Monthly Cotton Economic Letter (2017.06)

Jul 20, 2017 | by Flora

Recent price movement

Both NY futures and the A Index were volatile over the past month, quickly rising and falling in the middle of May. Current values are at the lower end of trading ranges defined throughout the spring. Other benchmark prices were mostly stable in May and early June.

l After rocketing to levels over 87 cents/lb in intraday trading in mid-May, values for the nearby July NY futures contract quickly returned to their longer-term trading range between 76 and 79 cents/lb. Recently, values have been testing the lower end of that range, but have yet to decisively break through support near 76 cents/lb.

l Prices for the NY December futures contract, which overtook July as the contract with the most open interest in mid-May, were comparatively stable over the past month. Despite the sharp rise in prices for July futures, values for the December contract were not able to hold above the 75 cent mark. Recent levels have been consistently hovering around 72 to 73 cents/lb.

l With the spurt in July futures, the A Index posted its highest value of the crop year May 15th (94.9 cents/lb). Since then, the A Index has fallen back to levels near 86 cents/lb, which is close to the average it has maintained over the past several months.

l The China Cotton (CC) Index moved slightly higher over the past month. In international terms, prices rose from 105 to 107 cents/lb. In domestic terms, prices rose from 16,000 to 16,100 RMB/ton.

l Cash prices for the Indian Shankar-6 variety were mostly stable in international terms in May and early June, holding to levels near 85 cents/lb. In domestic terms, values were also steady, holding to levels near 43,000 INR/candy.

l Pakistani prices were stable over the past month (near 79 cents/lb in international terms and near 6,800 PKR/maund in domestic terms).

Supply, demand, & trade

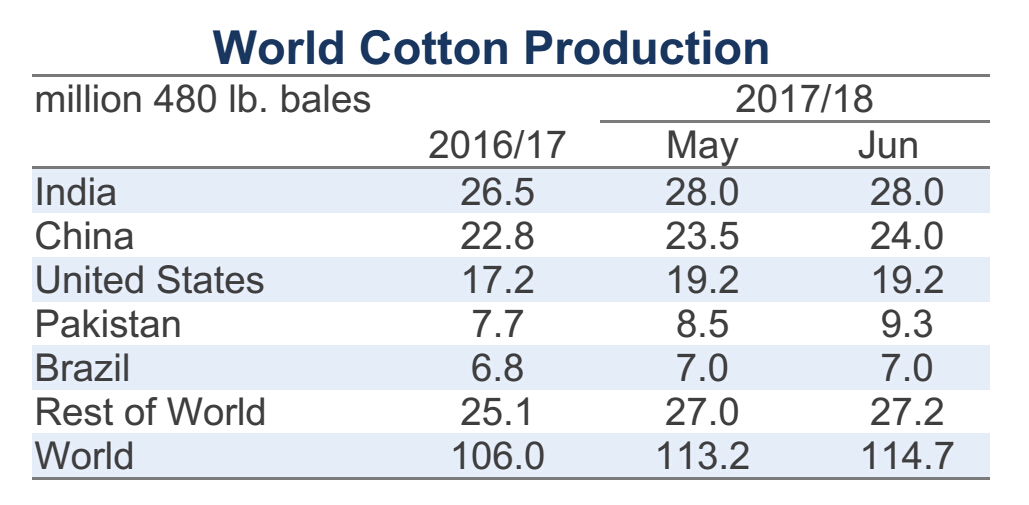

This month’s USDA report featured increases to forecasts for both global production and mill-use in the upcoming 2017/18 crop year. The projection for the world harvest was lifted 1.5 million bales, from 113.2 to 114.7 million. The projection for world mill-use was lifted 760,000 bales, from 115.8 to 116.5 million.

The rise in the global production figure was primarily a result of heightened expectations for Pakistan (+800,000 bales, from 8.5 to 9.3 million), China (+500,000 bales, from 23.5 to 24.0 million), and Mexico (+150,000, from 1.1 to 1.3 million). There were no downward revisions.

For mill-use, the increase was mostly a result of increases for China (+500,000 bales, from 37.5 to 38.0 million), India (+200,000, from 24.0 to 24.2 million), and Pakistan (+200,000 bales, from 10.4 to 10.6 million).

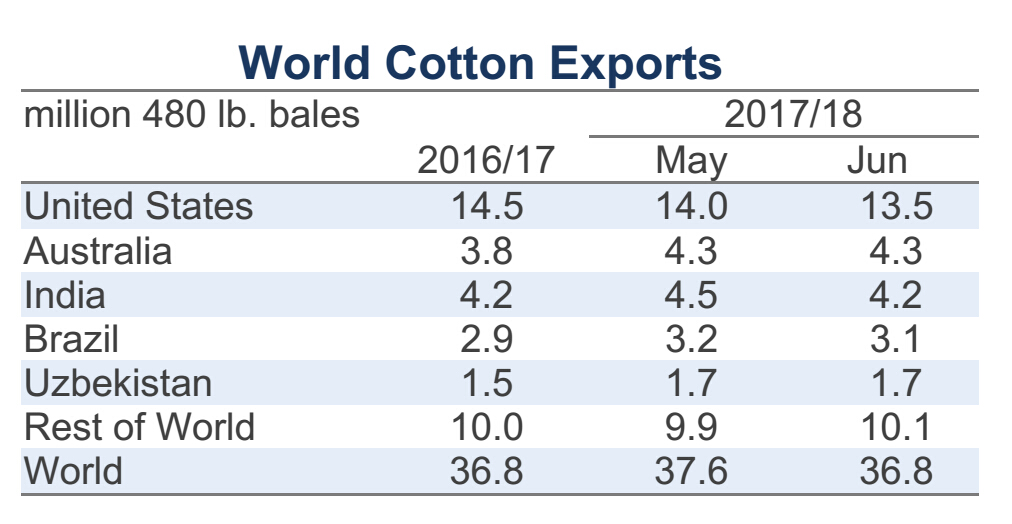

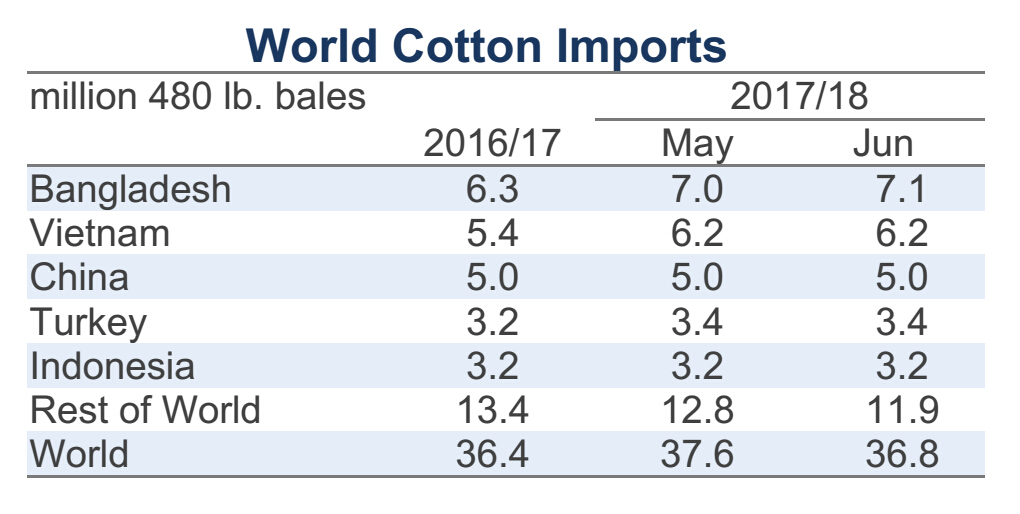

Predictions for global cotton trade were revised lower (-785,000 bales, from 37.6 to 36.8 million). The reduction was driven by higher production forecasts for importing countries, including Pakistan (import forecast down 600,000 bales, from 2.6 to 2.0 million) and Mexico (import forecast down 125,000 bales, from 975,000 to 850,000). Export projections were lowered for the U.S. (-500,000 bales, from 14.0 to 13.5 million), India (-300,000 bales, from 4.5 to 4.2 million), and Brazil (-100,000 bales, from 3.2 to 3.1 million). There was an increase to the export number for Pakistan (+100,000, from 350,000 to 450,000).

Even with a reduction in the estimate for 2017/18 beginning stocks, the net result of this month’s updates for predicted 2017/18 ending stocks was an increase of 564,000 bales (from 87.1 to 87.7 million). If realized, this implies a drawdown in world stocks of 1.6 million bales next crop year (from 89.3 at the end of 2016/17 to 87.7 million at the end of 2017/18).

This global reduction is expected to be focused on China, where stocks are expected to drop 9.1 million bales, from 48.4 million bales at the end of the current 2016/17 crop year to 39.3 million bales at the end of 2017/18. If realized, Chinese stocks would be 40% lower at the end of the upcoming crop year than they were at their peak in 2014/15 (66.9 million bales). Nonetheless, the current forecast indicates that Chinese stocks will remain at a level nearly double the volumes near 20 million bales that were common in the mid-2000s, a time period when Chinese mills were consuming 50 million bales (projection of 38.0 million for 2017/18). Stocks for the collection of countries outside of China are projected to rise 20% in 2017/18 (from 40.9 to 48.4 million) and to reach a new record.

Price outlook

The forecast global production deficit dropped to only 1.8 million bales in this month’s updated set of estimates. This is within a margin of error that could be closed by good weather in a couple major producing countries. Whether or not the world ends up with a slight surplus or a slight deficit of production relative to mill-use will not significantly alter key assumptions involving the distribution of ending stocks inside and outside of China.

For the past several years, China has been successful in drawing down its reserves. In 2017/18, another large drawdown in government-controlled stocks should occur, pulling Chinese ending stocks from the equivalent of 130% of annual mill-use in 2016/17 to 105% in 2017/18. While this is an important reduction, China still has a tremendous amount of cotton in storage. For this reason, the Chinese government could be expected to maintain import quotas at low levels for another crop year or two, until the stocks-to-use ratio drops to levels closer to historical averages. Throughout most of the 2000s, China’s stocks-to-use ratio was near 50%.

However, China has a production deficit that can be expected to hold at levels in excess of ten million bales. As a result, China will eventually need to lift import quotas. The market just does not know when the Chinese government might decide to do so. In addition, it is unknown how the Chinese might eventually decide to lift quotas. It is possible they could jump directly from current volumes near four million bales to those over ten million bales that were common in the past. It is also possible that the Chinese government could feather in the increases, lifting restrictions incrementally over a period of several years.

The consequences for global cotton prices would be very different. This crop year, the world outside of China is expected to produce a large surplus that will serve as a buffer against the possibility of a sharp increase in Chinese import quota. Whether or not a buffer stock will be maintained outside of China will be a factor to watch for price direction over the longer-term.

Chinese import quota is allocated on a calendar year basis. Last crop year, the market got news regarding Chinese import quota levels late in the summer. Whenever an announcement is made for 2018, it can be expected to influence price direction.