Monthly Cotton Economic Letter (2017.03)

Mar 13, 2017 | by China Textile

Recent price movement

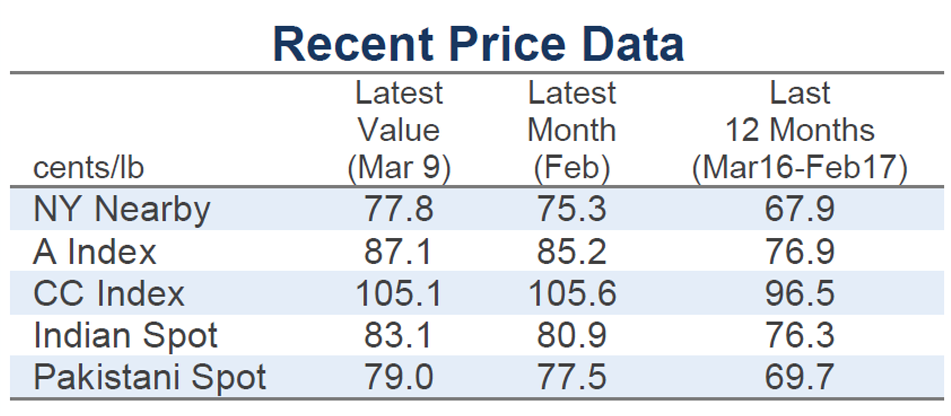

Most benchmark prices moved higher over the past month. Volatility was a feature of futures markets.

-

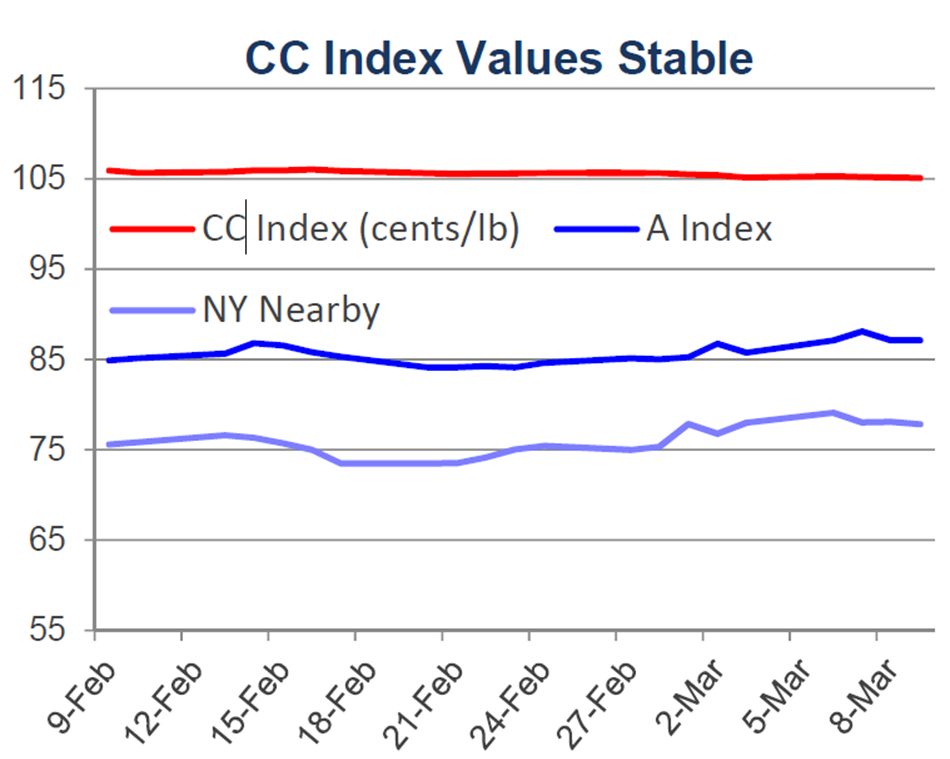

The May NY futures contract was volatile over the past month. Values dropped several cents/lb near the middle of February, but made up for those losses and climbed above the values posted mid-February in several spurts in early March. The latest values have been near 78 cents/lb.

-

The A Index also rose a couple of cents over the past month. In early February, A Index values were near 85 cents/lb. The most recent values have been near 87 cents/lb.

-

In both international and domestic terms, the China Cotton (CC) Index has been comparably stable, holding to levels around 16,000 RMB/ton or 105 cents/lb.

-

The stability of CC Index has contrasted with the volatility in Chinese futures. Values for the May ZCE futures contract gained nearly 500 RMB/ton early in the week of March 6th and reached levels just above 16,400 RMB/ton before collapsing later in the week and dropping to levels near 15,600 RMB/ton.

-

Prices for Indian Shankar-6 variety increased from values equivalent to 80 cents/lb in early February to those near 83 cents/lb in the latest trading. In domestic terms, values rose from 42,000 INR/maund to 43,400 INR/maund.

-

Pakistani prices were mostly stable. In international terms, values held near 78 cents/lb. In domestic terms, values held near 6,700 PKR/candy.

Supply, demand, & trade

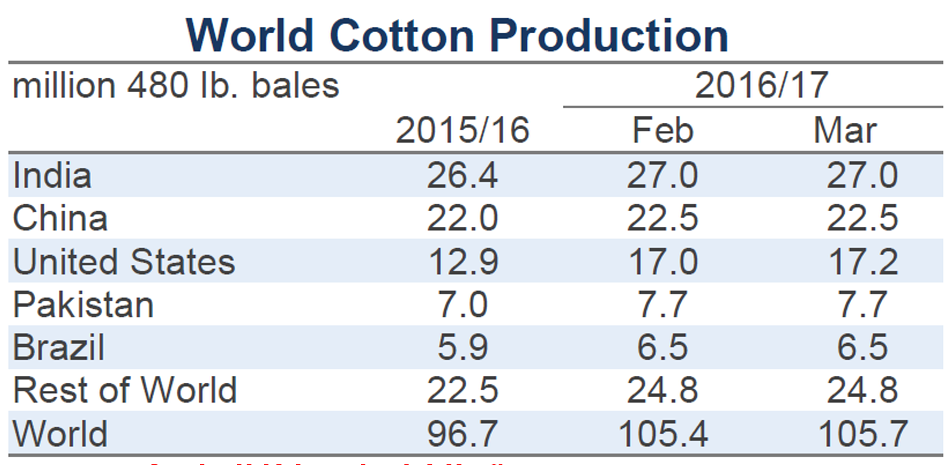

This month’s USDA report included a slight increase to the forecast for the 2016/17 world cotton crop (+300,000 bales, from 105.4 to 105.7 million). The addition to the global figure was primarily a result of a larger projected U.S. harvest (+271,000 bales, from 17.0 to 17.2 million). There were no other significant changes to country-level production figures.

The forecast for world mill-use was virtually unchanged (-90,000 bales, from 112.5 to 112.4 million). At the country-level, notable revisions included additions to estimates for Vietnam (+200,000 bales, from 5.2 to 5.4 million) and Indonesia (+150,000, from 2.9 to 3.1 million) as well as lowered expectations for Turkey (-350,000 bales, from 6.6 to 6.3 million).

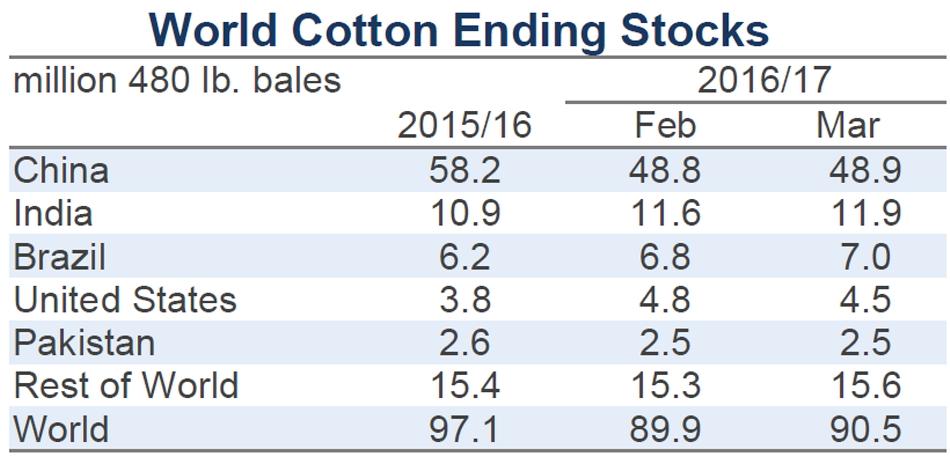

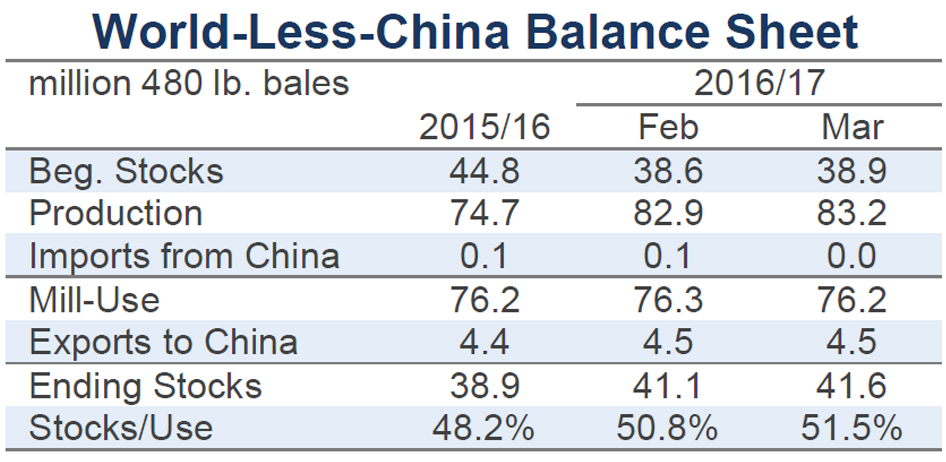

A larger crop and lower mill-use suggest a larger estimate for global ending stocks, and a 265,000 bale upward revision to beginning stocks amplified the change. The current USDA figure for 2016/17 world ending stocks is 90.5 million bales, which is 580,000 bales higher than February’s estimate and 6.6 million bales below the level of stocks at the end of the 2015/16 season.

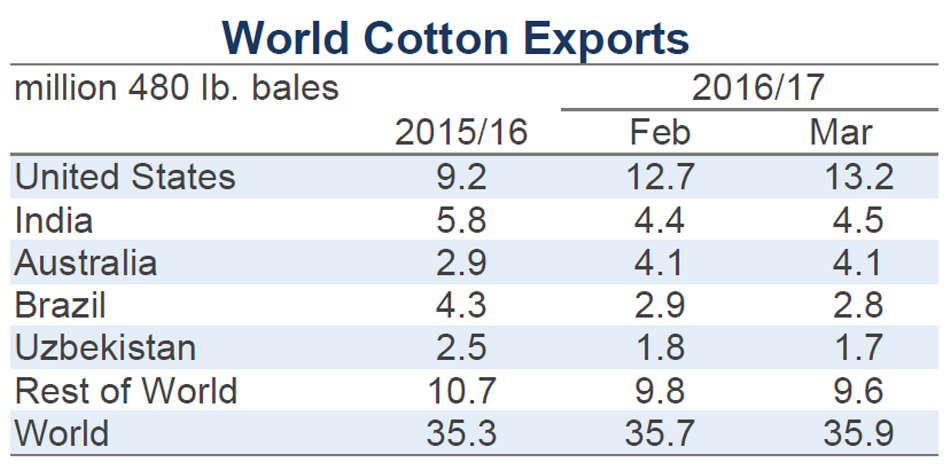

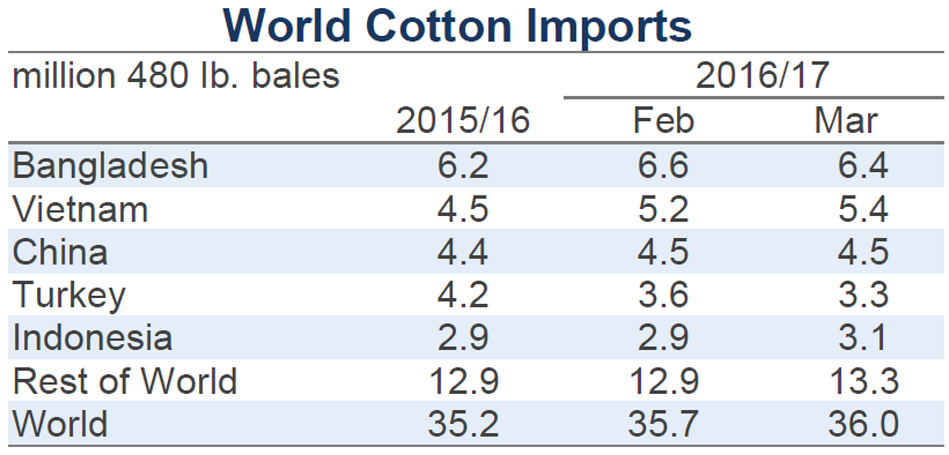

Global trade estimates were increased slightly (+210,000 bales, from 35.7 to 35.9 million bales). Import forecasts were lifted for India (+400,000 bales, from 1.8 to 2.2 million), Indonesia (+200,000, from 2.9 to 3.1 million), Vietnam (+200,000, from 5.1 to 5.3 million), and Brazil (+100,000, from 100,000 to 200,000). Import forecasts were lowered for Turkey (-350,000, from 3.6 to 3.3 million) and Bangladesh (-200,000, from 6.6 to 6.4 million). Export forecasts were increased for the U.S. (+500,000, from 12.7 to 13.2 million) and India (+100,000, from 4.4 to 4.5 million). Exports forecasts were reduced for Brazil (-100,000, from 2.9 to 2.8 million) and Uzbekistan (-100,000, from 1.8 to 1.7 million).

Price outlook

At their annual outlook forum in late February, the USDA releases preliminary forecasts for the upcoming crop year. In their early set of figures for 2017/18, the USDA indicated that a decline in ending stocks of a magnitude similar to that predicted for 2016/17 (6.6 million bales) can be expected next crop year.

Normally, successive declines of several million bales would be associated with strong upward movement in prices. However, the market has yet to return to normal conditions after the massive accumulation of stocks in China between 2011/12 and 2014/15. Even with large reductions in 2015/16 and 2016/17, world stocks at the end of the current crop year are still expected to be about 50% higher than they were in the mid-2000s, a time period when volumes were setting records at levels a little over 60 million bales and A Index prices were between 50 and 60 cents/lb. Another meaningful decline in global stocks in 2017/18 will represent another important step on the transition back to market conditions where global ending stocks figures will once again have direct implications for prices, but this transition can be expected to take several more years.

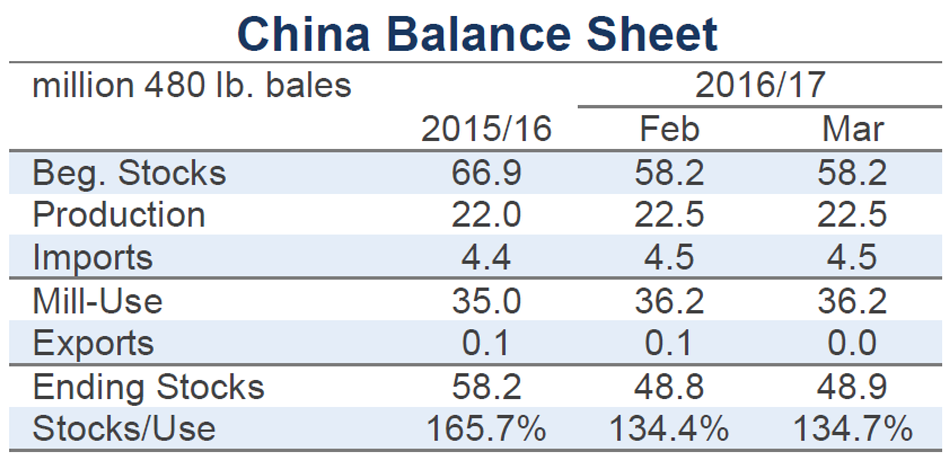

Central to that process will be the drawdown of stocks in China and the elimination of the accessibility related distinction between Chinese stocks and stocks in the rest of the world. In the current crop year, Chinese stocks are expected to fall 9.3 million bales (from 58.2 million in 2015/16 to 48.9 million). Early USDA forecasts predict a reduction of a similar size in 2017/18. A key assumption relative to that forecast is continued uptake at auctions of reserve-held cotton. The Chinese government reinitiated the auction process March 6th. The current round of sales is scheduled to run through the end of August, but it can be extended if demand is strong. As was the case during the previous round of sales (May - September), demand has been strong thus far. In each of the first five days, essentially all of the cotton offered for sale was purchased by Chinese mills and traders.

Outside of China, stocks are forecast to rise by about three million bales for a second consecutive crop year in 2017/18. This increase in available supply should imply downward pressure on prices. However, as movement in the current crop year has shown, less predictable variables associated with government policies, on-call sales, and speculation will also influence price direction.