Status quo of China’s man-made fiber industry (2016)

Improved performance and profitability

Mar 07, 2017 | by Zhao Zihan

In 2016, the man-made fiber industry in China was gradually adapt to the new normal, and took the initiative to accept the new normal in response to national supply side reform, enjoying speed-up new product development as well as obvious de-capacity and de-stocking, which are mainly reflected in the following aspects:

-

Firstly, the new capacity of main products was slowed down; the operation quality was significantly improved; the output increased at a moderate rate; the overall operating rate was better than in 2015 despite the obvious influence from season changes.

-

Secondly, affected by G20 Summit, some enterprises had to shut down for maintenance, for which the supply and demand was improved, and the inventory reached a historic low.

-

Thirdly, the man-made fiber products presented sound sales but significant differences between varieties influenced by the domestic weaving demand growth and the increased exports of chemical fiber products.

-

Fourthly, driven by the moderate rise in oil prices, the commodity prices rebounded, and the main varieties of chemical fibers remained a slight growth in the first half as well as a significant rising in the second half, but still in the historical low. The overall efficiency of enterprises increased significantly compared to the same period in 2015 thanks to the greatly enhanced profitability of main chemical fiber products and the improvement of corporate cash flow, coupled with inventory profit.

-

Fifthly, the large-scale leading enterprises enjoyed obvious cost advantages thanks to the integrated development of industrial chain. However, the industry was still suffering structural and periodic excess capacity, while some varieties and businesses were in difficulties, tending to be a polarization.

In 2016, the man-made fiber industry saw an industrial added value growth rate of 6.1%, higher than the growth rate of industrial and textile industry. The main business income was 766.28 billion yuan, an increase of 3.71% year on year; the total profit reached 36.64 billion yuan, a rising of 19.9% year on year; the sales profit margin increased by 0.65 percentage points compared to the last year to 4.78%; the scale of losses was 16.27%, 3.62 percentage points lower than 2015.

Production

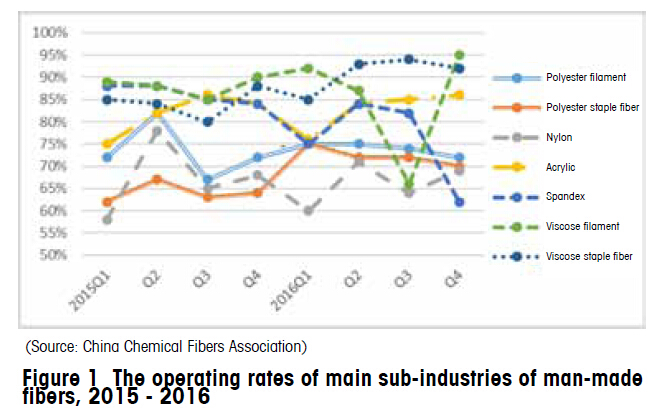

The man-made fiber industry witnessed a cumulative production of 49.437 million tons in 2016, a growth rate of 3.98% according to the sampling survey analysis of China Chemical Fibers Association. The overall operating rate continued to improve (Figure 1). Specifically, the polyester filament presented an average operating rate of about 76%, with an effective operating rate of 82%; the polyester staple fiber was about 70%; viscose filament and staple fiber showed a respective average operating rate of 91.3% and 90.4%, both higher than 2015; the average annual operating rate of nylon was 70%, just a limited growth, while that of spandex was 86%, showing a downward trend.

Price

In 2016, especially the second half of the year, the international commodity prices rebounded in varying degrees, synthetic fiber raw materials and product prices were affected accordingly, therefore, the main product prices in chemical fiber market presented a rising trend, and even a rapid growth in the second half, especially after October when the rates were at 30% -50%.

Inventory

The chemical fiber product inventory, except polyester products which saw a temporarily increase during G20 Summit in the early September in 2016, presented an overall trend of high followed by low, and the lowest point throughout the year was mostly at the end of December. Firstly, the new capacity of the main varieties was slowed down. Secondly, the downstream needs of the chemical fiber industry, especially in the second half of 2016, turned for the better. Thirdly, the downstream enterprises of man-made fiber industry always buy when the prices are going up instead of going down, which is also contributed to the sale. In addition, the polyester enterprises’ policy cut-off and operating rate control during G20 Summit also resulted in the reduction of polyester stocks.

Import and export

In 2016, China imported 810,600 million tons of chemical fiber in total, down 3.64% year on year, while the the exports totaled 3.9268 million tons, an increase of 15.48% year on year, accounting for 7.94% of the output, and the exports increased by 2.92% in value. In the export products, polyester filament accounted for 50.34%, polyester staple fiber 25.98%, accounting for 76.32% of total exports in volume, and 55.04% in value.

In the 2016 textile industry, the main sub-industries suffered double decrease of exports in both volume and value, but the man-made fiber industry was the only one that enjoyed export growth at a double-digit rate, mainly influenced by technological progress, product quality improvement, textile industry transfer, growing foreign demand, “Shenghong • Chinese Fiber Fashion Trends Release”, Yarn Expo, and so on. With the increase in exports, the industry needs to be alert to foreign trade barriers and trade litigation issues.

Investment

In 2016, the man-made fiber industry actually completed 111.6 billion yuan in fixed assets investment, accounting for 14.6% of the main business income, with an investment growth rate of 0.34%, 2.53 percentage points lower than the previous year. The investment growth has been in a downward trend since 2011 (Figure 2), reflecting that the chemical fiber industry is gradually adapt to China’s economic development of the new normal. However, to reduce investment in fixed assets will also affect the upgrading of equipment and the use of intelligent equipment.

However, it is learned that the new orders of polyester filament equipment in 2017 and 2018 have reached a record high, while viscose staple fiber also has a large number of new production projects. To control the production capacity within a reasonable release will still be an issue that requires the industry to seriously deal with.

Quality

The chemical fiber industry achieved a total profit of 36.64 billion yuan in 2016, an increase of 19.86% year on year, and 4.63 percentage points higher than that in 2015, proving to be the fastest among the sub-industries of the textile industry. The scale of losses was 16.27%, down by 3.62 percentage points year on year, but the losses of loss-making enterprises decreased by 23.11% year on year, for the large enterprise groups showed strong profitability.

As the price of chemical fiber products increased and industry profits grew year on year, the chemical fiber industry enjoyed significantly improved operating capacity, for example, the turnover of accounts receivable increased by 0.65 percentage point year on year, inventory turnover rose by 2.85 percentage points, current assets turnover grew by 0.38 percentage point, booming in both production and sales. In the profitability indicators, the main business profit margin was 4.78%, a growth of 0.64 percentage point year on year; net assets yield increased by 0.72 percentage point; sales growth rate rose by 2.5 percentage points year on year.

The gradual increase in profit margins is of a direct relation to the continuous structural adjustment and industrial upgrading that the chemical fiber industry has been promoting to build the core competitiveness. With the rising in profit margins, the industry’s enthusiasm for investment in fixed assets might be encouraged, and to control a reasonable capacity growth and adjust the industrial structure will continue to be the key to the future development of the industry (Figure 3).

Prospect of China’s chemical fiber operation in 2017

In face of increasingly unstable international economic operating environment, the International Monetary Fund predicts that the world GDP growth rate will be 3.4% (PPP) in 2017, and the crude oil prices are to remain in the middle and low positions, with a slight upward trend.

China’s economic growth is still at a moderate rate, and the economic development still has many favorable conditions and positive factors. A number of international organizations are optimistic about China’s economic growth, for example, IMF, the United Nations and the World Bank all forecast that China’s economic growth rate will be 6.5% in 2017. In addition, JPMorgan Chase & Co., HSBC, Citibank and other foreign institutions also issued reports, predicting that China’s economy will be further stabilized in 2017.

It is expected that the industrial added value of above-designated enterprises will continue to maintain the growth rate of about 6%, and the textile industry will enjoy growing domestic demand in support of the macroeconomic stability and income growth, which will support the textile industry to maintain a stable operation with increasingly stabilized industry quality, creating a stable demand environment for the chemical fiber industry.

It is predicted that in 2017, the man-made fiber industry will see an output growth of 3% to 5%, while the operating rate will remain stable with a slight picking up. In the first half of the year, the main products prices are to present an upward trend, however, the profit growth will fall owing to the larger base in 2016, and the sales margins will remain the same as in 2016.