Status quo of China’s nonwovens and industrial textiles industry, 2017

May 10, 2018 | by Zhao Zihan

In 2017, the nonwovens and industrial textile industry in China continued to deepen the reform of the supply-side structure and ensured the sustained and stable development through technological innovation and refined management. The investment in fixed assets continued to maintain a rapid growth, and the quality of operations maintained a good level. Exports reversed the slow growth or even declining trend in recent years. Due to the fluctuation of the price of major fiber raw materials and the rapid increase in the effective supply of some products, the profitability of the industry slightly decreased compared with the same period of last year; the growth rate of industrial added value fell to 4.0%; and the total profit growth in some areas declined.

Overall performance of the industry

Production growth rate falls

Since the 12th Five-Year Program period, the production of China’s industrial textiles industry has maintained a rapid growth. The total fiber processing has increased from 9.1 million tons in 2011 to 14.5 million tons in 2016, an average annual growth of 8.1%, making it the largest in industrial textiles producing, trading, and consumption in the world. The rapid growth of China’s industrial textiles is mainly due to the construction of China’s high-speed rail, highways and water conservancy infrastructure, the gradual tightening of environmental protection policies, the improvement of people’s living standards and the improvement of medical and health standards. In 2017, China’s economic structure was accelerated, and the industrial textiles industry was facing a more complicated development environment. The growth rate of production fell back to 4.00%, and the total fiber processing volume for the year was 15.083 million tons (The total amount of industrial fiber processing includes the amount of fiberglass used). Various fiber processing is shown in Table 1. The production of textiles for filtration and separation, medical and hygiene, geotechnical and building & construction continued to maintain a relatively high growth rate, while the growth rate of production of textiles for synthetic leather and textiles for sport and leisure was relatively lower.

Table 1 2017 China’s Industrial Textile Industry Fiber Processing Capacity

|

Categories |

Output in 2017 (10,000 tons) |

Growth rate in 2017 |

|

Medical and Hygiene Textiles |

155.5 |

7.50% |

|

Filtration and Separation Textiles |

130.9 |

8.20% |

|

Geotextiles |

99.6 |

6.80% |

|

Building and Construction Textiles |

75.0 |

7.00% |

|

Transport Textiles |

78.7 |

3.30% |

|

Protective and Safety Textiles |

38.7 |

5.00% |

|

Structural Reinforcement Textiles |

124.8 |

3.60% |

|

Agricultural Textiles |

79.5 |

2.50% |

|

Packaging Textiles |

103.9 |

4.00% |

|

Sport and Leisure Textiles |

40.8 |

2.00% |

|

Canvas and Tarp Textiles |

249.7 |

3.26% |

|

Synthetic Leather Textiles |

113.1 |

1.50% |

|

Isolation and Insulation Textiles |

46.0 |

2.50% |

|

Cord (Cable)Textiles |

76.6 |

5.00% |

|

Industrial Carpet Textiles |

47.7 |

2.00% |

|

Others |

47.8 |

3.00% |

|

Categories |

1508.3 |

4.00% |

Source: China Nonwovens and Industrial Textiles Association

Investment maintains a rapid growth

Fixed asset investment is an important indicator of industry vitality and entrepreneurial confidence. It can be seen from Table 2 that in 2017, although the growth rate of the industry’s production declined, the investment in fixed assets continued to maintain a rapid growth. The total investment amounted to RMB 84.925 billion, which represented a year-on-year increase of 2.76%. It was at the highest level in all textile industries and was 18 percentage points higher than the investment in 2016, re-entering the rising period. The investment in nonwovens accounted for 44.1% of the entire industry, with a growth rate of 22.38%; the investment growth rate of rope cables was close to 50%; the investment in canvas and tarp was increased by 26.22%; the investment growth in filtering, geotechnical, transportation and other fields reached 28.41 %. The tyre cord fabric industry continued its decline for many years, and investment dropped by 22.85%. The investment in fixed assets in the industry is mainly the increase in new production capacity, especially in the fields of spunbonded nonwovens, spunlace nonwovens, geotechnical textiles, building & construction textiles, and filtering and separating textiles. And the companies also put more investment in driving the technological transformation and upgrading of existing equipment, especially energy conservation & emission reduction and smart manufacturing.

Table 2 Investment in Fixed Assets of China’s Industrial Textile Industry in 2017

|

Sectors |

Investment (billion RMB) |

Investment Groeth (%) |

|

Industrial textiles |

84.93 |

22.76 |

|

Nonwovens |

37.48 |

22.38 |

|

Ropes and cables |

8.99 |

48.92 |

|

Ribbons and tyre cord fabric |

4.71 |

-22.85 |

|

Canvas and tarp |

9.90 |

26.22 |

|

Other industrial textiles |

23.86 |

28.41 |

Source: National Bureau of Statistics

Good economic benefits

According to data from the National Bureau of Statistics, in 2017, the main business income and total profit of enterprises above designated size in the industrial textile industry in China were RMB 289.75 billion and RMB 16.51 billion respectively, an increase of 5.19% and a decrease of 3.90%. It is the first falling that total profits had ever seen since the 12th Five-Year Program. The reasons for the decline are as follows: First, the ribbons and tyre cord fabric sector continued to slump. In 2017, the main business income in this area was reduced by 3.44%, and the cost was reduced by only 1.89%, resulting in a decrease in its gross profit margin by 1.41 percentage points. The total amount has been reduced by nearly 30%. Second, in 2017, the price fluctuations of major chemical fiber raw materials made it difficult for enterprises to transfer all price pressures to users in a short period of time, affecting the profitability of the company. Third, the industry’s investment has been active and production capacity has grown rapidly in recent years. It is difficult for the market to fully absorb the new capacity in the short term, which has led to fierce competition among companies in some areas and the sales price of products has been under greater pressure. According to the survey conducted by the association, it is difficult for companies to generally reflect the sales price of products in escalation with raw materials. Customs data also show that the export prices of most commodities have declined to varying degrees.

Of the five categories of products given by the National Bureau of Statistics, the other industrial textiles including filtration, geotechnical, protective, and automotive textiles exhibited the best development (see Table 3), and the total income from main operations and total profit are respectively RMB 44.262 billion and RMB 2.874 billion, with an increase of 13.35% and 22.28% respectively. The gross profit margin was 15.53%, an increase of 0.51 percentage point, and the profit rate was 6.49%, an increase of 0.47 percentage point, which was nearly 0.8 percentage point higher than the industry average, reflecting the good development potential and profitability. The development of enterprises in this area is in good condition. On the one hand, these products have high technological content and strong market competitiveness, playing an increasingly important role in all fields. On the other hand, these areas are facing markets of high-speed development including environmental protection, infrastructure construction, and transportation, etc., enjoying ample room for development.

Table 3 Economic Benefits of China’s Industrial Textile Industry in 2017

|

Categories |

Unit |

Industrial textiles |

Nonwovens |

Ropes and cables |

Ribbons and tyre cord fabric |

Canvas and tarp |

Other industrial textiles |

|

Main Business Income |

Billion RMB |

289.750 |

139.573 |

30.055 |

50.842 |

25.018 |

44.262 |

|

±% |

5.19 |

6.73 |

4.28 |

-3.44 |

3.56 |

13.35 | |

|

Main Business Cost |

Billion RMB |

250.242 |

119.947 |

26.059 |

45.484 |

21.364 |

37.388 |

|

±% |

5.30 |

6.51 |

4.94 |

-1.89 |

3.40 |

12.66 | |

|

Gross Margin |

% |

13.64 |

14.06 |

13.30 |

10.54 |

14.60 |

15.53 |

|

± percentage point |

-0.09 |

0.18 |

-0.54 |

-1.41 |

0.13 |

0.51 | |

|

Total Profit |

Billion RMB |

16.506 |

8.399 |

1.817 |

2.130 |

1.286 |

2.874 |

|

±% |

-3.90 |

-1.03 |

0.73 |

-29.86 |

-14.13 |

22.28 | |

|

Profit margin |

% |

5.70 |

6.02 |

6.04 |

4.19 |

5.14 |

6.49 |

|

± percentage point |

-0.54 |

-0.47 |

-0.21 |

-1.58 |

-1.06 |

0.47 |

Source: National Bureau of Statistics

Rebounded imports and exports

With the technological advancement of China’s industrial textiles, the further promotion of the “Belt and Road” Initiative, and the economic recovery of major developed countries, the companies in the industry have made great progress in exploring the international markets. In 2017, the industrial textile industry exported 24.261 billion U.S. dollars, a year-on-year increase of 5.99%, reversing the situation in which exports have been growing at a low rate for many years or even declined. In the same period, the imported industrial textiles worth 7.054 billion U.S. dollars, a year-on-year increase of 12.18%. The economy is full of vitality and the demand for high-tech and high-quality products is still relatively strong.

-

The main export products

In 2017, the export value of major products maintained a varying degree of growth. The export value of industrial coated fabrics, wiping cloth, industrial fiberglass products, and tyre cord fabrics increased by more than 10%. Felt cloth, tents, ropes and cables, nonwoven protective clothing and airbags also enjoyed faster growth, but the packaging textiles decreased by 2.93%, and the medical dressings was basically the same as last year (as shown in Table 4).

Table 4 Main Export Products of China’s Industrial Textile Industry in 2017

|

Products |

Export Value (100 million USD) |

Growth Rate of Export Value

(%) |

Growth Rate of Export Volume

(%) |

Price Changes (%) |

|

Industrial textiles |

242.61 |

5.99 |

- |

- |

|

Industrial coated fabric |

33.54 |

10.21 |

8.09 |

1.95 |

|

Nonwovens |

26.12 |

2.31 |

7.48 |

-4.80 |

|

Felt and tents |

24.08 |

8.38 |

15.04 |

-5.79 |

|

Synthetic leather and base cloth |

21.15 |

2.31 |

3.96 |

-1.59 |

|

Packaging textiles |

17.36 |

-2.93 |

-4.48 |

1.62 |

|

Diapers and sanitary napkins |

16.07 |

5.41 |

12.42 |

-6.24 |

|

Ropes and cables |

15.81 |

8.05 |

7.85 |

0.19 |

|

Wiping cloth |

9.72 |

10.13 |

12.71 |

-2.29 |

|

Industrial glass fiber products |

9.17 |

10.8 |

12.59 |

-1.58 |

|

Nonwoven protective clothing |

8.63 |

8.77 |

9.38 |

-0.56 |

|

Airbags |

8.34 |

7.27 |

8.69 |

-1.30 |

|

Medical dressing |

7.69 |

0.61 |

5.31 |

-4.46 |

|

Tyre cord fabric |

6.9 |

15.13 |

8.56 |

6.06 |

Source: General Administration of Customs

-

The main export markets

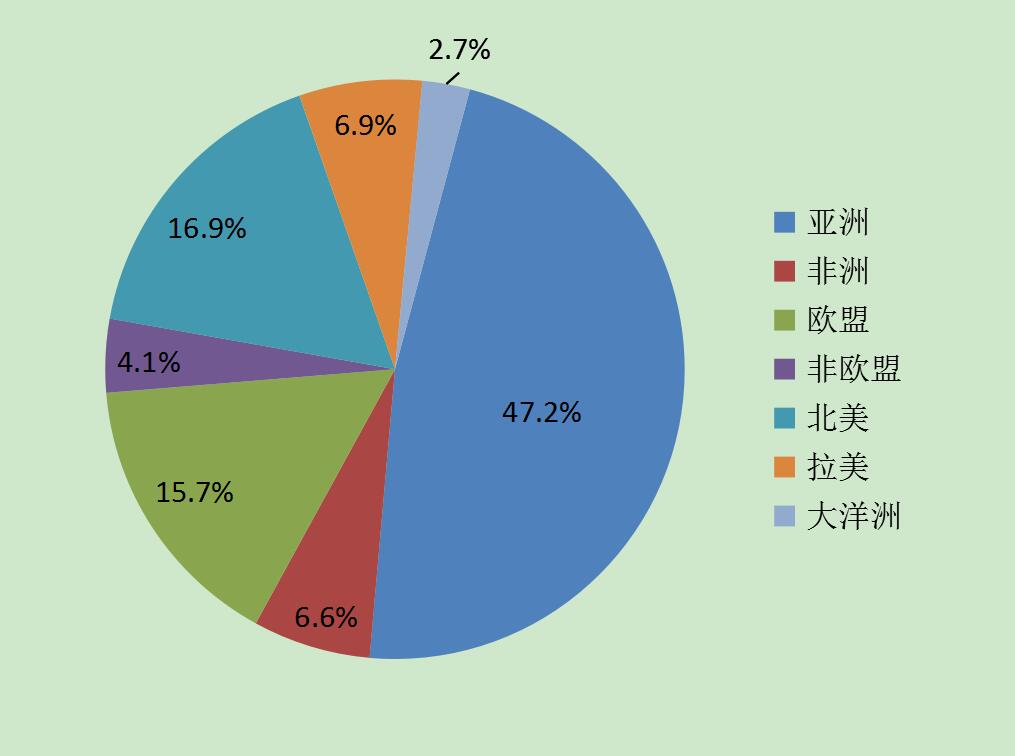

Figure 1 shows that Asia is the largest export market of industrial textiles in China, accounting for 47.2% of annual exports, followed by North America and the European Union with a share of 16.9% and 15.7%, respectively. The share of Africa and Latin America is 6.6% and 6.9% respectively.

Source: General Administration of Customs

Figure 1 Main Export markets of China’s Industrial Textile Industry in 2017

The United States is still the largest country where Chinese industrial textiles are exported. Table 5 shows that in 2017, export value amounted to 3.74 billion U.S. dollars, an increase of 7.09% year on year. Japan was the second largest one, but exports fell by 3.12%. In recent years, China’s exports of industrial textiles to Vietnam and India have grown relatively rapidly, which were respectively 1.35 billion U.S. dollars and 1.03 billion U.S. dollars in 2017, with respective growth rates of 13.1% and 15.23%. The top five countries in export value accounted for 37.8% of China’s total exports. In addition, China’s Hong Kong, Germany, Indonesia, Russia and the Philippines are also important markets. The export value of these 10 countries and regions accounted for 51% of the total.

Table 5 Main Export Markets of China’s Industrial Textile Industry in 2017

|

Countries |

2017Value (USD) |

Growth Rate (%) |

|

The United States |

3,736,901,092 |

7.09 |

|

Japan |

1,846,752,612 |

-3.12 |

|

Vietnam |

1,354,639,868 |

13.10 |

|

South Korea |

1,160,605,579 |

5.87 |

|

India |

1,029,693,879 |

15.23 |

Source: General Administration of Customs

Coated fabrics, synthetic leather and its base cloth, and nonwovens are China’s major export products to India and Vietnam. Export value is relatively large, but in terms of export prices, Vietnam is higher than India. Vietnam and India are countries with rapid economic growth around China. The demand for various industrial textiles is relatively large. China’s industrial textile industry has strong advantages in equipment manufacturing, technological innovation, product quality, etc. It is superior to European and American countries and other developed countries in terms of price, and geographically adjacent to it, the overall advantages are very obvious. It is to continue to increase the development of these two markets.

-

Imports

In 2017, China imported industrial textiles of 7.054 billion U.S. dollars, an increase of 12.18% year on year. Among them, diapers and sanitary napkins saw the largest amount of imports, reaching 1.423 billion U.S. dollars. Imports of nonwovens, industrial coated fabrics, airbags, and industrial fiberglass products were also relatively high, at 883 million U.S. dollars and 768 million U.S. dollars, 638 million U.S. dollars, and 606 million U.S. dollars respectively. In addition to airbags, the imports of the other four categories of products were all increasing; however, the import prices of major products declined at different rates. Japan, China Taiwan, South Korea, the United States, and Germany are the main sources of imported industrial textiles in China, with imports accounting for 78.4% of the total.

Status quo of key sectors

Medical and hygiene textiles

Medical and hygiene textiles are widely used in the industrial textiles industry. From the perspective of disposable sanitary products, the market for women’s sanitary napkins is relatively mature and has a high penetration rate. It also maintains a natural growth every year at about 5%, and the quality of products continues to grow toward high levels. Baby diapers are still a market with rapid growth at about 15%. The industry continues to innovate in surface materials, absorbent cores, product design, etc. The Chinese market has been able to lead the innovation and development of the global diaper industry; and adult incontinence products are still in the market cultivation period of very large potential, with an annual growth of more than 30%. However, to achieve a breakthrough needs a relatively long-term process based on joint efforts from the level of economic development, consumption habits, and related national policies. Wiping products (dry towels and wipes) is another high-growth market with a growth rate of more than 10%. In particular, as economic conditions improve and the pace of life accelerates, the scope of application and use of disposable wiping products will continue to expand. In 2017, the investment and production of spunlace nonwovens and spunbonded nonwovens for sanitary materials continued to grow at a high rate. China’s sanitary materials also actively explore overseas markets. In 2017, the export value of diapers and sanitary napkins reached 1.607 billion U.S. dollars, an increase of 5.41% year on year, of which adult incontinence goods exports reached 240 million U.S. dollars.

The development of the medical textile industry is relatively stable, and the degree of concentration of the industry is relatively high. The export proportion of the industry is relatively large. In 2017, China exported 893 million U.S. dollars worth of disposable nonwoven protective clothing, an increase of 8.77% year on year. The export of medical dressings such as gauze and bandages totaled 769 million U.S. dollars, a year-on-year increase of 0.61%. Due to the factors of China’s medical insurance policy and product certification system, the proportion of disposable medical textiles used in hospitals in China is not high, and the products are mainly produced in the form of OEMs for exports.

According to the association’s research on key enterprises in the field, the company’s main business income and total profit respectively increased by 15.55% and 16.23% in 2017, and the profit rate was basically the same as that of the same period of last year.

Geotextiles and construction textiles

The market for geotextiles and construction textiles is closely related to the country’s infrastructure construction. In 2017, the investment in fixed assets of the railway industry in China completed 801 billion RMB, with 35 new projects and 356 billion RMB new investment. The accumulated investment in highway construction reached 2116.25 billion RMB, a year-on-year increase of 17.7%, and the implementation of water conservancy investment was 717.6 billion RMB, creating a new record high. The country’s huge investment in fixed assets and the advancement of the “Belt and Road Initiative” have contributed greatly to the development of China’s geotextiles and construction textiles industry.

The market for geotextiles and construction textiles is closely related to the country’s infrastructure construction. In 2017, the investment in fixed assets of the railway industry in China completed 801 billion RMB, with 35 new projects and 356 billion RMB new investment. The accumulated investment in highway construction reached 2116.25 billion RMB, a year-on-year increase of 17.7%, and the implementation of water conservancy investment was 717.6 billion RMB, creating a new record high. The country’s huge investment in fixed assets and the advancement of the “Belt and Road Initiative” have contributed greatly to the development of China’s geotextiles and construction textiles industry.

Although the overall development of the industry is relatively good, due to the impact of the national environmental protection policy, the production of small enterprises within the industry is affected. In the long run, with the adjustment of national engineering bidding policies and improvement of engineering projects on geotechnical materials performance indicators, small companies with weak product development and poor quality control capabilities will suffer more upgrading pressures.

Transport textiles

Transport textiles are a relatively fast growing field in industrial textiles. First of all, the auto industry still maintained a certain growth. In 2017, China’s auto production was 29,015,400, an increase of 3.19% year on year, of which the growth rate of SUVs and commercial vehicles was 13.81% and 13.95% respectively, and the output of new energy vehicles was increased by 53%. China has become the world’s largest car producer. Secondly, textile materials have strong advantages over traditional materials in terms of weight, sound insulation, comfort performance, and environmental performance, showing an obvious trend to replace traditional materials. Thirdly, the application of new textile materials in vehicles is expanding. For example, microfiber materials are being more widely used in automobile seats, door panels, etc. High-performance fiber composite materials are gradually used in new energy vehicles. As technology matures and costs are reduced, the use of fiber composites in automobiles will become more widespread. In addition to automobiles, the application of textile materials in high-speed rail and aircraft is also expanding, including not only traditional seat fabrics but also new honeycomb materials, door panel materials, and filter materials.

It is more difficult for transport textile companies to enter the supply chain of auto companies and the cycle is longer. Therefore, the size of companies in the industry is generally large and the degree of industrial concentration is high. However, with the development of domestic auto companies, there are also some smaller supporting companies in the industry. According to the statistics of the association, in 2017, the main business income of the backbone enterprises increased by 8.75%, and the total profit was basically the same as last year.

Filtration and separation textiles

In 2017, China intensified efforts to improve the atmospheric environment, seeing significantly improved air quality, in which the filtration and separation textile companies have played an important role, and the industry has ushered in a rare opportunity for development. In 2017, the emission standards for air pollutants in the industrial sector were revised again, and a new round of environmental improvement reform of enterprises was emerging. The emission concentration of soot and dust less than 10 mg/Nm3 has gradually become normal.

Bag type dust removal has the characteristics of efficient purification of fine particles, wide range of processing air volume, and small influence of dust properties. Bag filter has become the mainstream dust removal equipment, and its industrial application is very extensive. The application ratio has been rising year by year. The reality shows that bag filter has gradually become the mainstream equipment for the efficient purification of particulate matter. Bag type dust removal has become the main force in China to achieve ultra-low emissions and upgrade the standard. In terms of water filtration, benefiting from the increase in environmental protection requirements, woven filter fabrics also developed rapidly in 2017, and the export value reached 129 million U.S. dollars. According to the survey conducted by the association, the main business income and total profit of backbone enterprises in 2017 increased by 21.97% and 13.95% respectively, and the profit rate was about 10%.

Filtration and separation textiles are industrial consumables. National environmental protection requirements will maintain relatively high standards. It is expected that the industry will continue to maintain a rapid growth. China has established a complete industrial chain from high-performance fibers to engineering services in this field, and it is highly competitive. However, market competition is not standardized. In particular, a large amount of accounts receivable has had an adverse effect on the development of the industry.

Structural reinforcement textiles

At present, China has become the world’s largest and fastest growing market for wind power generation, and offshore wind power has achieved rapid development. According to statistics, in 2017, China added 15.3 million kilowatts of grid-connected wind power, and cumulative grid-connected installed capacity reached 164 million kilowatts, accounting for 9.2% of total installed power generation capacity. Due to changes in policy, the newly installed capacity of wind power in China has continued to decline since 2015, but due to the increase in average stand-alone power, the use of glass fiber and carbon fiber still maintains a relatively high level.

With the technological advancement of domestic carbon fiber, China’s carbon fiber composite material industry has also achieved rapid development. However, compared with developed countries, applications are mainly concentrated in the field of sports and leisure products, and are now gradually being applied to transport, while being applied in aviation very little. According to customs data, in 2017, China exported 1,984 tons of carbon fiber and products, and the export value was 74.92 million U.S. dollars, an increase of 7.96% and 21.13% respectively over the same period of last year, while the value of imports during the same period reached 435 million U.S. dollars, an increase of 4.15% year on year.

Protective and safety textiles

The market for protective and safety textiles in China is very large. Front-line workers in the fields of fire protection, petroleum and petrochemicals, coal, steel and metallurgy all need high-quality products to ensure occupational safety. With the deepening of the people-oriented concept and the improvement of related safety production regulations as well as the development of the national emergency industry and the promotion of military-civilian integration strategy, the development of the security field has received more and more attention; however, compared with medical textiles, filtration and separation of textiles and other rapidly developing areas, this sector shows a slower pace.

On the one hand, it is related to the technology and products within the industry. China has made great breakthroughs in the development of various types of flame-retardant, cut-resistant, anti-static special fibers and fabrics, but subject to standards, testing and certification, the high-end market in this area, such as some protection products for special conditions, still needs to purchase from multinationals. Compared with the giants such as DuPont, 3M, and Honeywell, China’s enterprises are small in scale and have weak innovation capabilities. The gap between basic R&D and product development is relatively large. On the other hand, standards in the area of security protection are lagging behind, and procurement policies with low bid prices have also limited the application of new products and technologies to a certain extent, and cannot effectively protect workers.

According to the survey conducted by the association, in 2017, the main business income and total profit of key enterprises increased by 6.42% and 13.90% respectively.

Forecast of industry development in 2018

In 2018, China’s industrial textile industry is facing a more favorable environment. First of all, China’s economy and society will continue to maintain healthy and stable development. The GDP growth rate is expected to reach about 6.5%. The development environment faced by manufacturing enterprises is more optimized, for the state attaches importance to the development of the real economy, deepens the reform of the supply-side structure, vigorously reduces taxes and fees, and strongly encourages technological innovation. National income continues to grow, the gap between urban and rural areas is narrowed, and the integration of military and civilians is further advanced. The state will continue to increase investment in environmental protection, infrastructure construction and new energy sources, and the domestic demand market for major products of the industry will continue to maintain a rapid growth. The global economy continues to recover. The demand for industrial textiles in the developed markets of Europe and the United States continues to grow at a moderate pace. Countries and regions along the Belt and Road have a strong demand for the disposable sanitary materials, nonwovens, coated fabrics, geotextiles, and filter materials in China.

China’s industrial textiles not only have the largest scale in the world, but also have made tremendous progress in the training of professionals, special equipment and raw material guarantees. The gap between the developed countries in terms of technological innovation, new product development, refined management, and product quality has been gradually scaled down, achieving many achievements in smart manufacturing and green manufacturing. The strength of backbone enterprises has grown, with products not only meeting domestic needs, but also having strong competitiveness in the world.

In 2018, China’s industrial textile industry will develop steadily. The growth rate of production and sales will be slightly higher than that of 2017. Exports will continue to maintain a high growth rate, and profitability will be improved. The growth rate of investment in fixed assets may see somewhat dropping.