the UAE, with a total export of 35.34 billion USD, accounting for 42.4% of the total exports of textile and apparel to the countries and regions along the Belt and Road. The growth of the export of textile and clothing along the Belt and Road is higher than the growth of export of the industry, accounting for more than one-third of the total.

Active investment in the east

From January to November 2017, the fixed investment of China’s textile industry was 1230.93 billion yuan, a year-on-year increase of 6.29%. In terms of the regional structure, the growth rate of investment in the eastern region was 8.7%, an acceleration of 4.5 percentage points over the same period of the previous year and accounting for 80.1% of the national investment increase. The relatively high growth rate in the eastern part of the country based on lower new capacity shows that the enterprises are of high enthusiasm in putting investment into transformation and upgrading. (Table 1)

Table 1 China’s textile industry investment in different regions

Table 1 China’s textile industry investment in different regions

|

Regions |

Investment amount (billion RMB) |

Y/Y (%) |

Proportion (%) |

Proportion changes |

|

The whole industry |

1230.925 |

6.29 |

|

|

|

The Eastern area |

727.081 |

8.74 |

59.07 |

1.33 |

|

The Central area |

378.013 |

3.25 |

30.71 |

-0.90 |

|

The Western area |

125.830 |

2.06 |

10.22 |

-0.42 |

|

Xinjiang |

53.659 |

16.63 |

4.36 |

0.39 |

Except for the chemical fiber industry, the growth rate of investment in the front-end industries of the industry chain decreased from the same period of the year earlier. The investment growth rate of the three major downstream industries increased over the previous year. The total investment in the three downstream industries totaled 597.04 billion yuan, accounting for 48.5% of the total investment in the industry. The investment growth was 6.0%, 25.8% and 4.8% respectively. (Table 2)

Table 2 China Textile Sub-sector Investment, January - November, 2017

Table 2 China Textile Sub-sector Investment, January - November, 2017

|

Industries |

Investment amount (billion RMB) |

Y/Y (%) |

Y/Y changes (%) |

|

The whole industry |

1230.92 |

6.3 |

-0.4 |

|

Man-made fibers |

121.28 |

17.5 |

14.5 |

|

Cotton spinning |

324.64 |

4.2 |

-12.8 |

|

Dyeing & printing |

33.22 |

-1.8 |

-10.6 |

|

Wool textile |

36.07 |

-1.5 |

-12.8 |

|

Bast and leaf fibers textile |

10.35 |

-18.3 |

-22.2 |

|

Silk |

14.49 |

4.7 |

14.0 |

|

Filament weaving |

44.21 |

-0.7 |

-14.9 |

|

Knitting |

58.53 |

12.0 |

8.5 |

|

Home textiles |

69.84 |

6.0 |

14.3 |

|

Nonwovens and industrial textiles |

77.68 |

25.8 |

23.4 |

|

Garments |

449.52 |

4.8 |

0.7 |

|

Textile machinery |

24.32 |

-9.5 |

-16.4 |

Steady improvement in performance

In the first eleven months of 2017, the profit margin of the textile industry was 5.26%, up 0.13% from the same period of the previous year, and the profitability of the industry increased. The main revenue of one hundred yuan was 88.49 yuan, a decrease of 0.1% year on year and a slightly increase in cost control; asset-liability ratio was 51.8%, down 0.22 percentage point from the same period of the previous year, and achieved some success through deleveraging. (Table 3)

Table 3 Performance of China’s Textile Industry, January - November, 2017

Table 3 Performance of China’s Textile Industry, January - November, 2017

|

|

Index value |

Y-o-Y / Changes |

|

Main business income |

6507.99 billion RMB |

4.71% |

|

Total profits |

342.41 billion RMB |

7.41% |

|

100 RMB main business income cost |

88.49 RMB |

-0.10% |

|

Total asset turnover |

1.5 times / year |

-0.98% |

|

Asset-liability ratio |

51.80% |

Down 0.22 percentage point |

|

Profit margin |

5.26% |

Up 0.13 percentage point |

|

(Operating expenses + Administrative expenses + Financial expenses) / Operating income |

6.21% |

Up 0.03 percentage point |

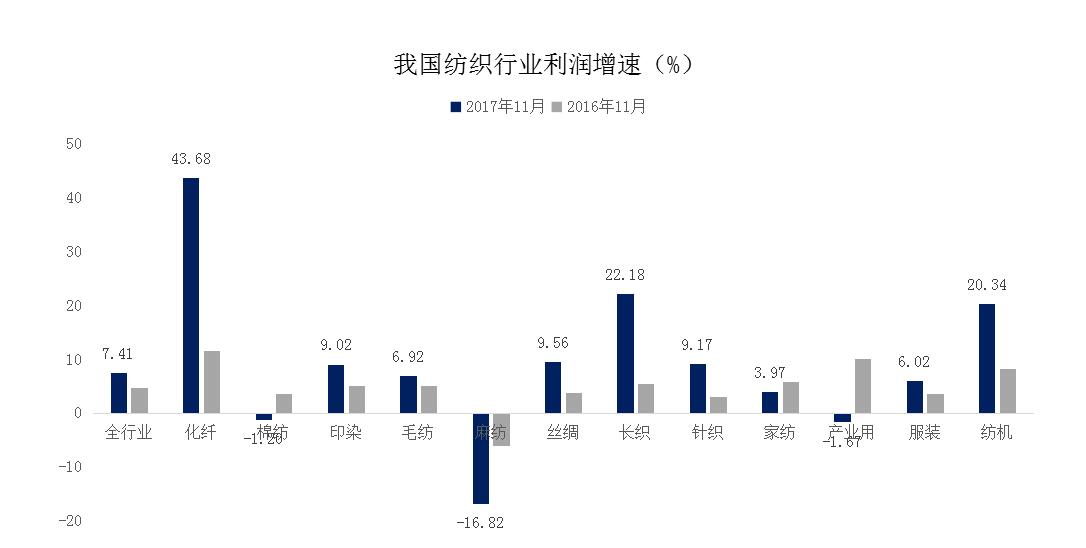

From the perspective of sub-sectors, the profit growth of chemical fiber, filament yarn weaving and textile machinery industry witnessed remarkable growth. The profit growth of cotton spinning, bast fiber spinning and technical textile industries declined. The profit growth of chemical fiber industry accounted for 50.7% of the total. (Fig. 4)

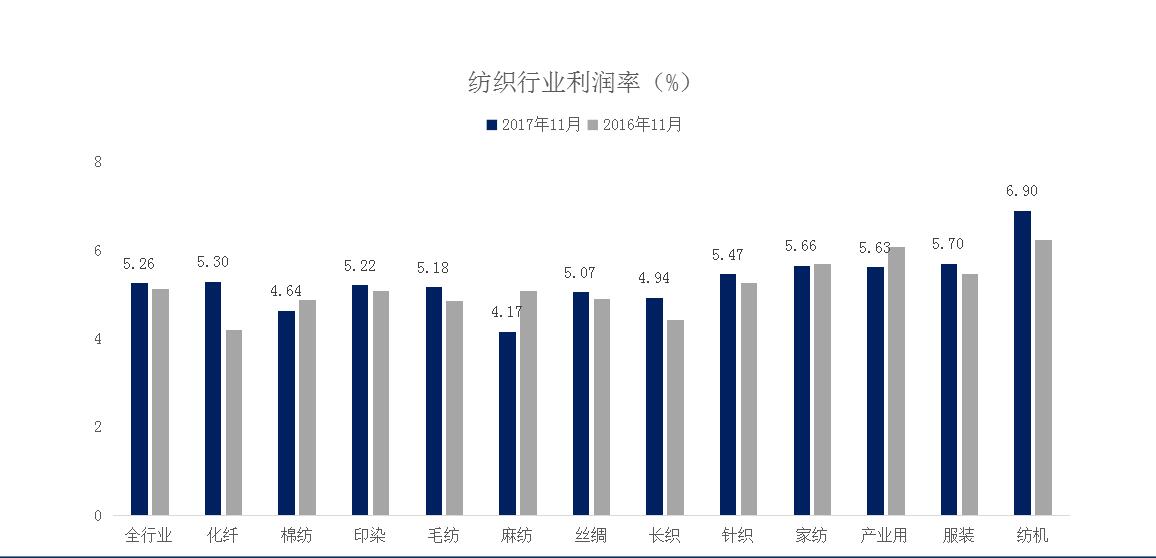

Differentiation in different sectors of the industry’s internal industrial chain is relatively significant: from January to November 2017, the profit margin of China’s textile industry increased by 0.13 percentage point. Among them, the profit margin of chemical fiber, filament weaving and textile machinery industries increased significantly, with respective profit margins of 5.30%, 4.94% and 6.90%; the profitability of cotton spinning, bast fiber spinning and technical textile industries saw somewhat decline over the same period of the previous year, with profit margins of 4.64%, 4.17% and 5.63% respectively. (Fig. 5)

Economic outlook in 2018

Looking forward to the trend of economic operation of the industry in 2018, the analysis of CNTAC shows that the growth rate of China’s textile industrial added value will remain at 5%, the export growth at 2%, the main business revenue growth at 7%, and the total profit growth at 7%.

In terms of raw material prices: the cotton price trend is relatively stable. The supply and demand pattern in the international cotton market is relatively loose and lacks the basis for sharp price increases. Although the domestic cotton supply gap is still under way, with the adjustment of the State Reserve and import policies, the price difference to the international market is expected to be controlled at a reasonable interval.

International crude oil prices have risen, and the over-supply has been gradually eased. Although the increasing oil prices will push up the cost of chemical fibers, it will also bring support to the growing downstream product prices. Chemical fiber industry is expected to continue to maintain a rapid growth as in 2017.

In terms of international market demand, the demand in the international market has been steadily increasing but the growth rate will not significantly increase. As the global economy continues to recover, consumer confidence will improve and overall consumer demand will grow steadily. Economic recovery cycle and clothing consumption growth rate will be lower than durable goods and service expenditures. Consumption in developed countries generally rebounded with the economic recovery. Consumer spending structure is relatively stable, the proportion of clothing and shoes spending remained at 3% to 4%. However, during the economic recovery cycle, residents will prefer entertainment, food and beverage consumption and expand related expenses. Clothing consumption ratio will be reduced, while consumption growth will be relatively slow.

Consumption will see a steady growth in domestic demand, and the growth rate is basically the same as in 2017. On the one hand, the sustained and steady growth of the national economy provides a healthy and sound economic environment for domestic consumption. On the other hand, the rapid growth in resident income, increased willingness to spend, and the rapid development of consumer finance have provided positive support for the expansion of domestic demand. The characteristics of domestic demand upgrading are significant. Consumers’ demands for quality, culture and environmental protection are increasing. The rapid development of experience consumption and sharing economy all pose new challenges to the optimization-supply organizations in the textile industry.